Wearable technology's great leap forward

Wearable technology is marching towards ubiquity and Indian firms like GOQii, Ducere and Leaf Wearables are expanding the purview of its functionality

Image: Mexy Xavier

Image: Mexy Xavier

Vishal Gondal, 39, founder and CEO of fitness technology company GOQii (pronounced ‘Go Key’), is frequently seen at gatherings sporting his trademark red Polo shirt and his company’s wearable fitness band on his wrist. It is no different when Forbes India meets him in his Mumbai office. The poster boy of Indian wearables is heading GOQii at an interesting stage of its evolution. “We started with fitness, but now we’re expanding,” he says.

GOQii raised $13.4 million in a Series A funding round led by New Enterprise Associates (NEA) in November 2015, followed by another round of undisclosed funding from the venture capital arm of Edelweiss Financial Services in February this year.

The success in raising funds apart, the decision to expand is also emblematic of a shift in the wearable technology sector, which is evolving beyond the standard step-counting fitness bands.

GOQii, that began operations in 2014, currently integrates fitness tracking with coaching and behavioural change. Essentially, it analyses the physical activity of its users using data collected from its wearable fitness band. The analysis is done by professionals with whom users can interact on GOQii’s platform for a fee.

It is this interaction that is set to improve. “We’re going from lifestyle coaching to medical care and insurance,” explains Gondal. The implications of this move are significant, particularly at a time when Indian health care is seeing the emergence of several players looking to solve the inefficiencies of the system.

Over the past few years, the wearable technology segment has undergone the typical technological journey from obscurity to intrigue. Now what seems obvious is the path to ubiquity. Research and advisory firm Gartner estimates that the worldwide sales of electronic wearable devices will total 274.6 million in 2016, 18.4 percent higher than in 2015. Of the $28.7 billion (around Rs 1.89 lakh crore) revenue that the sales of these devices will generate this year, $11.5 billion will be from smartwatches. While smartwatches—50.4 million of which will be sold in 2016, according to Gartner—are leading the charge, wristbands and other fitness trackers are also expected to sell 34.97 million and 21.11 million units, respectively.

As part of its technology, media and telecommunications predictions for India in 2016, consultancy firm Deloitte says digital wearables will see “significant adoption across consumer segments”. In a section titled ‘Wearables: The next smartphones’, the Deloitte report also quotes Counterpoint Research, which estimates that a million wearable devices were sold in India in 2015.

“Over the past decade, we have seen wearables evolve from offering basic alerts [for calls and text messages] and fitness monitoring to basic internet browsing and email functionality,” says PN Sudarshan, senior director, Deloitte India. GOQii has gone a step ahead with the integration of payments on its fitness band through a recent tie-up with Axis Bank. “In the medium- to long term, we will see wider functionalities being offered by wearables,” says Sudarshan.

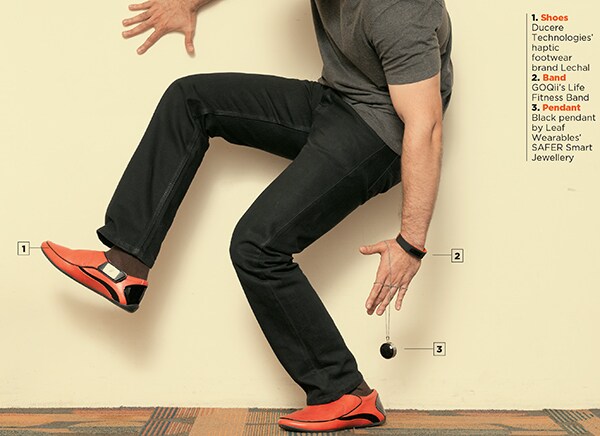

Other Indian companies too are going beyond the standard purview of a wearable device. Secunderabad-based Ducere Technologies—the maker of Lechal, which it claims is the world’s first haptic footwear brand—is one. (Haptic technology recreates the sense of touch using vibrations.)

