This real estate asset is pandemic proof

India's massive data consumption, the coming of 5G technology and the move towards data localisation make data centre development the go-to business

Demand for data centre space requirement is likely to increase by around 15 to 18 msf across major Indian cities in the next five years

Demand for data centre space requirement is likely to increase by around 15 to 18 msf across major Indian cities in the next five years

Out of adversity came success for 46-year-old technology-focussed entrepreneur Sridhar Pinnapureddy. In the early 2000s, his internet service venture Pioneer Internet had failed to scale up and ran into losses. “There was a compelling need to carve out a niche, to either differentiate or die," he tells Forbes India. His intuition, in 2005, was that data centers—then largely used by websites—would be the future powerhouses of the economy.

Pinnapureddy and his leadership team travelled to the US to study data centers there and realised that India did not operate a single Tier-4 data centre. Tier-4 data centres, contrary to perception, need to be of the highest quality, with a completely fault tolerant design, continuous cooling, an expected uptime of 99.995 percent and no more than 26.3 minutes of downtime in a year. A Tier-1 data centre is basic and offers little sophistication to the client, besides an uptime of 99.67 percent.

In February 2008, CtrlS, the company Pinnapureddy founded, built India’s first Tier-4 data centre in Hyderabad. In 2011, CtrlS launched Asia’s largest Tier-4 hyperscale data centre in Mumbai followed by others in the last decade.

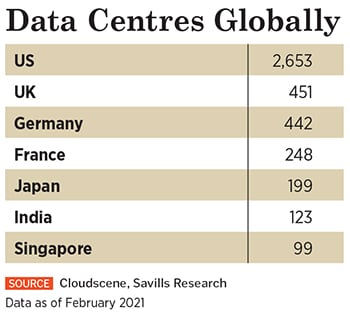

Pinnapureddy could not have got his act more right. Over the past decade, the explosion of data consumption, adoption of cloud services, 5G technology and artificial intelligence in India has all meant an increased demand for hyperscale data centres. But India has only 0.2 MW of data centres per 100,000 people compared to 8 MW in the US.

Data localisation has also been one of the key drivers for data centres in India. In 2018, the Reserve Bank of India (RBI) called on payment system providers to store payments data in India. The draft Personal Data Protection Bill, which is being debated by a joint parliamentary committee, signals towards the storage of data in India. A JLL report of September 2020 notes that the capacity of India’s data centres is expected to rise nearly three times to 1,078 MW by 2025 from 375 MW last year, representing a $4.9 billion investment opportunity during this period.

Pandemic-proof real estate asset?

Data centres have been among the real estate assets that were least affected due to the pandemic-related crisis, a Savills Research spotlight on data centres says. Demand for data centre space requirement is likely to increase by around 15 to 18 million square feet (msf) across major Indian cities in the next five years.

All of this has meant the rapid rise in data centre companies that are managing these assets. Hyderabad-based CtrlS operates six Rated-4 hyperscale data centers in India spread across close to 1 msf. The company’s expansion plan includes building 6 msf of data centre space powered by about 700 MW. “In Mumbai, we are building a 2 msf data centre park with 300 MW capacity Hyderabad with 300 MW power capacity, and Chennai with 100 MW," says Pinnapureddy.

CtrlS, whose clients include Walmart, Exxon, Disney, FedEx and Panasonic apart from Etisalat, Emirates and SBI, now sees building edge data centres—smaller data centres closer to the end user—as the next growth opportunity. CtrlS will be building 16 of them as regional data centres.

CtrlS, whose clients include Walmart, Exxon, Disney, FedEx and Panasonic apart from Etisalat, Emirates and SBI, now sees building edge data centres—smaller data centres closer to the end user—as the next growth opportunity. CtrlS will be building 16 of them as regional data centres.

NTT Global Data Centers and Cloud Infrastructure, which is the India region of NTT Global Data Centers, manages 10 data centres in Mumbai, Delhi NCR, Chennai and Bengaluru. The Hiranandani Group has also forayed into this high growth area after understanding the value proposition it offered and the demand supply gap, its group CEO Darshan Hiranandani tells Forbes India.

Hiranandani has built Yotta NM1, a massive Tier-4 hyperscale data centre in Panvel, which offers co-location, connectivity and cloud services to several technology-led companies. He adds that their upcoming projects include the Yotta data centre park in Chennai (four data centres), where construction activity will start in early January 2022 and Delhi (six of them), without disclosing the time frame.

The group also has plans for a centre in West Bengal, which would be part of the ₹8,500 crore investments over the next three years in data centres and industrial parks across various states in India. Hiranandani declined to say how many data centres will be built each year. “India’s eastern and Northeastern belt offer huge opportunities to store data," he adds.

undefinedCtrlS now sees building edge data centres—smaller data centres closer to the end user—as the next growth opportunity[/bq]

Both the Hiranandani and CtrlS managements declined to discuss financials of their ventures. But building high quality data centres is not cheap. Unlike other real estate assets, there are too many variables relating to ensuring quality checks, scale of operation, construction cost, bandwidth cost and designing the data centre. Analysts say the base cost could start at ₹18,000 to ₹20,000 per sq ft for the land.

Globally, the number of large data centres operated by hyperscale providers doubled to 597 in 2020 from a previous level in 2015, media reports said based on a Synergy Research study. Amazon, Microsoft and Google combined account for over half of all major data centres.

Demand notwithstanding, there is unlikely to be a gold rush towards this niche-but-high-growth area. It would mean that only seven or eight large entities will survive in the coming years, offering premium services.

First Published: Jun 29, 2021, 15:18

Subscribe Now