The sales pitch struck a chord with some consumers. Besides, this was a time when awareness about “nasties"—such as parabens and sulphates—in creams and shampoos had caught on and the idea of a “made safe" brand caught attention across online platforms.

So much so that a year later, on the back of tactful influencer tie-ups and community-driven promotions, the brand went on to expand its portfolio to offer personal care products for mothers too, and then over the next five to six years, it changed course, and diversified into the thriving market of colour cosmetics and beauty products for millennials and Gen-Z.

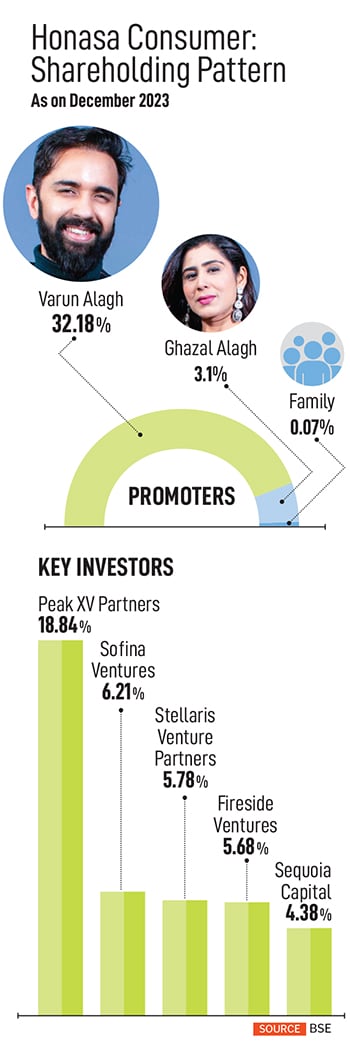

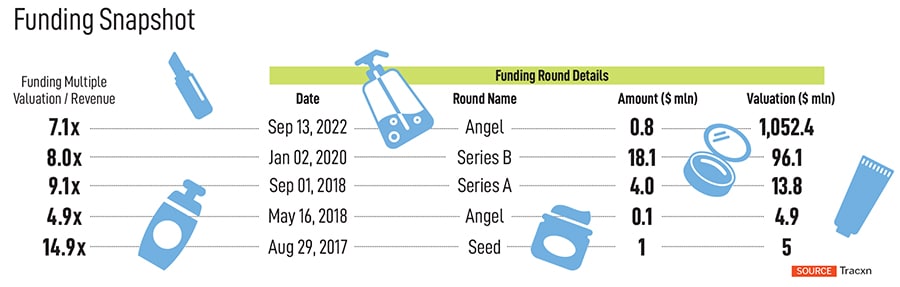

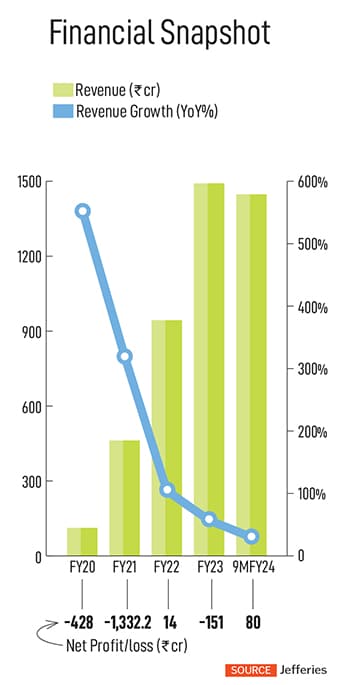

This is the story of Mamaearth, the flagship brand of Honasa Consumers. With buzzy digital marketing strategies backed by multiple rounds of fund infusion (see table) from venture capital (VC) investors such as Fireside Ventures, Sofina and Sequoia capital, to name a few, the beauty and personal care firm, co-founded by husband-wife duo, Varun Alagh, chairman and CEO, and Ghazal Alagh, chief innovation officer, set off on a high-speed growth path.

With a full disclosure that he is an investor in the company, Kunal Bahl, co-founder, Titan Capital, says, “Honasa’s journey is one of exceptional ambition backed by stellar execution."

D-Street debut

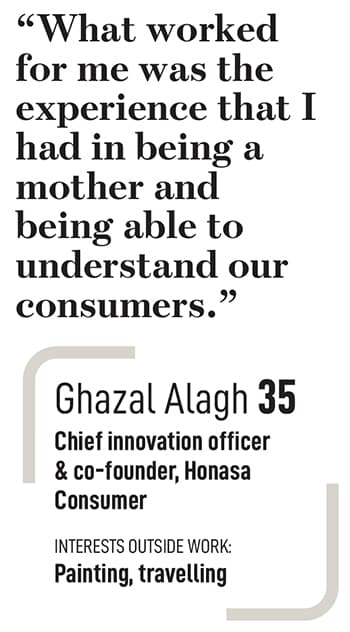

In November last year, the seven-year-old startup, after some back and forth with the markets regulator regarding its DRHP, listed on public markets to raise around ₹1,700 crore to fund advertising costs for brand visibility, and for setting up new EBOs and BBlunt salons. The IPO (see table) got a tepid response from investors due to concerns around valuation and the company’s business model.

