Build strong culture for strong bottomline: Bajaj Allianz's Tarun Chugh

By putting in place a strong team and processes, bringing in clarity of vision and purpose, Bajaj Allianz Life Insurance clocked a 58 percent jump in business amid the pandemic

Santanu Banerjee, CHRO (left), Tarun Chugh, managing director & CEO

Santanu Banerjee, CHRO (left), Tarun Chugh, managing director & CEO

Image: Nayan Shah for Forbes India

Insurance is a brick-and-mortar product," says Santanu Banerjee, CHRO of Bajaj Allianz Life Insurance Company (BALIC). “The product itself is intangible, but the person selling it is not. It has a very touch and feel quality to it."

Yet, BALIC has not just managed its business through the Covid-related lockdowns but actually saw it jump by 58 percent, at a time when the industry as a whole shrunk. How so?

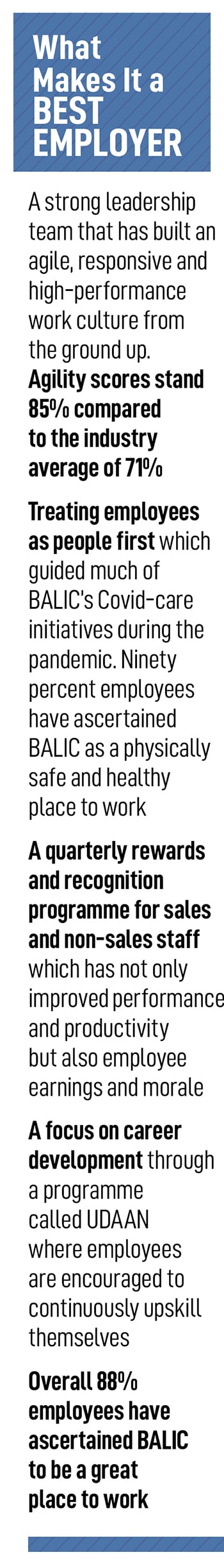

“I would say the culture we’ve built and the quality of our team [now 15,000-strong, up from 5,000 five years ago] helped us sail through," says Tarun Chugh, BALIC’s CEO. The culture, he says, is rooted in values of empathy, customer satisfaction, collaboration, high-tech innovation and ownership. But this wasn’t the case five years ago when the legacy organisation was ridden by archaic processes, siloed departments and bureaucratic behaviour.

By first putting in place a strong team and processes, bringing in clarity of vision and purpose, BALIC’s top leadership was able to create an agile, responsive and high-performance workforce. By the time Covid-19 struck in March 2020, the foundation had been set, explains Chugh.

By first putting in place a strong team and processes, bringing in clarity of vision and purpose, BALIC’s top leadership was able to create an agile, responsive and high-performance workforce. By the time Covid-19 struck in March 2020, the foundation had been set, explains Chugh.

Since employees were used to calling customers and then landing up at their homes to sell them the insurance products, a large part of the initial lockdown was spent in what Banerjee calls “training choreography". That is, training sales personnel on how to conduct WhatsApp video or Zoom calls in a way that they still connect with customers. BALIC then deployed a screen-sharing tool called Smart Assist Agent which further helped enrich the sales process. Ticket sizes actually went up as a result, says Banerjee.

But a business is only as good as its employees, and emotions such as fear and anxiety were running high among BALIC’s people as the first and second waves of Covid-19 took hold of the country. The company quickly jumped into action and implemented a slew of employee-centric measures: It enhanced the life insurance cover of employees, adding a special Covid-19 cover, set up a 24x7 telemedicine service and put in place a family assistance programme. Under the latter, families of deceased employees received not just financial assistance of up to ₹1 crore but also education assistance of ₹2 lakh per annum for two children up to graduation. “This security net created a lot of goodwill in the hearts and minds of our employees," says Chugh.

Further, as work from home became the new normal, BALIC realised the toll the blurring boundaries between home and work were taking on its employees, especially mothers. So they put in place a “lights off" policy during lunch time between 1 pm and 2 pm for lunch and after 6.30 pm. Regular CEO webinars with all employees served as a motivational tool and helped keep the team spirit alive despite the distance Covid-19 created.

Not only were there no layoffs during the pandemic, but salaries, promotions, bonuses, and rewards were rolled out in a timely manner. Moreover, the company transitioned from annual bonuses to quarterly incentives. As a result, employees’ performance and productivity picked up, as did their earning potential and morale.

Several measures are here to stay post the pandemic, says Banerjee. Such as work from home. It was initially a procedure, now it’s a policy. Employees can choose to work from office or home, based on a rostering system. Employee wellness took centrestage during the pandemic and will continue to do so later as well, he says.

So how does BALIC measure the success or otherwise of its employee initiatives? “Proof of the pudding lies in the eating," says Banerjee. Employee engagement, defined by how people talk about the company to their peers or kin, is at an all-time high. Scores now hover around the high 80s pre-pandemic it stood at 68. In fact, to ensure that it was continuously listening to its employees, the management shifted from an annual engagement survey methodology to a quarterly one.

Says Chugh, “What all of this did was show employees that BALIC cares."

First Published: Mar 02, 2022, 11:45

Subscribe Now