RBI's signal to PPI holders: Use licence for only what is mandated

The latest note to stop UPI in a co-branded arrangement will hurt some fintechs, who will have no option but to disallow this feature to users, according to experts

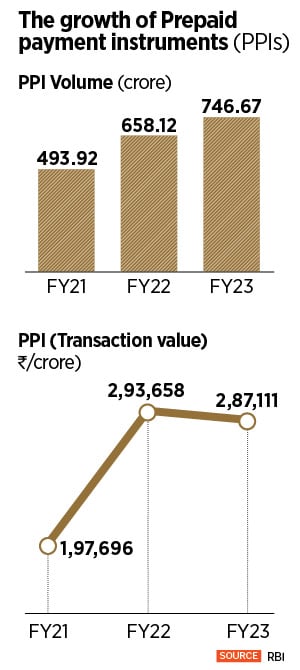

The Reserve Bank of India (RBI) has just got more stringent on the usage of prepaid payment instruments (PPIs) and the accountability of funds being transferred into these mobile or payment wallets, smart cards and magnetic chips. This week, the issuers of PPIs—which include banks and non-banks—received a circular from the National Payments Corporation of India (NPCI), which directed them “to discontinue any issuance of PPI wallet on partner or a co-branded app for PPI on UPI, with immediate effect".

They have been given time till June 30 to stop this activity. The circular does not explain the rationale for the move or whether it is a temporary or permanent move.

In most cases, a PPI licensed holder—largely banks or non-banks—offer the UPI facility to its users. But if the PPI user has partnered with a fintech or another enterprise for a co-branded prepaid instrument (wallet), it will now not be allowed to offer UPI to make payments, to its users.

The latest NPCI notice includes the following details: ‘PPI holders shall be on-boarded for UPI by their own PPI issuer only. We hereby direct all the PPI issuers on UPI to discontinue any issuance of PPI wallet on partner/co-branded app for PPI on UPI with immediate effect. Customer communication and closure of PPI wallet on partner/co-branded app should be completed by June 30.’

The note further says that the PPI issuer will need to share an official confirmation to the NPCI, discontinuing the partner or the co-branded model for PPI on UPI.

Some of the fintech companies Forbes India spoke with said it is difficult to assess the number of players involved in the co-branding exercise, but estimated it could be somewhere between 30 and 50. Some of the names who might be impacted could be DreamX (a subsidiary of Dream11), Fampay, Muvin, and Akudo.

Some of the fintech companies Forbes India spoke with said it is difficult to assess the number of players involved in the co-branding exercise, but estimated it could be somewhere between 30 and 50. Some of the names who might be impacted could be DreamX (a subsidiary of Dream11), Fampay, Muvin, and Akudo.

Dream11 declined to comment on the latest notice. The company is learnt to have a co-branded arrangement with Pine Labs to offer UPI. An industry source says the firm was a “beta version" service which it started a month ago, but will now have to be discontinued. Fampay did not respond to calls.

These PPI holders will need to replace the UPI feature with other avenues which could be monetised.

Sanjay Khan Nagra, partner (corporate and commercial practice group) at Khaitan & Co, says: “The RBI through its master directions on PPIs issued in 2021 had allowed only licensed PPI issuers to onboard its customers for UPI purposes. NPCI through its circular in January 2022 also reiterated that only licensed PPI issuers can utilise its UPI rails."

“The current order by NPCI is a clarification to RBI’s two-year-old master direction on the subject matter allowing a registered PPI issuer to access the UPI rails in any form. RBI in recent times has been closely monitoring lookalike financial products launched by its regulated entities in a co-branded form. This appears to be a similar step," Nagra tells Forbes India.

“UPI transactions do carry a slightly higher risk of fraud, with very little accountability and a couple layers of check. Money being transferred through a UPI transaction needed to be tracked," a fintech industry source says, declining to be named.

“The RBI is signalling to PPIs that the activity for which a licence has been issued to them, usi mein raho (limit yourself to that activity only). Beyond this, if you are planning on doing anything, then humse permission lo (take permission from us)," he says.

Earlier last year, the RBI had issued another directive stating that PPIs must not be loaded through credit lines issued by non-bank lenders. The concern was real: That it did not want fintechs to start aggressively extending lines of credit.

Rajat Depande, CEO of fintech startup FinBox, which is a digital lending infrastructure provider says the PPI is a “lightly-regulated market" and in case the co-branding is not with a recognised player, the RBI would see the need to have a closer look.

“The RBI looks at fintechs as financial services and they certainly want innovation to take place but do not want uncontrolled growth," Deshpande tells Forbes India.

“Payments which are largely being made through technology are usually fast. The RBI has a blunt instrument to control it," the fintech industry source says.

There is already enough underground chatter on social media through WhatsApp groups. But experts we spoke to admit that nobody really understood the RBI’s exact rationale or fear at this stage. One has to wait and watch, there are bound to be more clarifications.

First Published: Jun 29, 2023, 17:59

Subscribe Now