The year was 2007. Everyone was gung-ho about the world markets were establishing new peaks. Ajit Dayal was on the road raising money for international investments in India. But when he met people, he told them to hold on, that they should not be allocating too much money to India, and to give his company only 20/25/33 percent of what they wanted to eventually give him. “But you’re an India manager, you’re looking for business and AUM [assets under management], and you’re telling us not to buy India," investors told him, recalls the founder of investment firm Quantum Advisors. But it was their assumption that India was overvalued then, and they told clients, “We’ll call you when the markets collapse." Obviously, in 2008, when the Lehman crisis hit, Dayal and his team made the calls.

About 14 years and a few peaks and troughs later, the markets are at some sort of a peak yet again. And the obvious question you ask the man who has been in the business since the ’90s is: Do you think the markets are overvalued? “Currently, markets are certainly not inexpensive. I don’t know if they’re overvalued," he says. It’s a dynamic situation in the short term, depending on whether Covid-19 drags on or if it disappears quickly. “But on a five- seven-year view, India will give you a rate of return that’s very respectable as an international investor, and certainly, as a domestic investor you should be invested in equities for the long haul," he says, on a Zoom call from Europe.

In Mumbai, IV Subramaniam, managing director and group head-equities at Quantum Advisors, pitches in. “Since 2016, the large listed companies have been getting a more favourable place to operate while the smaller companies are dying out, and we are still not very clear about how much of that is captured in the valuations of large companies. So, we are constantly evaluating."

The way to nirvana

Though the factors are different in every market cycle, and no one can predict how the uncertainty surrounding Covid-19 will pan out, some things remain the same: Their model of value investing and predictability that they have put in place over the years.

Value investing involves purchasing a stock where the market price is below the stock’s intrinsic value it’s something Dayal honed and imbibed by working with Tom Hansberger, the legendary co-founder of Templeton Mutual Fund and a value investment maven.

Dayal set up Quantum in 1990 as an independent equity research firm, which became a local partner for Jardine Fleming for its India business from 1992 to 1995. From 1997 to 2004, it partnered with global investment firm Hansberger Global Investors (HGI) to advise them on their India portfolio and help Hansberger research and invest in stocks for their global portfolios. Dayal was deputy chief investment officer for HGI from 1997 to 2004 and also the lead fund manager of the Vanguard International Value Fund after HGI got the mandate to manage it in July 2000.

“There are many ways to invest in stocks," he says. “You can be a growth investor, you can be a blue-chip investor... there are various paths to God, various ways to reach your nirvana, you can choose different religions. The one that we understand, that we like, is ‘value’: That is what Subbu and I are at the core."

Over the 25 years since Dayal and Subramaniam first started working together in 1996, the two have built research teams, looked for ‘catalysts’, and put in place a fixed set of parameters to check. And along with that, the two also seem to have built a trove of investment stories—where in the unlocking of value, not just balance sheets and performance, but also things like canteens, driving around cities and drinking tea and coffee in expensive cups and saucers, come into play.

Take the case of ING Vysya Bank, where a visit to the office of the CEO in 2006 made them wary while a change in management was the catalyst that drove the decision to invest. “It was the previous CEO and the room was massive. The secretary’s room was probably bigger than our office," recalls Dayal. ING Vysya was then a bank that gave loans to small businessmen and missing out on the exponential growth in retail lending in India, and “literally, sitting in an ivory tower". The contrast flagged off a disconnect. And then the new CEO came in, 25 years younger, dynamic, and as Dayal puts it, “had done some great things in Australia, and was planning to bring some of those ideas to India". They bought the stock.

“We bought it [ING Vysya] at less than a one-time price to book and eventually sold it at more than three times the price to book," adds Subramaniam, the evaluation strategy being looking at good management, good business, but out of favour for some reason, and some visible catalysts for the value to get unlocked.

![]()

If there was an ivory tower in the case of ING Vysya, in the case of Infosys, in 2007, Dayal made his way to the company’s canteen. He was preparing a research report on the company and knew there was nothing Nandan Nilekani or Mohandas Pai or NR Narayana Murthy could tell him that would not be in the annual report or on their website. So, he asked for permission to have lunch in their canteen. “I thought, IT companies are built on human resources, right?" he says. He parked himself in the canteen for about three hours from noon, eating lunch (“which I, of course, paid for") and since he wasn’t supposed to speak to anyone, just listened and took in the atmosphere.

