Never in recent history has the world witnessed a more synchronised pace of relentless rate hikes to tame stubbornly high inflation levels. The sudden financial tightening has choked growth and squeezed many banks out of shape. This, combined with the ongoing war between Russia and Ukraine, and the strained relations between China and the US, has put the world economy on tenterhooks.

Geopolitical concerns aside, the unfolding turmoil in the global banking industry underlines financial stability issues given how interconnected money markets are worldwide. The global financial crisis of 2008 is a reminder of possible shocks of varying degrees the world at large is exposed to when its biggest capital provider faces trouble. This will occupy a place of importance for central banks as markets chew over whether the quantitative tightening cycle is approaching its peak.

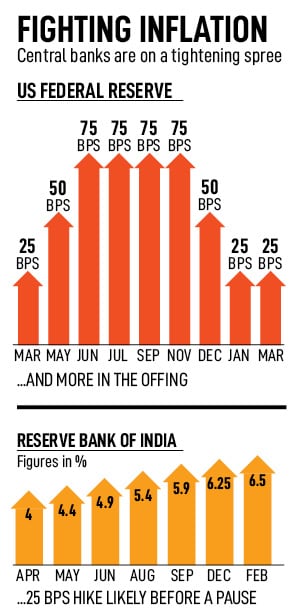

Since March 2022, the US Federal Reserve has lifted rates by 475 basis points to 4.75-5 percent target range. The terminal rate is seen around 5.6 percent by year-end. In March, it raised the policy rate by 25 basis points even as it took note of spill over risks in the financial system. There are signs of stress in many regional banks after the collapse of Silicon Valley Bank (SVB) set off alarm bells. US Federal Reserve Chair Jerome Powell mentioned that most committee members did take the spill over risks into account but “some additional policy rate firming may be appropriate."

However, if stress in the banking system does not intensify, the bank did not rule out the possibility that stronger macro data could push the US Fed to hike rates beyond May.

Prasenjit Basu, chief economist, ICICI Securities, expects the US economy to slip into recession in the second quarter of the current calendar year and he believes the tightening in credit conditions will further deepen the recession and generate slack in the labour market, which will help to pull down core inflation.

“We have been skeptical about the FOMC’s [Federal Open Market Committee] forecasts over the past 15 months, but think the Fed is now realistic. Monetary tightening remains necessary to fight exceptionally high inflation, but some of the Fed’s work will be done by the tightening in credit conditions amid the turmoil in the US banking system, which will also push the economy into recession. A bit more monetary pain lies ahead, with easing unlikely before Q2CY24 despite the intervening recession," he adds.

Despite the banking mayhem, last month the Bank of England (BoE) hiked interest rates by 25 basis points to 4.25 percent after a worrying inflation print. In fact, barely hours after Credit Suisse was thrown a lifeline of $54 billion, the European Central Bank (ECB) increased rates by 50 basis points to 3.5 percent. Investors and money markets have their seatbelts on as they brace for volatility even though banking regulators claim to be on the front foot to thwart bank failures and contain the damage.

RBI likely to raise the repo rate by 25 bps

On April 3, the Reserve Bank’s Monetary Policy Committee (MPC) will gather in Mumbai to set the benchmark rate and take stock of inflation and other macroeconomic data over a three-day bi-monthly credit policy meeting. India Inc was hopeful the rate-setting panel would hold rates, pause, and offer some respite.

![]() Now, that looks unlikely, as most analysts and economists have pencilled in a repo rate hike of 25 basis points given the higher-than-expected retail inflation print of 6.44 percent in February and the ensuing global chaos. Unlike some global banks, Saugata Bhattacharya, EVP and chief economist, Axis Bank, explains Indian financial institutions are on firm footing. The painful clean-up of bad loans exposed chinks and led to stronger bank balance sheets.

