How Spocto is making collecting on loans quicker and more efficient

The startup's AI-enabled platform allows financial institutions to assess risk profiles of customers and monitor portfolios in real time to ensure smoother collection

The best way to lose a customer is to give the account to one’s collection department. This is Sumeet Srivastava’s firm belief. It is also what led to his founding Spocto, an artificial intelligence-enabled platform that allows financial institutions to assess the risk profiles of their customers.

Sample this: When a customer takes a home loan, a credit and profile check is done. While past behaviour may show that the customer is likely to pay up, how does one make an assessment for, what in most cases, is a loan with a 20-year tenure? At any point in the journey the loan could go bad and the lender may have missed the warning signs.

Or a two-wheeler loan customer may have an unpaid charge of Rs100 on account of one bounced debit for monthly loan installments. That charge would not allow them to remove the hypothecation on the vehicle and make a sale impossible. How does one get this account closed?

As credit has exploded in the last decade the number of consumer interactions have increased manifold. In FY22 alone personal loans rose 22.4 percent by value to Rs792,400 crore, according to data by CRIF High Mark, a credit bureau. There were 58 million active loan accounts. Each of them has to be managed and monitored for signs of stress.

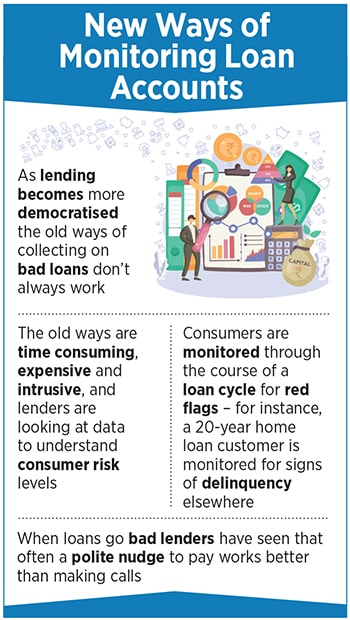

Lenders have seen old collection methods failing. Outsourcing to a collection agency brings in sub-optimal results. At Rs1200 the cost of sending an agent may not be worth it when collecting on a personal loan payment of Rs2000. At the same time financial institutions realise they cannot be good lenders unless they learn to collect efficiently. Warning signs have to be picked up and consumers have to be nudged to make payments. This is painstaking work that is often outsourced and best done through the use of technology.

Enter Spocto, which set up shop in 2017. Srivastava, who co-founded the company with his wife Puja, had spent a decade with Monsanto in India and Asia. In this time he’d seen the power of technology and how it had changed the lives of farmers. He had witnessed first-hand how indebted they were to the change technology brought about. The penny dropped for him when he saw that in appreciation, a farmer had put the RSVP number on a wedding card as the service Monsanto provided crop information on. “I called up the farmer and he mentioned that his annual income had gone up by Rs70,000-100,000 by using this service." That was when he decided against moving back to the US with Monsanto and work in the B2B space in India. (His prior stint with General Electric’s finance arm had given him an insight into retail banking.)

In February 2022 debt marketplace Yubi bought a 75.1 percent stake in Spocto for Rs400 crore to enable lenders to use Spocto’s recovery solution. Spocto operates as an independent unit at Yubi. Gaurav Kumar, founder and CEO of Yubi, explains that for Yubi Spocto’s work with lenders in India was a key reason for their purchase. “We believe it is not possible to deepen debt markets without offering strong collection capabilities," he says.

Over the last decade lenders have worked to hone their credit collection skills. For them it has been a learning curve as they have tried to balance the cost of collection with the effort and time taken. As the number of accounts has risen they’ve realised that new to credit customers need to be treated differently. The collection methods used for a large loan to a corporate cannot be the same as those used for a Rs50,000 personal loan.

Here’s what they are up against. Only 18 percent of the country has a bureau record but with the proliferation of Aadhaar numbers a person’s identity is no longer in question. So when a new to credit customer applies, a lender can often take a quick decision on starting the person with a Rs10,000-100,000 loan.

Even with a customer with a 750 credit score and above the there is a 38-40 percent chance of him defaulting, Srivastava explains. How does one solve for this problem?

Using an analogy from marketing it becomes possible to understand how to map a customer. Let’s say a customer searches for a flight ticket to Thailand or a yellow couch. While this data cannot be tracked to a specific customer due to the General Data Protection Regulation it can be used in an anonymised form. As a result, on that computer banner ads for flights to Thailand or a yellow couch would start showing up.

Similarly, when a customer applies for a loan there are as many as 240 data points that can be tracked. Let’s say an employee from a particular company is applying for a personal loan. The IP address is publicly available. The lender can immediately tell that the person is in office when applying. If applying from home the lender knows the speed of the data connection being used. A 40 mbps customer would be treated differently from a 300 mbps customer. Then, once a phone number is entered, it is possible for the lender to see if it is a mobile phone with a data connection as there are startups who sell API information. If the person is not using a smartphone that tells the lender something about their socio-economic background.

Data points like these help lenders make credit assessments for customers and also allow for smoother collections. “If I send a collection agent to a customer using an iPhone 14 I am likely to have the door slammed in my face," says Srivastava.

Once the loan is assigned it needs to be monitored. Spocto looks for signs that a regularly paying customer may not make the next payment. For instance, if a credit card statement that has been delivered to an email ID is not delivered in a particular month a red flag goes up. If a mobile number goes inactive another red flag goes up. If a card inactive for months is being swiped close to the credit limit the bank would keep a close eye.

Secondly, when it comes to collections, customers do not want to be disturbed in an intrusive manner. For millennials, sending an email asking for payment works better than getting a call center employee to chase them. Jitesh Puri, head retail strategy and debt management at IndusInd Bank, who has worked in this business for over two decades says that only 1-1.5 percent of customers default. The rest either have a temporary cash flow issue or have simply forgotten to pay. Using aggressive tactics is often counterproductive. “Thanks to technology we are able to talk to a customer in the language they understand," he says. The bank is a Spocto customer and has been progressively expanding its usage of their offerings.

By using a combination of demographic data, psychographic data and digital behaviour data Spocto has been able to predict the chance of a customer defaulting to within 30 percent, according to Srivastava. This compares to the 38-40 percent chance that a credit bureau score can predict.

The company says it works on mapping digital journeys for each customer and then creating a risk assessment. For instance, if a well-meaning customer has not paid, an SMS with a payment link would be sent. If the customer clicks on the link, the risk assessment moves a notch lower. If he attempts to pay but doesn’t succeed due to his UPI account not working the risk assessment would move even lower. A few days later another message would be sent with a payment link and the risk assessment done once again. Each of these is a different digital journey to slot the consumer in a different bucket.

While declining to disclose numbers on their success rate Spocto says the results have been very encouraging. The company on October 5 launched their offering for clients in the Middle East.

Spocto is also clear that they won’t take any balance sheet risk. The model is a fee-based model and the risk of not collecting on the loan remains on the lender’s balance sheet. Srivastava says he expects to be serving 40 million consumers with 85 lenders by March 2023 across agriculture loans, personal loans, home loans and buy now pay later. As lending continues to rise apace the demand for services like these looks set to stay.

First Published: Oct 07, 2022, 13:10

Subscribe Now Working with Lenders

Working with Lenders