Some experts believe the move may have been premature, but Varun says philosophically, “It’s just meant to happen when it’s meant to happen."

![]() Although markets weren’t convinced, Honasa Consumer’s listing unlocked high returns for its angel and VC investors who sold shares in the OFS portion. For example, actor Shilpa Shetty Kundra earned over ₹39 crore on her investment of ₹5.83 crore in 2018. But this pales in contrast to returns earned by, for instance, actor Alia Bhatt, whose investment of ₹4.95 crore in Nykaa in July 2020 yielded a return of close to ₹54 crore when the company listed on the bourses in October 2021.

Although markets weren’t convinced, Honasa Consumer’s listing unlocked high returns for its angel and VC investors who sold shares in the OFS portion. For example, actor Shilpa Shetty Kundra earned over ₹39 crore on her investment of ₹5.83 crore in 2018. But this pales in contrast to returns earned by, for instance, actor Alia Bhatt, whose investment of ₹4.95 crore in Nykaa in July 2020 yielded a return of close to ₹54 crore when the company listed on the bourses in October 2021.

Honasa’s early investors, such as Bahl and Rohit Bansal, according to reports, entered the company at an average cost of ₹3.21 per share. Similarly, Rishabh Mariwala reportedly bought shares at an average cost of ₹6.05 per share. When they partly sold off their shares through the OFS, they harvested profits to the tune of ₹36.5 crore and ₹181.2 crore respectively. VC funds like Fireside Ventures, Sofina and Stellaris also participated in the OFS to book profits. In fact, the promoters offloaded 3 percent and own 35.3 percent now (see table).

The founders claim the company is growing at 2 to 2.5 times the industry and a large chunk of the brands cater to ‘masstige’ segment with about 60 percent of the revenue coming from the face care category in the nine months of the current fiscal year.

The playbook

While the jury is out on several aspects of Honasa’s business model, there is resounding acclaim for its ability to create a buzz on digital platforms with its advertising and promotion methods to build a hype around the most basic and mundane.

![]() Runa Gupta, a marketing professional who worked in community marketing last year, says, “Mamaearth teamed up with mothers on Facebook communities who acted as advocates and created a strong WOM (word of mouth), visible in the brand SOV (share of voice) within the communities, which was supported by product trials and multiple other engagement approaches forming a well-connected network of nano influencers within these communities."

Runa Gupta, a marketing professional who worked in community marketing last year, says, “Mamaearth teamed up with mothers on Facebook communities who acted as advocates and created a strong WOM (word of mouth), visible in the brand SOV (share of voice) within the communities, which was supported by product trials and multiple other engagement approaches forming a well-connected network of nano influencers within these communities."