“When you are watching people come and go, you get a sense… There are so many financial indicators in the annual report. But there is no indicator of what the people look like, whether they look happy or unhappy, angry or stressed, are they grumbling, ‘yeh khaana itna kharrab hai, kantala aata hai yeh company mein aane ke liye, bus mein aane ke liye [the food is so bad, It’s boring to come to work, it’s a pain to come by bus], whatever, you never know," he says.

Canteens can also be an important measure of activity, of hierarchy and how the management thinks—whether managers eat in the same canteen or somewhere else that is fancier, with expensive crockery that you are afraid you might break.

When they wanted to invest in Tata Motors (earlier known as Telco) in 1997, just after the Asian financial crisis in July, the “khabar [news]" was that there were unsold Telco trucks parked for kilometres outside the factory in Pune, and that the company had even rented farmland around the area to park them. Because they believe in going and “pinching" to check things out for themselves, the two drove down. After realising that there weren’t as many trucks as had been made out, they paid a visit to the canteen where they could see the number of permanent and non-permanent workers coming in. “Speaking to the people who ran the canteen, including about the amount of food they prepared, gave an important measure of the level of activity in the factory," recalls Subramaniam.

Driving around Hyderabad, researching companies in 2007, set alarm bells ringing about Satyam Computer Services. “We had hired a car to take us around to meet companies and every other building the driver would say, ‘yeh Raju ka hai, yeh Raju ka hai [this is Raju’s, that is Raju’s]’," says Subramaniam. When they came back and looked into it, trying to calculate how the founder (Byrraju Ramalinga Raju) had so much wealth, they knew something was off.

These are intangible, non-financial parameters that speak about a company’s governance and management style, and while they launched their proprietary integrity screen in 1996, since 2015, their ESG parameters have also been quantified “so that," says Dayal, “you can quantitatively make a judgement, as opposed to Ajit saying, ‘I think only one out of 1,000 people were smiling on the Infosys campus, they have an HR problem’. Now you can actually mark and track data and see what happens over time."

![]()

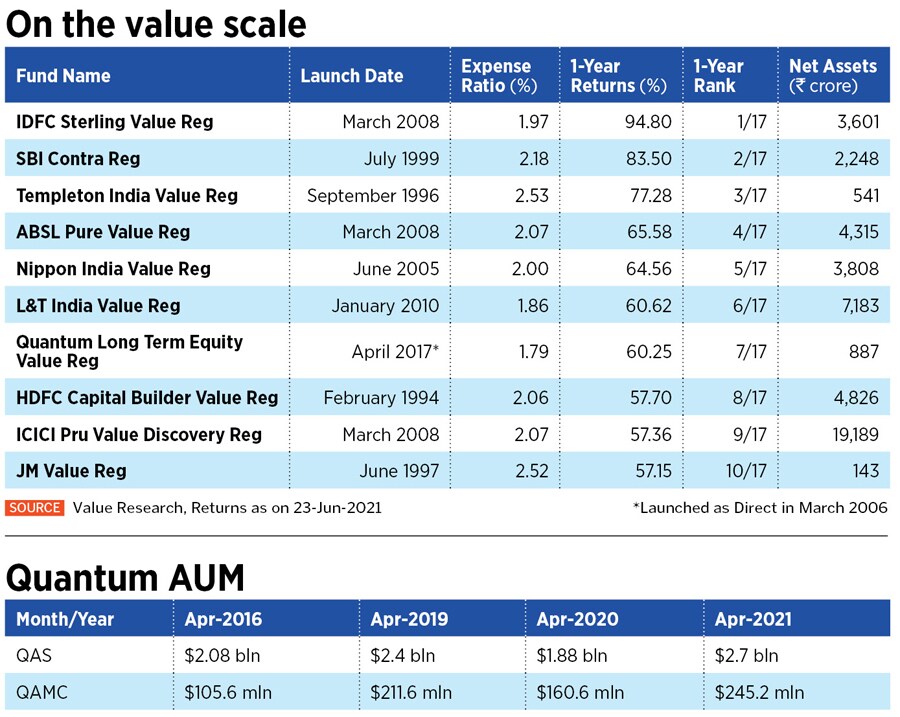

The company manages about Rs 20,000 crore of AUM for international investors under a PMS licence, and even as it continued dealing with international clients, it took their learnings and the process into their asset management company in 2006, launching mutual funds for domestic investors. Its value product, the Quantum Long Term Equity Value Fund, has an AUM of about Rs 887 crore and is ranked among the top 10 in a ranking by independent financial advisory firm Value Research. The Quantum India ESG Equity Fund, launched in 2019, was a natural extension of its integrity screen and parameters.

