Inside Amazon's game plan for India

The ecommerce company has secured 100 million-plus customers in India, across verticals ranging from payments to exports. Despite regulatory hurdles, it is bullish on the Indian market and is making b

[br]

Dhaval Patel plans the festive collection for his brand Navrang Handicrafts a year in advance. Patel started his retail store in Rajkot in 1990, and for years his sale would range between three to four products per day. Around the pandemic, for months there was no sale, and the small-scale entrepreneur had almost made up his mind to shut shop.

A few months later, someone suggested he list his products on Amazon through its Local Shops programme. Almost immediately, his sales went up by 50 percent. “We receive orders from every part of India, sometimes even cities that we’ve never heard of," he says. To keep up with this demand, he’s had to expand.

Like Patel, there are over 12 lakh sellers in India who are now using Amazon as a platform to sell their products, not just in India but even globally. “For sellers—large and small—Amazon helps them reach a massive customer base," explains Manish Tiwary, country manager, India Consumer Business, Amazon India.

The upcoming festive season in October and November is a particularly busy time. The ecommerce giant claims that last Diwali, it saw close to 30,000 sellers cross Rs1 lakh in terms of sales and almost 700 to 800 new product launches.

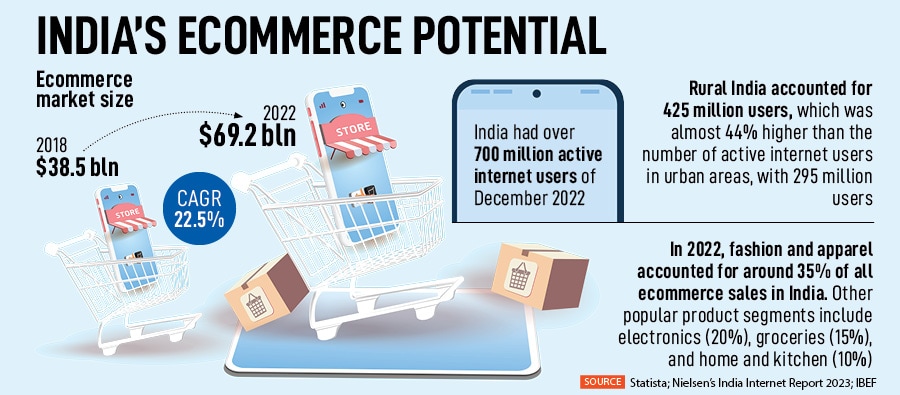

According to a recent study by Nielsen Media commissioned by Amazon India, 81 percent of consumers intend to shop online during this festive season and one in two consumers are willing to increase their spending this festive period compared to last year.

The study further states that consumers plan to spend across a range of categories during this festive period. About 75 percent are interested buying electronic gadgets and products (smartphones, TVs, refrigerators, ACs), luxury and authentic beauty brands, home furnishing/improvement items and consumables, online.

“The Prime Day sale has also indicated that users seem to be getting back to normal, and the sentiments look positive. This Diwali seems to be the first one since Covid-19 where the user is feeling bold enough to plan—so we’re expecting this festive season to be a big one," says Tiwary.

Also listen: Flipkart Big Saving Days versus Amazon Prime Day — what"s different this time?

According to Statista, the ecommerce market in India has grown rapidly over the last 4-5 years. In 2018, the market size was $38.5 billion, which grew to $69.2 billion by 2022—a compound annual growth rate (CAGR) of 22.5 percent. However, this only accounts for only 6-7 percent of the total retail market in India. As one of the largest players in the race, Amazon India has played a significant role in growing the market and the infrastructure around it.