Now, that looks unlikely, as most analysts and economists have pencilled in a repo rate hike of 25 basis points given the higher-than-expected retail inflation print of 6.44 percent in February and the ensuing global chaos. Unlike some global banks, Saugata Bhattacharya, EVP and chief economist, Axis Bank, explains Indian financial institutions are on firm footing. The painful clean-up of bad loans exposed chinks and led to stronger bank balance sheets.

To that extent, India is ring-fenced. But it is not insulated. Lakshmi Iyer, CEO—Investment & Strategy, Kotak Investment Advisors, says volatility and uncertainty in the global financial markets have increased over the past few weeks.

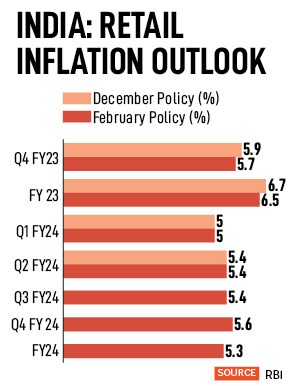

“The ECB and the US Fed have delivered 50bps and 25bps hikes respectively in March and incremental rate hikes from these two key central banks will depend on how incoming macro data and financial markets conditions evolve. In India, CPI remains above the 6 percent threshold, including core inflation which remains sticky. Though CPI is likely to trend lower in the coming months, the probability of a 25bps rate hike in the upcoming MPC seems high. To hike or not to hike could be the most discussed agenda as the clamour for a pause seems to be only growing," Iyer adds.

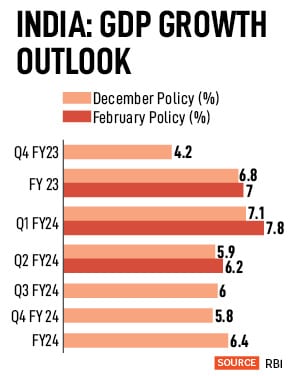

The clamour for a pause is louder because durable economic recovery is tepid. Foreign brokerage firm Nomura expects domestic GDP growth to decline from 6.3 percent y-o-y in Q3 FY22 to around 5 percent in Q4 FY22 and 4.3 percent in Q1 FY23. It cautions weaker global growth, tighter global financial conditions, and the lagged impact of domestic policy tightening, will lower GDP growth to a below-consensus 5.3 percent in FY24 from 7 percent in FY23.

![]() “We remain concerned about growth prospects this year, primarily factoring in the impact of the global slowdown on exports and investment. A global soft landing will have limited positive spill over effects for India, as higher-for-longer global rates will weigh on financial conditions and hurt capex, while China’s services-led reopening is unlikely to benefit India. Monetary policy also acts with long and variable lags, so the full impact of tighter domestic monetary policy and liquidity conditions on growth is yet to materialise. Meanwhile, continued weakness in the rural sector, and K-shaped trends in consumption make it an unreliable driver of growth in the near term," say the economists at Nomura.

“We remain concerned about growth prospects this year, primarily factoring in the impact of the global slowdown on exports and investment. A global soft landing will have limited positive spill over effects for India, as higher-for-longer global rates will weigh on financial conditions and hurt capex, while China’s services-led reopening is unlikely to benefit India. Monetary policy also acts with long and variable lags, so the full impact of tighter domestic monetary policy and liquidity conditions on growth is yet to materialise. Meanwhile, continued weakness in the rural sector, and K-shaped trends in consumption make it an unreliable driver of growth in the near term," say the economists at Nomura.

This explains the policy dilemma, and the widening split between the rate-setters over policy rate and stance. In the December meeting, one of the six members voted for a pause and two members voted against continuation of the policy stance. Recently, in the February meeting, Ashima Goyal and Jayanth Varma, external members of the MPC, voted against the majority decision of a rate hike of 25 basis points and the continuation of the current policy stance.

