IT services Q2 earnings provide mixed signals, reflecting strong demand but also

Infosys sees its cloud services revenues cross $1 billion in the September quarter, reflecting the sustained cloud shift

Infosys, yesterday, raised the lower end of its revenue projection band for the current fiscal year, but lowered the upper bound of its operating margin estimate—capturing an industry-wide trend amid a potential recession in the Indian IT companies’ biggest markets.

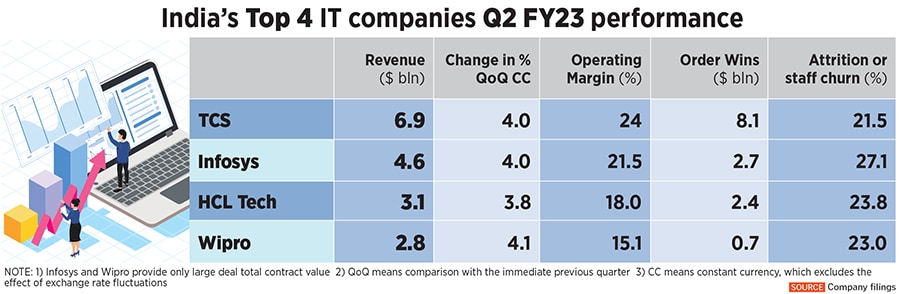

Thus far, India’s top four IT companies as well as notable mid-sized companies like Mindtree have reported their Q2 numbers and they reflect continued strong demand, but also more caution and a slight pullback in actual spending on these services.

At Infosys, India’s second biggest IT services company, reported revenues rose 4 percent for the three months ended September 30 from the previous quarter and 18.8 percent from a year earlier, in constant currency terms. The Bangalore company said it had won $2.7 billion in large contracts, its biggest haul in seven quarters. More than half of this was “net new," CEO Salil Parekh said on October 13.

Infosys defines a large deal as any order worth $50 million or more in value over the life of the contract.

“We strongly believe Infosys will be at the forefront of driving the digital journey of clients," Sumit Pokharna, vice president and research analyst at Kotak Securities says.

“More importantly, low exposure to legacy services, solid digital credentials and ability to structure and win integrated and complex transformation deals are positives and will power industry-leading growth," he says.

That said, Infosys’s 4 percent sequential Q2 revenue growth, while “robust", was below the brokerage’s estimate of 4.7 percent, Pokharna points out.

Global spending on IT and business services pulled back slightly in the third quarter of the calendar year, amid rising economic concerns, though the volume of contracts signed in the quarter remained near all-time highs, according to Information Services Group, a global technology research and advisory firm that tracks every such contract worth $5 million or more.

The September quarter actual contract value for the combined global market of what ISG calls XaaS and managed services was at $23.2 billion, down 3 percent versus the previous year. XaaS at $14.1 billion includes compute and storage (infrastructure, at $10.5 billion) and software as a service ($3.6 billion). It fell for the first time since the beginning of 2015 when ISG started tracking it.

And managed services—which fell 1 percent to $9 billion—include IT outsourcing ($6.8 billion), which rose 2 percent in the September quarter, and business process outsourcing ($2.3 billion) which slumped 10 percent, according to ISG.

The 3 percent reduction in the combined market was the first year-over-year decline in a quarter for the broader market since the fourth quarter of 2016, ISG said in its press release on October 13.

“Demand remains at an all-time high, but we are seeing some pullback in spending, as enterprises delay decision-making due to concerns about the economy," Steve Hall, president of ISG, said in the press release. “Companies are still invested in ongoing digital transformation but are going slower for now."

One explanation for the sustained demand amid worries of recession is that businesses around the world are changing the way they do business. Their reliance on technology has increased significantly.

In the past, even as recently as just before the Covid pandemic, what IT experts call “transformational managed services" were seen as “discretionary", meaning they were good to have but not critical, explains Mrinal Rai, senior manager and principal analyst at ISG.

These services were managed by vendors, including the Indian IT companies, and over time, “transformed" to deliver benefits including higher efficiency and effectiveness, apart from cost savings, and perhaps even some additional revenue opportunities.

Today, enterprises are literally overhauling their operations in such a way that “what used to be a discretionary expenditure has now become a necessity," Rai says. Companies recognise that to push through with these transformations of how they do their business, they have no option but to spend on technology.

This is also why transformation-oriented contracts, which were a much smaller source of revenue for the IT companies in the past are growing rapidly, while the traditional outsourcing of managing IT infrastructure and applications is table stakes and commoditised.

While the transformation contracts remain smaller in comparison to the large infrastructure deals, their scope is expanding, Rai says, with much more involvement from senior business executives on the clients’ side, and not just the IT teams.

At Infosys, CEO Parekh also signalled the sustained shift to the cloud that started picking up during the Covid pandemic. During Q2, the company saw more than $1 billion in cloud services revenues, he said.

TCS saw demand across consulting, cloud services and digital technologies, the company said in its press release. Demand for cloud modernisation services continued across all hyperscaler cloud services-–meaning services related to cloud infrastructure and technologies offered by Amazon Web Services, Microsoft and Google Cloud-–in all industry verticals, TCS said.

Most clients continue to prefer a hybrid cloud approach, meaning a combination of their own privately owned networks and those offered by companies including AWS, Microsoft and Google but also smaller vendors such as Snowflake.

TCS reported quarterly earnings rose 4 percent sequentially for Q2. The over 600,000-strong company reported an order book of more than $8 billion garnered during its fiscal second quarter.