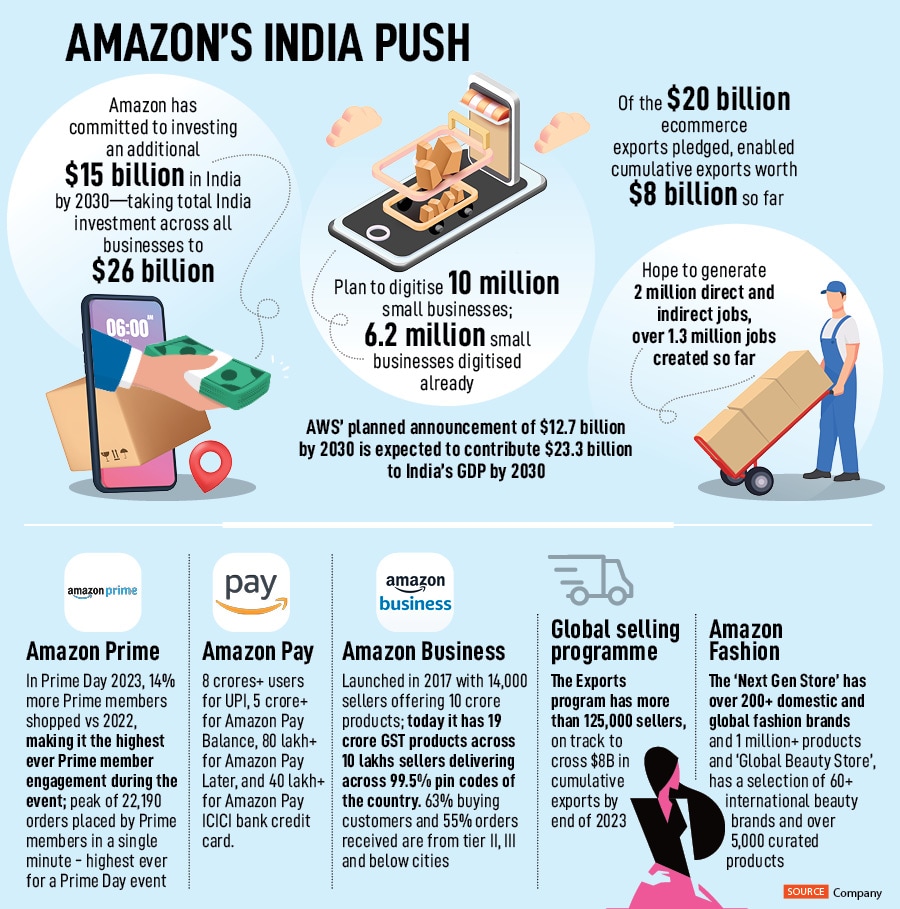

Amazon started its India operations in 2013, selling books. Since then, the business has grown multi-fold, with presence across sectors ranging from grocery and pharmacy to OTT and music. With a 100 million-plus customer base, Amazon has been extremely bullish about the Indian market. In 2020, during Amazon Smbhav’s event, founder Jeff Bezos said, "I predict that 21st century is going to be the Indian century." Amazon has committed to investing an additional $15 billion in India by 2030—taking the total up to $26 billion, across all its businesses.

When Tiwary joined the company in 2016, the platform was much smaller in India. “Now, when I travel with my work laptop and people see the Amazon stickers on it, 70-75 percent of the people sitting next to me have shopped or sold on Amazon—and they have good and bad anecdotes. This just goes to show, how in the last 10 years, the platform has become a part of India’s social fabric," he says. Amazon has also been selling freezers for cold storage and electric scooters on the marketplace. “Our aim is to remain customer-centric, so we never restrict ourselves saying we can’t meet a certain customer demand," reckons Tiwary.

One of the biggest growth drivers for the business has been the Prime programme, which was launched in India in July 2016. The subscription, which offers which offers a variety of benefits from faster deliveries to OTT subscription, Tiwary claims is “one of India"s most loved paid loyalty program."

Akshay Sahi, director, Prime and Delivery Experience, Amazon India, explains, “Over the years, we have seen that Prime membership is a bestseller during all key sale events, and we now see a lot of our new Prime members coming from smaller towns." The 2023 Prime Day Sale, was the biggest in India ever, with 14 percent more Prime members shopping as compared to last year, claims the company. “This year, we saw a peak of 22,000+ orders being placed by Prime members in a single minute close to five smartphones got sold every second, with 70 percent demand coming from Tier II & III cities," claims Sahi.