“In the second half of 2021-22, monetary policy was complacent about inflation, and we are paying the price for that in terms of unacceptably high inflation in 2022-23. In the second half of 2022-23, monetary policy has, in my view, become complacent about growth, and I fervently hope that we do not pay the price for this in terms of unacceptably low growth in 2023-24," Varma argued.

But RBI Deputy Governor Michael Patra held a very cautious outlook for inflation and said the stance of monetary policy will need to remain disinflationary till inflation returns to target, as per the minutes of the February meeting.

“Although it seems to have peaked, inflation remains high and, in my view, it is the biggest threat to the macroeconomic outlook. Restoration of price stability – as statutorily mandated – will provide a solid foundation for a growth trajectory that actualises India’s potential. Taking into account the height of inflation, current and projected, monetary and financial conditions still reflect some slack, although they are moving into tighter territory with the follow through of recent monetary policy actions. The issue is one of timing," Patra said.

RBI Governor Shaktikanta Das, in the previous MPC meet, had highlighted the problem of stickiness of core inflation at elevated levels and the considerable uncertainty on the evolving price trajectory due to ongoing geopolitical tensions, global financial market volatility, rising non-oil commodity prices, and weather related events. Many of these concerns persist and will weigh on the agenda as the six-member rate-setting panel ponders on whether to give growth a chance at the cost of inflation.

Bank of America believes some amount of unexpected tightening in bank lending standards may be in the offing. “The US economy may see tighter lending standards than what could be explained by macroeconomic fundamentals. If so, our view is that it could indeed substitute for further rate hikes. Hence, we no longer expect a 25bp rate hike in June and now foresee a terminal target funds rate of 5.0-5.25 percent reached in May," its economists said.

Bank of America believes some amount of unexpected tightening in bank lending standards may be in the offing. “The US economy may see tighter lending standards than what could be explained by macroeconomic fundamentals. If so, our view is that it could indeed substitute for further rate hikes. Hence, we no longer expect a 25bp rate hike in June and now foresee a terminal target funds rate of 5.0-5.25 percent reached in May," its economists said. Now, that looks unlikely, as most analysts and economists have pencilled in a repo rate hike of 25 basis points given the higher-than-expected retail inflation print of 6.44 percent in February and the ensuing global chaos. Unlike some global banks, Saugata Bhattacharya, EVP and chief economist, Axis Bank, explains Indian financial institutions are on firm footing. The painful clean-up of bad loans exposed chinks and led to stronger bank balance sheets.

Now, that looks unlikely, as most analysts and economists have pencilled in a repo rate hike of 25 basis points given the higher-than-expected retail inflation print of 6.44 percent in February and the ensuing global chaos. Unlike some global banks, Saugata Bhattacharya, EVP and chief economist, Axis Bank, explains Indian financial institutions are on firm footing. The painful clean-up of bad loans exposed chinks and led to stronger bank balance sheets. “We remain concerned about growth prospects this year, primarily factoring in the impact of the global slowdown on exports and investment. A global soft landing will have limited positive spill over effects for India, as higher-for-longer global rates will weigh on financial conditions and hurt capex, while China’s services-led reopening is unlikely to benefit India. Monetary policy also acts with long and variable lags, so the full impact of tighter domestic monetary policy and liquidity conditions on growth is yet to materialise. Meanwhile, continued weakness in the rural sector, and K-shaped trends in consumption make it an unreliable driver of growth in the near term," say the economists at Nomura.

“We remain concerned about growth prospects this year, primarily factoring in the impact of the global slowdown on exports and investment. A global soft landing will have limited positive spill over effects for India, as higher-for-longer global rates will weigh on financial conditions and hurt capex, while China’s services-led reopening is unlikely to benefit India. Monetary policy also acts with long and variable lags, so the full impact of tighter domestic monetary policy and liquidity conditions on growth is yet to materialise. Meanwhile, continued weakness in the rural sector, and K-shaped trends in consumption make it an unreliable driver of growth in the near term," say the economists at Nomura.