Digital currency pilots: On course, with potential to achieve something huge

The CBDC retail pilots are expanding in scope, participation and reach. Experts say that with the RBI's sustained push, it could emerge bigger than UPI in coming years

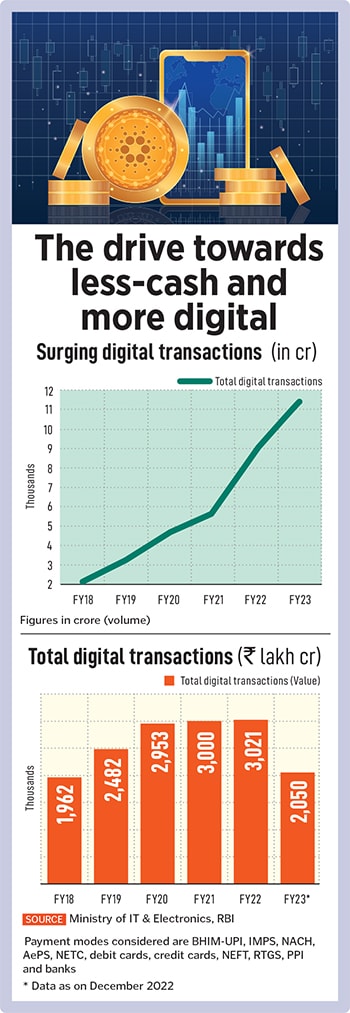

The Unified Payments Interface (UPI) could be considered the ‘Big Brother’ in India’s digital payments ecosystem it commands over 75 percent of overall transactional volume in retail digital payments. But it is quite likely that the digital payments landscape could start to see changes by end-2023, with the Reserve Bank of India (RBI) expected to accelerate the presence and usage of the Central Bank Digital Currency (CBDC) nationwide by then.

The CBDC or e-rupee is in the pilot stage for both wholesale and retail uses. During the 12 months to March 2024, the RBI aims at “expanding the ongoing pilots in CBDC-Retail and CBDC-Wholesale by incorporating various use cases and features. The pilot in CBDC-Retail is proposed to be expanded to more locations and to include more participating banks," it said in its annual report released in end-May.

India came late to the CBDC party (see table), but that is because it already possesses a well-established and successful digital payments system in the form of UPI. In May, the RBI continued to add to the scope of the CBDC pilots, with more banks joining in. There are now 13 banks and 16 locations where CBDC is being made available. State Bank of India, HDFC Bank, Kotak Mahindra Bank, ICICI Bank, Axis Bank, Yes Bank and IDFC First Bank, besides others, have launched their digital rupee wallet.

In the case of merchants, several thousand across at least 50 centres, including the metros and several tier 2 cities, have been selected by the RBI to offer CBDC services. India’s largest retail chain, Reliance Retail, has already started accepting retail payments in digital rupee. “With more Indians willing to transact digitally, this initiative will help us provide yet another efficient and secure alternative payment method to customers at our stores," V Subramaniam, director, Reliance Retail, said in a media statement in February.

In the case of merchants, several thousand across at least 50 centres, including the metros and several tier 2 cities, have been selected by the RBI to offer CBDC services. India’s largest retail chain, Reliance Retail, has already started accepting retail payments in digital rupee. “With more Indians willing to transact digitally, this initiative will help us provide yet another efficient and secure alternative payment method to customers at our stores," V Subramaniam, director, Reliance Retail, said in a media statement in February.

Yes Bank’s head of digital banking and transformation, Ajay Rajan, says: “CBDC is a secure legal tender backed by RBI directly, hence it has the highest level of trust. It will be accepted as a medium of payment and a safe store of value by all citizens, enterprises, and government agencies. It is a convenient alternative to cash with underlying benefits of denomination selection and anonymity (under WIP as mentioned by the regulator)."