With the onset of the UPI revolution, Amazon Pay has become a lever in driving the platform’s success in India. Over the years, Pay has grown to 8 crore+ users for UPI, 5 crore+ for Amazon Pay balance, 80 lakh+ for Amazon Pay Later, and 40 lakh+ for Amazon Pay ICICI bank credit card. Despite growing competition, Mahendra Nerurkar, VP, India & Emerging Markets Amazon Payments says, “We continue to focus on improving resilience, latency and success rates for our core payment infrastructure and making our payment products more intuitive and rewarding for any customer to adopt." Innovation to stay ahead of the curve continues, as conversational payment via Alexa—where users can pay bills through voice commands—remains a priority.

Additionally, its global selling programme has helped small and large scale sellers expand beyond the Indian market. Currently they have close to 125,000 sellers who are part of the programme, on track to cross $8 billion in cumulative exports by end of 2023, claims the company. “It is important to note that these are not raw materials or commodities, these are finished products—from small sellers who would otherwise not have had the ability to get through the complexity of exporting it anywhere in the world," explains Tiwary. The marketplace has also signed a deal with India Post to cover cross-border logistics and shipments for businesses, to help them sell internationally. Sellers can drop their shipments off at over 100 India Post mail export centres, which will then be exported.

Sellers scaled up as the B2C business started picking up, when Amazon India realised there was a growing demand in the B2B space as well. For instance, a large corporate would struggle to find a good tissue paper vendor who would provide quality products along with the required GST invoices. On the other end, a small time tissue paper manufacturer in a Tier 3 city would be looking to expand. Says Tiwary, “We connected the two, with Amazon Business. A corporate has multiple options for all their needs, the process is transparent and hassle free. On the other end, the seller can scale up faster. It’s a win-win!"

Launched in 2017, Amazon Business started with 14,000 sellers and currently they have over 10 lakh sellers who offer a large selection of over 19 crore GST enabled products—from office supplies to large appliances. The main challenge that most business consumers faced, explains Suchit Subhas, director, Amazon Business, India, “Since indirect spends are spread over large number of stock-keeping units (SKUs) and vendors, they provide less room for negotiation for procurement team. This leads to increased procurement costs thereby having direct impact on profitability of the company."

However, as Amazon continues growing Tiwary says, “the overall penetration of ecommerce is nothing to write home about." Clearly, there is a long way to go. In terms of market share, Flipkart ($23 billion gross merchandise value or GMV) and Amazon ($18-20 billion GMV) lead on scale, with the two having about 60 percent market share currently, according to Bernstein. Reliance is third in the sweepstakes at present ($5.7 billion e-commerce sales) driven by attractive categories of fashion (Ajio) and JioMart (e-grocery).

Currently, the largest category within ecommerce is fashion—with a 25 percent GMV share, the category grew by over 40 percent in 2022, as per Bernstein. Players like Reliance’s Ajio, Myntra and even Nykaa are large competitors for Amazon in this space. The online grocery space for its Amazon Fresh vertical too, sees stiff competition from the likes of BigBasket, Blinkit, Zepto and Swiggy Instamart. Even for its B2B business, competitors such as Flipkart and Udaan are growing fast.

Even for Amazon Pay, the company has humongous rivals including PhonePe, Google Pay and Paytm—which in terms of number of transactions are ahead of Amazon Pay. According to numbers available on the National Payments Corporation of India (NPCI) website, Amazon Pay UPI’s numbers dropped from 75 million transactions in January 2022, to 57 million in May 2023. The value of transactions has fallen from Rs 6,300 crore in January 2022 to around Rs 5,700 crore in May 2023, as per a Moneycontrol report. However, its credit card in partnership with ICICI Bank is one of the most successful products in the country with more than 4.5 million users in less than five years.

With such cut-throat competition, what is Amazon’s strategy? “There is no strategy for competition," smiles Tiwary, during a conversation with Forbes India at Amazon office in Bengaluru. According to him, competition is healthy, “it pushes players to innovate further."