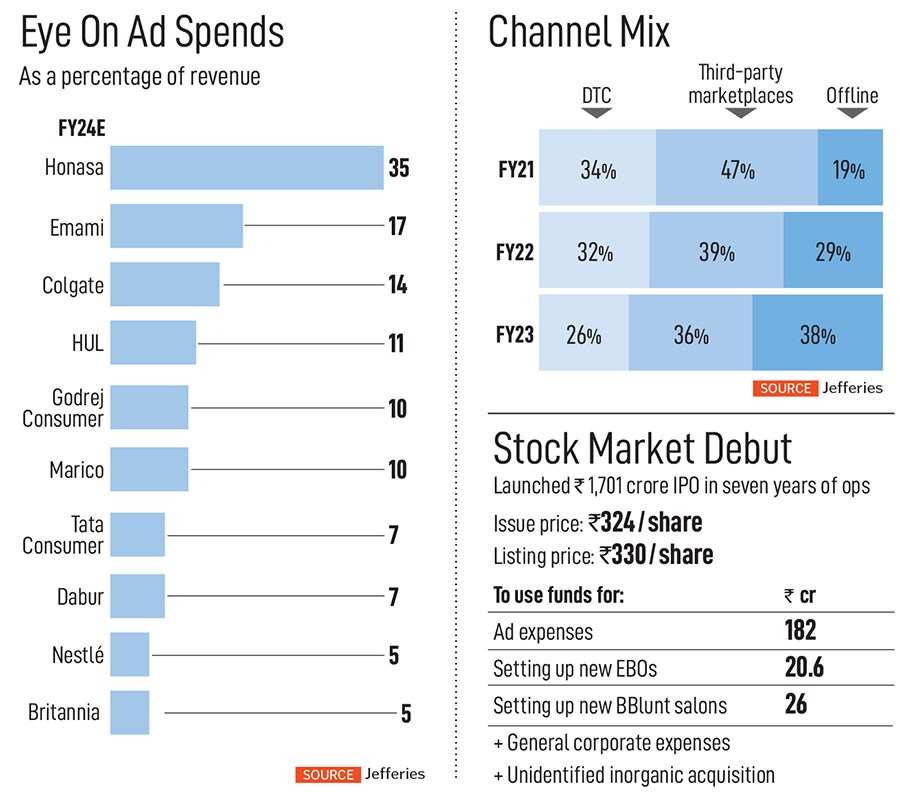

Honasa spends about 35 percent of its revenue on advertising versus 5 to 15 percent for traditional FMCG companies (see table). “High ad-spends is a key investor concern," Jefferies’ analysts note. Other unlisted peers—namely L’oreal India, Nivea India, ELCA Cosmetics and Lotus Herbals—spend about 26 percent of revenue on ad-spends, but have an Ebitda margin of 15 percent versus Honasa’s 7 percent, which analysts estimate could improve to 11 percent in two years.

Channel checks and the website show consistent offers of discounts to pull consumers: Buy one get one free, buy three pay for two, cashbacks and other freebies. At a time when industry behemoths are struggling with single-digit volume growth, Honasa reported a 35 percent volume growth in the December quarter. But contrary to industry practice of reporting underlying volume growth (UVG), Honasa reports volume as per unit sold. “UVG is a good concept, but it’s also slightly complicated in terms of execution," Varun says.

![]() To deliver industry-beating growth, the founders focus on leveraging data-capturing tools to discover consumer trends on the internet by tapping into, for example, key search words, to discover ‘trending’ ingredients. These insights, Varun says, drives the innovation process by helping the team to decide if, for instance, a shampoo should be called a lime or a lemon shampoo?

To deliver industry-beating growth, the founders focus on leveraging data-capturing tools to discover consumer trends on the internet by tapping into, for example, key search words, to discover ‘trending’ ingredients. These insights, Varun says, drives the innovation process by helping the team to decide if, for instance, a shampoo should be called a lime or a lemon shampoo?

Once a trending ingredient is identified, the team moves it from lab to market at lightning speed to beat competition. A case in point: In December 2022, ‘rosemary’ was a trending beauty ingredient and this activated the launch of a new rosemary haircare range of shampoo, conditioner and hair oil which hit the markets in around four months.

“We launched the range towards April 2023 before the hair fall and monsoon season, and in just six months, we were able to reach ₹50-crore plus ARR," Varun said at the company’s third quarter earnings call on February 9.

Honasa says it launched 122 new products in calendar year 2023, but declined to share granular details of revenue contribution and R&D expenses. “There are still a few white spaces we see where we feel the need to craft a new brand," Varun adds. “We’ll continue to come up with newer brands wherever we find those opportunities."

Honasa has a 100 percent dependence on third-party manufacturers to produce its entire range of products. These are not exclusive tie-ups. The founders argue this set-up is a lean and agile model which allows them to launch products far more quickly without capex commitments.

Concerns galore

Mohit Malhotra, CEO, Dabur, points out that while D2C brands can capitalise on specific trends, sustainable consumer loyalty is built on delivering quality products. He adds, “We don’t believe that 100 percent contract manufacturing is a safe strategy. While we do work with certified third-party manufacturers in the initial stages of a product launch to test the proof of concept, we quickly shift to our own manufacturing to ensure consistent product quality."

![]()

A brand manager of a wellness brand at a blue-chip corroborates quality risks arising from total reliance on working with non-exclusive third-party manufacturers: “We have a legacy and reputation to protect," she says on condition of anonymity.

![]() Importantly, one of the most credible R&D scientists and an industry veteran, with decades of experience across leading FMCG companies, in an off-the-record chat, explains that the average production time for beauty and personal care products for traditional companies is at least eight to 10 months.

Importantly, one of the most credible R&D scientists and an industry veteran, with decades of experience across leading FMCG companies, in an off-the-record chat, explains that the average production time for beauty and personal care products for traditional companies is at least eight to 10 months.

“This is the bare minimum baseline time period," the R&D expert adds. In traditional companies, R&D teams develop prototypes, this goes for customer testing, and then undergoes modifications based on the feedback. This takes around five months if not more. Next, a crucial stability study has to be undertaken to ensure that the product is safe and retains its original smell, texture and colour. This process takes another three to four months.