“It’s a middling performance, not outstanding, not disappointing," says Dhirendra Kumar, CEO, Value Research, about the domestic value fund. On the other hand, he adds, “they are good, hygienic funds, and more importantly, they will always do the right thing which will not hurt investors. They will be more predictable."

What this translates into is minimising risk and increasing predictability. “We look at risks first and then the returns, we have a long-term orientation, and we build teams so that all of these will result in very predictable returns," says Subramaniam.

It follows that companies that simply rely on their ability to affect policy making are out. “When policy-making is your only criterion for success and speed of excellence to make money, we don’t like to invest in such companies. Because policymakers change, and policies can change. And those who influence policy can change too. Someone with bigger, deeper pockets can come along and change policy," says Dayal. “I can try to model consumer behaviour. I can try to model competition, I can try to model raw material costs, but how do I model influence over policymaking? So how can I buy that stock? To model that opaque skill set doesn’t make sense."

Focussed on the long term

When Subramaniam walked into Dayal’s office 25 years ago, he saw a poster with a quote by Mahatma Gandhi on the wall: The means is as important as the end. It remains a maxim not just for investments, but also something that makes its way into the hiring process and the building of teams—where ethics matter because while analysts can be trained, ethics are not something that can be taught. “If a CA gold medallist interviewing to join Quantum tells me the end is the most important thing for him and he doesn’t care about the means, I know I’m building a scandal right there when I hire someone like that and one day give him control of money and client decisions over periods of time," says Dayal, adding that lack of values is not something you can unwind or teach someone. “Values is what someone learns around a family dining table."

For Kumar, their fund managers are “brilliant", competent and skilled, and there’s honesty and integrity. “They always give me examples, situations, context, which is better sometimes than some of the bigger fund managers. And when they go wrong with something, they don’t have a problem admitting to it."

However, he points out a few things on the domestic side of things. Like they seem to have spread themselves too thin instead of focusing on just two-three big funds. That they have sometimes been rigid about the target prices they set for a stock. And perhaps, the fact that calls taken by teams do not work.

“It’s a nice structure to de-risk it, but maybe they can have co-managers, three managers looking at different segments of the market. This committee business does not work, somebody could take charge, take a bet. I am not saying stardom. Maybe it’s a sensible strategy, but we are talking about capitalism, people are looking at getting credit, making money, and succeeding, and succeeding big time, rewards in line with that," says Kumar.

Some things they are open to adapt and change, but some things they remain firm about.

Among the things they wouldn’t compromise on, come what may, Dayal lists building out a significant cash balance in the balance sheet. “There could be a point in time when we tell our investors, we don’t like the India story at all. So take your money back and don’t allocate to India. We don’t want to handle your money, we have no opportunities in India. When we do that, we must have enough money in our balance sheet to continue paying our staff, continue paying rent, electricity, travel bills when we could travel for research, even with zero revenues. So that’s one thing we will always stay true to: Do what is good for our clients."

The second is the integrity of the process. “So, we will never compromise on the ethical framework of the portfolio in trying to generate a return," says Dayal. While the other part is, there should be no star, it’s all about teams. “If we believe that India is a great place to be for decades in the future, we better have teams in place and successors in place."

The succession plan is in place as is the capacity. The capacity of the Q India Value Equity product is $9 billion, and between India and international investors they are currently at approximately $2.82 to $2.9 billion, says Subramaniam. “On the domestic AMC business front, in the equity fund of funds, you can put in Rs 200 billion and we will endeavour to give you the same track record and in the liquid fund you can put in Rs 500 billion and you may get the same track record," he adds.

As in investing, so at a firm like Quantum, it’s all a matter of time.

IV Subramaniam (left) and Ajit Dayal of Quantum Advisors have built processes that put integrity at the heart of what they do

IV Subramaniam (left) and Ajit Dayal of Quantum Advisors have built processes that put integrity at the heart of what they do