Aakash IPO coming next year: Byju's

Bought for $1 billion in 2021, Aakash will hit the IPO street next year. What remains unclear is the much-delayed financial results of Byju's, which has been recently in the news for a valuation markd

Byju’s has announced the initial public offering (IPO) plans of educational institute Aakash Education Services, its costliest acquisition, which also happens to be the biggest revenue spinner for the embattled edtech major that was recently in the news for a valuation markdown by BlackRock, one of its backers. Aakash, underlines the media release announcing the IPO plans, has clocked a three-fold increase in revenue over the last two years. “It’s on track to reach Rs4,000 crore with an EBITDA of Rs900 crore in FY24," the release claimed.

The IPO talks of Aakash gained ground once the overall edtech engine of Byju’s started slowing down due to a waning pandemic, a flurry of aggressive and expensive overseas acquisitions and the coding craze led by WhiteHat Jr lost steam. In April this year, Mrinal Mohit, India CEO of Byju’s, confirmed that the edtech major is pepping to list Aakash. “IPO toh ho raha hai. (IPO is happening)," he asserted in an interview to Forbes India. But why Aakash, and why not Byju’s, which has always been the original plan?

The CEO, who happens to be one of the six founding members of Byju’s, told us what compelled the biggest edtech player to change the script. “The macro and micro environment has changed over the last year, and IPO of Byju’s won’t happen in the present situation," he added. Aakash, he underlined, is profitable, and is a business which people and retail investors in the country understand and can relate to easily. “They appreciate this business. Aakash has legacy, trust and credibility of over 30 years," said Mohit.

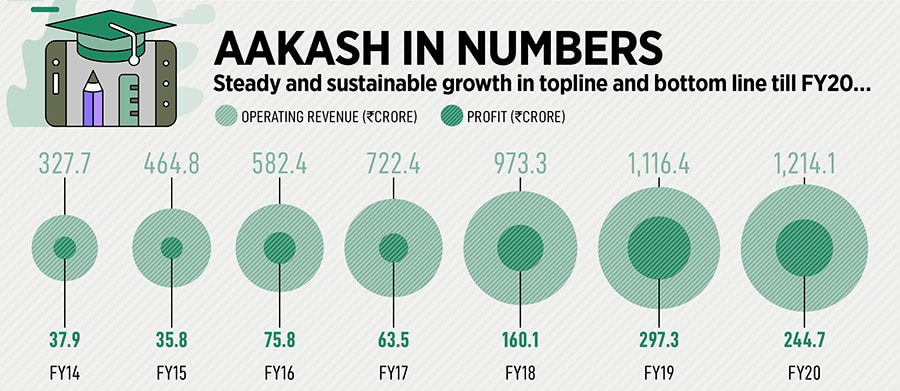

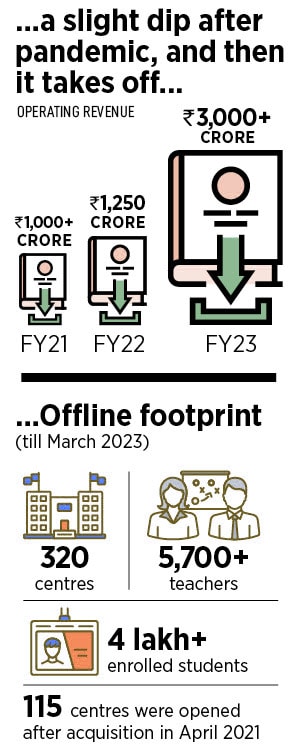

Aakash has been a robust and profitable story. The operating revenue increased from Rs327.7 crore in FY14 to Rs1,214.1 crore in FY20. After a slight blip in FY21—due to the pandemic hitting offline-heavy Aakash—the numbers rebounded strongly to Rs1,250 crore in FY22, and over Rs3,000 crore in FY23.

Aakash has been a robust and profitable story. The operating revenue increased from Rs327.7 crore in FY14 to Rs1,214.1 crore in FY20. After a slight blip in FY21—due to the pandemic hitting offline-heavy Aakash—the numbers rebounded strongly to Rs1,250 crore in FY22, and over Rs3,000 crore in FY23.

Analysts, industry watchers and funders tell us why Aakash makes more sense. First, the resurgence of offline education after the pandemic has taken the sheen off online teaching, which was the only mode of instruction during the peak of the Covid wave.

“Everybody thought that online would kill offline," says Anil Joshi, founder of Unicorn India Ventures, a venture fund backing early-stage startups. Consequently, brick and mortar coaching and teaching was written off. Interestingly, offline rebounded once schools and colleges opened up across the country, and a wave of edtech players started to struggle to find their feet in the old normal of offline world. Though the K12 wave started to ebb at an alarming pace, test prep segment—medical and engineering in particular—continued to boom in the online and offline world.

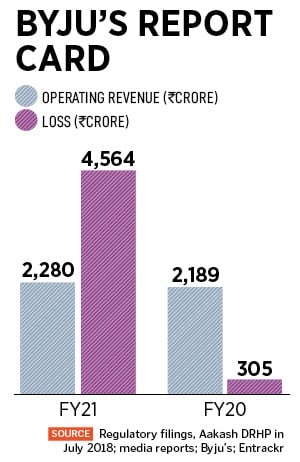

Second, a dip in online education coincided with the dawn of a funding winter. Byju’s, which reportedly spent over $2.4 billion in acquiring close to two dozen companies, started to cut costs to stem losses, which had ballooned to Rs4,564 crore in FY21. It reportedly laid off over 2,500 employees—around 5 percent of its headcount—started closing down its field sales centres across smaller cities, and paused its acquisition drive. The company also saw a staggering markdown in its valuation by one of its backers.

Second, a dip in online education coincided with the dawn of a funding winter. Byju’s, which reportedly spent over $2.4 billion in acquiring close to two dozen companies, started to cut costs to stem losses, which had ballooned to Rs4,564 crore in FY21. It reportedly laid off over 2,500 employees—around 5 percent of its headcount—started closing down its field sales centres across smaller cities, and paused its acquisition drive. The company also saw a staggering markdown in its valuation by one of its backers.

In April, US-based asset manager BlackRock, which owns under one percent stake in Byju’s, slashed the valuation by nearly 50 percent to $11.5 billion, and at the end of May, slashed it further to an estimated valuation of $8.4 billion. Last year, Prosus, the Netherlands-based technology investor, valued its 9.67 percent stake in Byju’s at $578 million at the end of the September-quarter.

First Published: Jun 05, 2023, 15:59

Subscribe Now