As per the R&D expert, to launch a product in four months could entail bypassing two critical steps: One, consumer trials, and two, the critical stability test. “Speed has become so important that the validation part of product design is circumvented," he adds. This gives an edge in terms of participating at speed with consumer trends, but raises questions about quality and the nature of innovation.

Challenges ahead

Moreover, Honasa does not have a moat or an enduring competitive advantage or pricing power. Barriers to entry are low and competition intensity across formats and distribution channels are high. This puts pressure on gross margins and can lead to execution challenges as the company looks to grow in the offline segment (see table).

In fact, not just D2C players, but incumbents with deep distributor ties and strong footholds in the offline space, are also inching into digital platforms to monitor consumer trends and beat D2C players at their own game. For example, a legacy company like Dabur has rolled out a slew of digital-first brands and now has an independent business unit for ecommerce with a young marketing team to drive innovation and advertising.

![]()

“We will use ecommerce as the launch platform for many of these new-age formats, build up scale here and then roll them out in other channels," Malhotra says. “The online space presents an easy entry for new players, but the trends developed by them are quickly replicated by organised players and at a much lower cost. So, the D2C brands have to continuously innovate and renovate and at a much faster pace, as compared to the organised players, in order to stay alive."

In modern trade, companies can buy shelf space, but to crack general trade, they need to build distribution might for reach. “You need feet on street which money alone can’t buy," says a marketing executive.

Though not a biochemist or pharmacist by training, Ghazal assures she can whip up cleansers and lotions in her kitchen as she claims to lead the firm to undertake safe innovations. As part of its growth plan, Honasa Consumer now houses five other brands: The Derma Co, Aqualogica, Ayuga, BBlunt and Dr Sheth, of which the last two were acquired in 2022, before the funding winter gripped the startup ecosystem.

Though not a biochemist or pharmacist by training, Ghazal assures she can whip up cleansers and lotions in her kitchen as she claims to lead the firm to undertake safe innovations. As part of its growth plan, Honasa Consumer now houses five other brands: The Derma Co, Aqualogica, Ayuga, BBlunt and Dr Sheth, of which the last two were acquired in 2022, before the funding winter gripped the startup ecosystem. Although markets weren’t convinced, Honasa Consumer’s listing unlocked high returns for its angel and VC investors who sold shares in the OFS portion. For example, actor Shilpa Shetty Kundra earned over ₹39 crore on her investment of ₹5.83 crore in 2018. But this pales in contrast to returns earned by, for instance, actor Alia Bhatt, whose investment of ₹4.95 crore in Nykaa in July 2020 yielded a return of close to ₹54 crore when the company listed on the bourses in October 2021.

Although markets weren’t convinced, Honasa Consumer’s listing unlocked high returns for its angel and VC investors who sold shares in the OFS portion. For example, actor Shilpa Shetty Kundra earned over ₹39 crore on her investment of ₹5.83 crore in 2018. But this pales in contrast to returns earned by, for instance, actor Alia Bhatt, whose investment of ₹4.95 crore in Nykaa in July 2020 yielded a return of close to ₹54 crore when the company listed on the bourses in October 2021. Runa Gupta, a marketing professional who worked in community marketing last year, says, “Mamaearth teamed up with mothers on Facebook communities who acted as advocates and created a strong WOM (word of mouth), visible in the brand SOV (share of voice) within the communities, which was supported by product trials and multiple other engagement approaches forming a well-connected network of nano influencers within these communities."

Runa Gupta, a marketing professional who worked in community marketing last year, says, “Mamaearth teamed up with mothers on Facebook communities who acted as advocates and created a strong WOM (word of mouth), visible in the brand SOV (share of voice) within the communities, which was supported by product trials and multiple other engagement approaches forming a well-connected network of nano influencers within these communities." To deliver industry-beating growth, the founders focus on leveraging data-capturing tools to discover consumer trends on the internet by tapping into, for example, key search words, to discover ‘trending’ ingredients. These insights, Varun says, drives the innovation process by helping the team to decide if, for instance, a shampoo should be called a lime or a lemon shampoo?

To deliver industry-beating growth, the founders focus on leveraging data-capturing tools to discover consumer trends on the internet by tapping into, for example, key search words, to discover ‘trending’ ingredients. These insights, Varun says, drives the innovation process by helping the team to decide if, for instance, a shampoo should be called a lime or a lemon shampoo?

Importantly, one of the most credible R&D scientists and an industry veteran, with decades of experience across leading FMCG companies, in an off-the-record chat, explains that the average production time for beauty and personal care products for traditional companies is at least eight to 10 months.

Importantly, one of the most credible R&D scientists and an industry veteran, with decades of experience across leading FMCG companies, in an off-the-record chat, explains that the average production time for beauty and personal care products for traditional companies is at least eight to 10 months.