Revenues for Q2 rose 15.4 percent in constant currency from the same period a year earlier. Profits for the quarter were at $1.3 billion, which was the same as for the year-ago period. Operating margins narrowed by 160 basis points to 24 percent from Q2 of FY22.

During the quarter, TCS won orders from customers such as Sainsbury’s, Catalent, PostNord, Bane Nor, Northern Powergrid, Prorail, Tap Air Portugal, and Boots.

The company added close to 10,000 new recruits to end the September quarter with 616,171 employees. In comparison, the company added close to 20,000 recruits during the same quarter last year.

“TCS reported a good overall quarter with growth driven by North America and India," Pokharna says. “EBIT margin increase was impressive. Margins will improve further and settle in the 25 percent range." EBIT refers to earnings before interest and taxes.

Across the sector, India’s top IT companies as well as larger foreign rival Accenture, are seeing strong demand for their services but also a hyper-competitive environment for deals and talent that is forcing them to trade some margins to win contracts and retain the best people.

And the growing importance of the transformational projects is also one reason for the high attrition in the industry. The demand for experienced recruits who can help deliver the transformational aspects of IT is high while the supply of such people is more limited.

HCL Technologies beat revenue expectations and increased its guidance for the fiscal year, signalling demand remains strong for its services in cloud, engineering, and digital technologies.

HCL Tech’s revenue for its fiscal second quarter rose 3.8 percent in constant currency terms, versus the first quarter and 15.8 percent from the year-earlier period. Revenues rose 1.9 percent in reported terms to $3,082 million from $3,025 million, India’s third-biggest IT services company said in an investor release, on October 12.

Analysts at Kotak Securities, for example, were expecting HCL Tech to report 2.9 percent increase in revenues in constant currency, on a sequential basis.

“Our bookings and pipeline continue to be very strong," chief executive C Vijayakumar said. The company added $2.4 billion in new contracts in Q2, a six percent increase over the previous quarter and 16 percent from a year earlier.

At fourth-ranked Wipro, revenues were in line with analyst expectations, increasing 4.1 percent quarter on quarter to $2.8 billion for Q2 and 12.9 percent from a year earlier, in constant currency.

India’s top IT companies continue to be highly profitable, but margins are under pressure across the sector due to attrition rates that are twice as high as last year.

HCL Tech reported operating margins of 18 percent for Q2, compared with 19 percent a year earlier, but higher than the previous quarter’s 17 percent. Profits for the Noida headquartered company for the three months ended September 30 rose to 7 percent to Rs 34.89 billion from the year earlier period.

At Wipro, Q2 operating margin was 15.1 percent versus 17.8 percent a year earlier. And profits fell nearly 10 percent to Rs 26.5 billion rupees for Q2 from Rs 29.3 billion a year earlier.

“Wipro will have to deal with more challenges in a slowdown given it is in the midst of a turnaround journey, has higher discretionary exposure and additional effort on integration of acquisitions," Kotak’s Pokharna says.

“While concerns around the economic outlook persist, our demand pipeline is strong as clients remain confident in our ability to deliver the value they seek, both on the growth and efficiency of their businesses. This is reflected in our revised revenue guidance of 15-16 percent for FY23," Infosys CEO Salil Parekh said in a statement.

In July, Infosys had forecast revenue growth in the range of 14-16 percent for the year that ends March 31, 2023. HCL Tech also raised its guidance for the full year. Revenues for the year that ends March 31, 2023, are now expected to be in the range of 13.5 percent to 14.5 percent, HCL Tech said, surprising analysts who were expecting it to retain its July projection of 12-14 percent increase over FY22.

Overall, Q2 revenues rose 13.9 percent in reported terms to $4.6 billion from the year earlier period. Revenues attributed to digital services accounted for 61.8 percent of overall sales and those grew at 31 percent during the quarter in constant currency terms, Parekh said.

Q2 operating margins expanded by 150 basis points sequentially as the company saw strong demand for its core IT outsourcing business as well, and attrition-–meaning staff churn-–trended downward for the third quarter in a row, on an annualised basis. Margins were lower by 2.1 percent in comparison with Q2 of FY22.

And in the backdrop of the overall macroeconomic environment and operations seeing an increasing proportion of staff returning to the office, Infosys changed its margin projection for the fiscal year to 21-22 percent from its July estimate of 21-23 percent. CFO Nilanjan Roy expects the company to end the year with margins closer to the lower end of the range.

Infosys continues to have the highest attrition rates among the top Indian IT companies. Q2 attrition was 27.1 percent versus 28.4 percent at the end of the previous quarter and 20.4 percent a year earlier.

The company ended Q2 with 3,45,218 employees, reflecting a net addition of about 10,000 recruits. Staff churn was 23.8 percent at HCL Tech and 23 percent at Wipro. Across the companies, the trend has been downward over the last three quarters.

At TCS attrition was at 21.5 percent at the end of Q2 compared with 11.9 percent a year earlier.

“Attrition has peaked in Q2, and we should see it taper down from this point, while compensation expectations of experienced professionals moderate," Milind Lakkad, TCS’s chief human resources officer, said in the press release.

Pokharna echoes this expectation: “We believe attrition will come down going forward as pent-up attrition following Covid has played out," he says. “Companies have replenished bench strength through aggressive hiring and expectations of a demand slowdown."

Also, compensation increase expectations of new hires has started to become more realistic, which is a favourable trend. And the headwinds from tight supply will progressively reduce as attrition rates and average premium for experienced recruits decline, he says.

First Published: Oct 14, 2022, 14:33

Subscribe Now