Then fate intervened, and soon, Mahindra was off to Harvard College to study liberal arts, where he majored in filmmaking and photography, quite unusual for the heir to a fledgling business empire then.

“I suppose when all of us are growing up, we do have a rebellious person inside us," Mahindra told the Ministry of Human Resource Development in 2019. “We need to feed that. I did not want to end my life where no matter how successful I was in business, (people shouldn’t say) he inherited everything and that his parents gave him everything on a silver spoon. I didn’t like that idea and so I wanted to do something in such a different area where nobody could say that my parents helped me, which is why when I did films." Mahindra then went on to do a film on the Kumbh Mela.

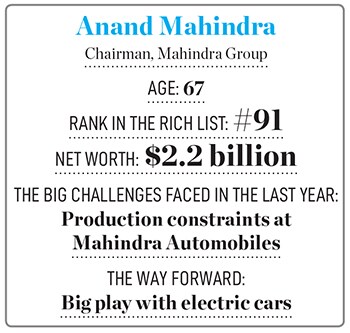

Mahindra, who was born to industrialists Harish Mahindra and Indira Mahindra, then went on to study at the Harvard Business School before joining Mahindra Ugine Steel Company Ltd in 1981. Three decades later, Mahindra took over as chairman and managing director of the Mahindra Group, before becoming the non-executive chairman in 2020, handing over the day-to-day running of the group to a professional management led by Anish Shah, the current MD and CEO of the Mahindra Group.

“One of the reasons we had succeeded and thrived over the past 75 years was that we were good at introducing change in the right measure at the right time," Mahindra said in 2019 when he appointed Shah as MD and CEO.

![]() Today, that gamble to bring in professionals seems to have worked. As chairman, Mahindra lords over the $19 billion Mahindra Group, whose business spreads across some 22 industries and has seen a phenomenal transition into its next phase of growth.

Today, that gamble to bring in professionals seems to have worked. As chairman, Mahindra lords over the $19 billion Mahindra Group, whose business spreads across some 22 industries and has seen a phenomenal transition into its next phase of growth.

Take, for instance, the change underway at Mahindra & Mahindra, the flagship automobile business of the group. In just two years, since the beginning of 2020, Mahindra & Mahindra has managed to reinvent itself and seen its market capitalisation grow two-fold, largely helped by the company’s renewed focus on building true blood SUVs.

Today, in what’s a sign of the company’s growing acceptance as India’s top automaker, Mahindra’s wait period for some of its flagship SUVs spans some 16 months, even as bookings continue to swell for India’s fourth-largest automaker. It all started with the launch of the second-generation Mahindra Thar—the first was introduced in 2010—in October 2020. The Thar, an iconic off-road SUV, modelled on the Willy Jeep, was launched with a revamped and rugged design, the latest infotainment options, an automatic gearbox to target the urban clientele, and a refreshed engine, among a slew of changes in Mahindra’s attempt to reclaim its losing turf in the domestic automobile market.

Then, a year later, Mahindra brought in its flagship model, the XUV 700, among the best-selling cars in India today, clocking bookings of over 10,000 units a month. The waiting period for the car now extends to over a year-and-a-half. Then early this year, the company launched the next generation of the Mahindra Scorpio, with an all-new design, priced at nearly half of what its competitors charged for similar features.

“By picking on our capability and competence, we want to attract consumers who are looking at multiple other segments," Rajesh Jejurikar, executive director for auto and farm sectors at Mahindra Group, told Forbes India in an earlier interview. “You can be a specialised position brand and still get volumes. To win in the SUV battle, you don’t have to make a product that’s similar to what somebody else is making. Because that’s what works for them. We must focus on our strengths. And that’s exactly the tweaking that we’ve done."

The recent turnaround came after a rather abysmal period when the company experimented with expanding its foothold in various segments of India’s automobile sector without much success, over the past few years, before regrouping to focus on its core area of work.

![]()

All that has meant that Mahindra has come back into the fight and reclaimed lost turf. Today, the company is India’s fourth largest carmaker with a market share of 8.58 percent, up by two percent from 6.3 percent compared to the year-ago period. The group’s commercial vehicles division saw a nearly five percent growth in market share compared to the year-ago period and is currently the second largest commercial vehicle maker in the country.

If not for its production constraints, largely due to the global semiconductor shortage, Mahindra would have sold more cars, and improved its market share in the domestic automobile market that is currently pegged at some $105 billion. “We have been having one blockbuster launch after another,"Anish Shah said on July 8 in Mumbai. The company is also the largest tractor maker in the country with a 40 percent market share and the largest electric three-wheeler maker with a 70 percent share.