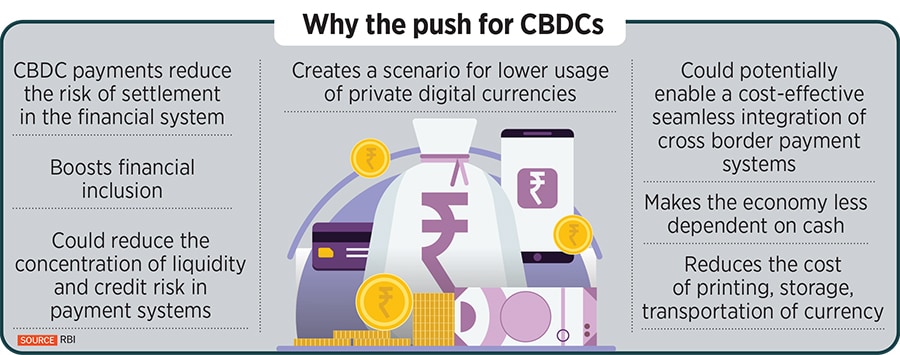

CBDC also helps curb emissions by nullifying operations such as printing, storage, transportation, and replacement of physical currency. The total expenditure on printing of banknotes in FY22 was Rs 4,985 crore and it does not account for the ESG costs of printing money, the RBI said in its report on Currency and Finance 2022-23, released in May.

RBI Governor Shaktikanta Das has been consistent in his message to urge banks, non-banking financial companies (NBFCs) and fintechs to push customers towards digital payments adoption. PwC’s ‘The Indian payments handbook’ for the period 2022–2027 forecasts the total transaction volume at more than 83 billion and this is expected to grow four times by FY27.

Yes Bank was among the first banks to be part of the RBI’s retail pilot programme. “We are seeing a good response from our customers," Rajan told Forbes India. It is one of the few banks where there is no restriction on account holders to join the CBDC programme, after registering themselves with the bank. Rajan called the RBI retail pilot a “success" but said the central bank would be the best to comment on it.

In the case of HDFC Bank’s e-rupee app, only select bank customers have been chosen to be part of the pilot. HDFC Bank, on its website, has explained the CBDC process: The RBI creates tokens which will be issued to financial entities, called TSPs (token service providers) for the CBDC programme. The TSPs then distribute these tokens to interested parties/customers.

The digital rupee tokens will work in the same way as bank notes or coins do, and can be used in lieu of cash. A ledger of the transactions is maintained with the regulator and thus the entire process eliminates the settlement mechanism between banks.

The RBI, in its concept note released prior to the pilots, said that it was simultaneously examining use cases that could be implemented with minimal or no disruption.

The RBI, in its concept note released prior to the pilots, said that it was simultaneously examining use cases that could be implemented with minimal or no disruption.

“Depending on different use cases, multiple technological options shall be tested and based on the outcomes, the final architecture shall be decided," it had said. “CBDC, across the world, is in conceptual, development, or at pilot stages. Therefore, in the absence of precedence, extensive stakeholder consultation along with iterative technology design must take place to develop a solution that meets the requirements."

Experts are clear that CBDC has the potential to achieve something huge. “When the pilots started in November-December last year, we saw the minimum viable product being created.

The RBI has taken baby steps and people are yet to see the value which CBDC can bring. Luckily the RBI has seen it and has the vision," says Ajeet Khurana, founder of Singapore-based Web3 advisory firm Reflexical and former CEO of ZebPay.

HDFC Bank, Axis Bank and Kotak Mahindra Bank declined to talk about the RBI CBDC programme.

“Currently CBDC is just movement of money and once RBI allows programmability of money and software is built on it, this is where we will see the merit of having a central bank currency being able to disburse funds it in a way that it is intended to be," Khurana says.

In the future, escrows accounts can become automated, special situation emergency payouts and government subsidies can be made, experts says. In April, Reliance General Insurance became the first insurance company to accept the RBI’s CBDC programme for collection of premia in digital mode.

Khurana says the CBDC is going to “start as a trickle but has the potential to become a tsunami. In a three-year timespan if the RBI does not lose its enthusiasm to promote it, the CBDC could be bigger than UPI in terms of number of transactions and volume," he says. The UPI is a payment system allowing money transfer but it does not touch the unbanked.

Though CBDC right now needs customers to use their bank account, in an advanced version it has the potential for individuals to use it without having a bank account.

“As CBDC adoption is pumped up, there will also be opportunity for new money businesses to come up," Khurana says.

The RBI never brought in CBDC to replace UPI it was always planned to co-exist with UPI. “India is a large market for multiple payment modes to co-exist," Rajan says.

As large ecommerce players show their interest in adopting CBDC and integrate it into their system, and as the technologies get more advanced, we could see smoother CBDC adoption.

The RBI could also consider cross border payments through CBDC. The coming months could only mean the deepening of the scope of digital currencies in India and the start of a new era.

First Published: Jun 07, 2023, 09:31

Subscribe Now