Amazon’s $26 billion investment in India will focus on goals including increasing exports, digitisation of small businesses, and generating employment. “We pledged to digitise 10 million small businesses enable $20 billion in ecommerce exports, and create two million direct and indirect jobs," Tiwary says. Of this, Amazon claims to have digitised over 6.2 million small businesses already, enabled exports worth $8 billion, and created over 1.3 million direct and indirect jobs in India. Of its total investment, AWS’ planned announcement of $12.7 billion by 2030 is expected to contribute $23.3 billion to India’s GDP by 2030.

Currently, the ecommerce giant boasts of reaching 100 percent pin codes in India. Of these, close to 60 percent of the demand is from Tier-II and Tier-III cities. “Improving infrastructure closer to smaller towns is necessary—for instance warehouse capacity of a small town in the Northeast might not be enough," explains Tiwary. In January 2023, the platform launched its own air cargo service called ‘Amazon Air’, to make the supply chain smoother. “Similarly, we were the first one to sign a deal with the Indian Railways where we will be using the country’s direct freight corridors for order deliveries," adds Tiwary.

Also listen: Amazon launches air cargo service in India Salesforce in Elliott"s crosshairs — report Log9 raises $40 mln

On the regulatory front, there are some daunting challenges. Foreign direct investment (FDI) in the ecommerce sector is restricted to 25 percent in the marketplace model and 100 percent in the business-to-business (B2B) model, limiting the ability of foreign ecommerce companies to invest in India. As per a TechCrunch report, these local legislations prevent “marketplace-model firms from owning, selling, and pricing goods directly." According to a Bernstein report, both Amazon and Walmart’s Flipkart have reduced its stake in affiliate sellers from 49 percent to 24 percent.

“These regulatory issues, which are important to safeguard the interests of Indian consumers, can slowdown the growth of ecommerce companies in India as they adopt these. However, the Indian government has taken many steps to address these regulatory issues. For example, the government has simplified the FDI rules for the ecommerce sector and they have also proposed a new data protection law that would streamline the data localisation requirements. The government is working to simplify the tax regime for ecommerce companies," says Rajat Wahi, partner, Deloitte India.

Tiwary and his team have been working closely with the government on the draft ecommerce policy as well. “As internet penetration in India has grown, we definitely need regulation and a policy that protects consumers, yet allows the digital economy to flourish," he says.

Before Amazon set up operations in India, it had presence across North America, Japan, Europe and China to an extent. “Cash on delivery wasn’t a feature in any of these geographies, Amazon India was the first to introduce it," Tiwari says. Even the distribution network had to be tweaked, as a majority of sellers being onboarded on Amazon, were SMEs—meaning, often they couldn’t deliver products to warehouses. So for the first time, packages were being picked up from sellers directly.

Innovation has been at Amazon India’s forefront from ‘Day One’. In 2013, when the global giant set up operations here, we were still in the 2G and 3G era. “We realised the customers were facing latency, so we launched a smaller sized app for when people are in bad network areas. This has worldwide implications, particularly for emerging markets," he adds.

Keeping localisation in mind, the marketplace is available in seven Indian languages including Hindi, Tamil, Telugu, Kannada, Malayalam, Marathi and Bengali besides English to provide users with a better customer experience. “Of all the global markets Amazon is present in, India is the only one which already has the app in seven languages, and growing," says Tiwary.

To increase ecommerce adoption for small businesses and easing their ecommerce journey, the company has also introduced a first of its kind generative AI-based personal digital assistant called "Amazon सहAI’. "It provides customised support to sellers on amazon.in, reducing their workload and simplifying time-consuming steps such as registration, listing, advertising support among others," explains Tiwary.

Even after a decade, Tiwary believes they are still at ‘day one’. With deeper expansion in existing verticals and an innovation-led approach, despite regulatory challenges the ecommerce giant continues to remain bullish on the Indian market. Tiwary stands by the core value of the company which he says is, “stay obsessed with the customer, because they are never satisfied and they keep raising the bar for us."

First Published: Sep 29, 2023, 15:07

Subscribe Now