Now, as the company finds itself on a firm footing, Mahindra is busy turning its attention to India’s electric vehicle (EV) segment and has announced plans to set up a subsidiary to focus entirely on building EVs. The company has managed to rope in British International Investment (BII), the UK’s development finance institution, to invest in the new subsidiary.

The new EV company will focus on four-wheel passenger EVs. “The total capital infusion for the EV Co is envisaged to be approximately ₹8,000 crore/$1 billion between FY24 and FY27 for the planned product portfolio," Mahindra & Mahindra said at the time of the announcement. “M&M and BII will work jointly to bring other like-minded investors in the EV Co to match the funding requirement in a phased manner."

![]() Early this year, the company launched the next generation of the Mahindra Scorpio, priced at nearly half of what its competitors charged for similar features. Representative imageImage: Adeel Halim / Reuters

Early this year, the company launched the next generation of the Mahindra Scorpio, priced at nearly half of what its competitors charged for similar features. Representative imageImage: Adeel Halim / Reuters

BII will initially invest ₹1,200 crore and the balance ₹725 crore on the EV company achieving certain milestones. Mahindra reckons that by FY27, it will be able to see EV penetration of between 20 percent and 30 percent in its portfolio. “Today, with government support, rapid lowering of the cost of ownership and increased consumer awareness of environmental issues, we believe that the time is ripe and right for us to enter the four-wheeler markets with our range of battery electric vehicles," Mahindra said during the company’s launch of five new electric SUVs for both domestic and international markets in August. The first four vehicles are expected to hit the road between 2024 and 2026.

“This year has been the best year for Mahindra," says Puneet Gupta, director for automotive forecasting at market research firm S&P Global Mobility. “They have been growing phenomenally for the past few years, largely because of some of the alliances that they put together in the past. That has led to a drastic improvement in the product. Now they have been focusing on realigning the organisation and the new management has brought about fresh thinking, and in the process consolidating the business."

In addition, Mahindra’s farm equipment division, which makes tractors, has also been witnessing stellar growth lately. In October this year, the company recorded sales of 50,000 units of tractors for the first time in a month. Last year, the company produced 355,000 tractors, the highest ever production in a year. Mahindra claims that its tractors are now present in all the habitable continents in the world.

Gearing up for more

While a significant focus will be towards electric transition at Mahindra & Mahindra, the group is also gearing up for more across the numerous business in which it currently has footprints.

This year, the group’s arm, Mahindra Lifespace Developers, the real estate division, crossed $1 billion in market capitalisation for the first time. Mahindra Lifespace has a presence across 15 countries and has been building residential and integrated cities and industrial clusters. The arm has completed, ongoing and forthcoming residential projects worth nearly 30 million square feet across six Indian cities.

![]()

Then there is Tech Mahindra, with a market capitalisation in excess of ₹1.02 lakh crore, and among the country’s biggest IT services companies. The company has over 1.5 lakh employees spread across 90 countries globally with revenues of ₹34,000 crore with profits of ₹4,913 crore as of FY22.

“Deal closures were soft due to the spillover of select deals into Q3, but importantly, the outlook of USD 700 million to USD 1 billion quarterly net new TCV (total contract value) was maintained," HDFC Securities said in a November report. “Key positives for Tech Mahindra were sequential improvement in free cash flow generation, operating performance (mitigating the wage hike impact) and line of sight for further improvement in margins, led by account pruning (BFSI & RoW impact in Q2), pricing, utilisation and sub-con optimisation (lower in Q2)."

Check out the complete lndia"s 100 Richest 2022 list

Then there is also the logistics business, which has emerged as one of the largest in the country, a used-car business, and a hospitality business in Club Mahindra that has been building a strong presence across the country. In all, the group had a market capitalisation of $31.63 billion in FY21, of which Mahindra & Mahindra contributed $13.52 billion, while Tech Mahindra constituted $13.13 billion. Mahindra Finance added another $3.36 billion with others, including Logistics, Lifespaces and Holidays, adding another $1.62 billion, according to a company presentation.

All that means the Mahindra growth story is only getting started. And Anand Mahindra, who didn’t want to be remembered as someone who got everything on a silver spoon, can be certainly proud of the legacy he has built during his time at the company. If the Mahindra story is anything to go by, he will only grow in the billionaire’s club.

Today, that gamble to bring in professionals seems to have worked. As chairman, Mahindra lords over the $19 billion Mahindra Group, whose business spreads across some 22 industries and has seen a phenomenal transition into its next phase of growth.

Today, that gamble to bring in professionals seems to have worked. As chairman, Mahindra lords over the $19 billion Mahindra Group, whose business spreads across some 22 industries and has seen a phenomenal transition into its next phase of growth.