What began as a project between friends Anirudh Sharma and Krispian Lawrence to create a navigation device for the visually impaired inspired the creation of Ducere’s haptic range of shoes and insoles. The company raised $2 million in 2014, through a combination of angel investments and debt, and is in the process of closing another round of funding, says Lawrence.

“In hindsight, one of the best things that we did was to build the product in India,” says Lawrence of the four-year-long development process. “This is because we had to solve so many problems that wouldn’t have existed in other places.” Lawrence recalls how, in 2011, when they began developing the product, digital maps were so inaccurate that they had to write their own algorithms to create customised paths. While maps have improved dramatically, the technology that Ducere developed in-house enabled it to do much more with their product, including ensuring precise navigation for hikers. Besides, he points out, building a company in India is significantly cheaper than in most other places.

But being an Indian company is no walk in the park. “Innovating on ideas based on hardware isn’t hard. The hard part is gaining local confidence,” says Ducere’s co-founder Sharma, 28. This includes gaining the confidence of investors—who are usually hesitant of investing in hardware companies—and convincing them about the appeal of the product.

A common refrain is on making a reasonably-priced product given the price-sensitive Indian market, says Lawrence, 32. “That may be true, but we have always looked at our product, thinking: ‘If I can sit here and buy a product from Cupertino, California, why can’t someone [overseas] buy something made in Secunderabad?’”

And it’s not just plain talk by the founders. Ducere’s shipment of 600 units to its first user group was sent to 37 countries in February. By May this year, the company will be shipping 12,000 pairs of its Lechal footwear, 95 percent of which will be outside India, says Lawrence. However, he believes India will eventually become the company’s largest market. “In the next three years, volumes will increase and the price of products will come down.” The experts concur.

“Wearable devices have just begun their journey towards becoming an integral part of human life,” says Bala Deshpande, senior managing director, NEA India. Deshpande adds that India is leapfrogging on the technology front. “This will require a significant amount of learning across the board—as a consumer and as a provider—as well as some behavioural shifts.”

For its part, Ducere’s learning has been to focus on fashion. If a product looks good, not only does it add value to the wearable device, it also plays another vital function: “With fashion, you’re giving the technology time to evolve,” explains Lawrence.

‘Smart jewellery’ firm Leaf Wearables, founded in 2015, is another company that has found new avenues for wearable technology through fashion. “We didn’t think of creating a wearable technology company to begin with. We wanted to solve the problem of safety [while travelling],” says Manik Mehta, one of the company’s co-founders. Smart jewellery simply presented itself as the best possible solution, he adds.

The Delhi-based company raised $250,000 in seed funding last year. Its flagship brand SAFER includes an assortment of wearable accessories—including pendants and leather cuffs—that can be transformed into safety and tracking devices by integrating them with an app on a smartphone.

Mehta, Ducere’s Sharma and Lawrence, and GOQii’s Gondal agree that the nature of computing is set to change and eventually the computer will be a part of the user’s body.

“It’s not going to be a single wearable that’s going to be the winner. Your shoe is going to talk to your watch, which in turn will talk to your eyewear. The future is going to be a wearable ecosystem, believes Lawrence. GOQii’s attempts to integrate varying facets of health and fitness into its service-led platform are indicative of such a trend. The company is already ‘hardware agnostic’, and its platform is compatible with the popular fitness tracker bands Fitbit and Jawbone, and even an iPhone’s motion sensor. And it has lofty ambitions: “We’re going to be the world’s largest preventive health care platform,” says Gondal.

But can smaller firms create a niche in a space dominated by a few large players with deep pockets? “Given the low product maturity in the present wearable ecosystem and standardisation of various hardware components, it is possible for a new entrant to develop a prototype by being firmware- or software focussed,” says Deloitte’s Sudarshan.

As technology around wearables and the Internet of Things continues to develop at a frenzied pace, India may well see more winners emerge in the near future.

First Published: Apr 20, 2016, 06:12

Subscribe Now