Temasek cautious in investing in weakening global economic outlook

The investment company's India portfolio has grown smartly over past five years with investing in new-age companies

Global investment company Temasek, owned by the government of Singapore, is turning cautious in investing across geographies, including India, due to the increasingly deteriorating economic conditions where central banks are tightening monetary policy to battle rising inflation. “We will act when it makes sense," Ravi Lambah, Temasek India head, told Forbes India, while discussing growth for their portfolio in FY22.

Temasek has reported a much lower return of 5.8 percent in FY22, compared to 24.5 percent for the corresponding period in the previous twelve months. The company has an exposure in India of over 5 percent out of the total portfolio value of $297 billion.

“We definitely see a slowdown and recession looming. Hence we are cautious. The pain in the emerging markets is due to what will play out in the West," Lambah said.

This week Nomura has cut its growth forecast for India to 4.7 percent in 2023, against an earlier estimate of 5.4 percent.

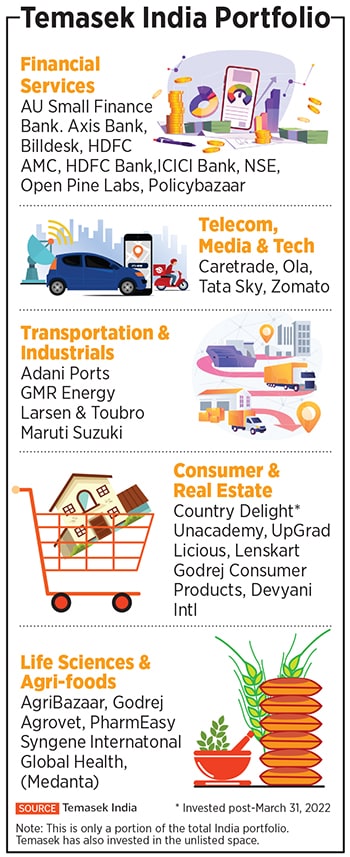

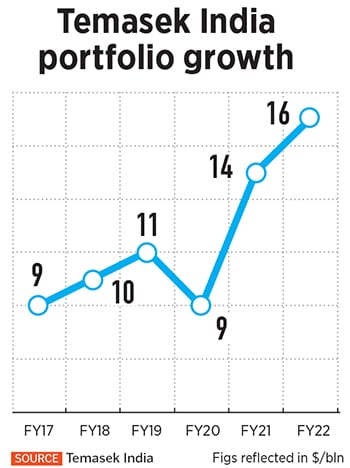

The positive part is that Temasek’s strategic shift in recent years to make early stage investments in new age companies such as Zomato, Licious, Lenskart and PharmEasy has started to play out. The India portfolio has nearly doubled in the past five years to $16 billion (see chart). Temasek continues to invest in India’s largest private sector banks—HDFC Bank, ICICI Bank and Axis Bank—besides newer banks like AU Small Finance Bank and industrial companies such as GMR Energy, Larsen & Toubro and Maruti Suzuki, in previous years.

Vishesh Shrivastav, managing director of Temasek India, said the shift in investment strategy took place over the past decade, after evaluating the customer spend and identifying innovators across the healthcare, life sciences and agri-tech sectors. Some of the portfolio companies such as Lenskart, PharmEasy and Ola plan to hit the markets with IPOs, but over an indefinite timeframe.

Lambah said that Temasek will continue to remain prudent in their exit strategies too. “We will hold [onto investments} if it makes sense. We are cautious right now but will act when it makes sense." Temasek took some money off the table last year from some of the IPOs which hit the capital markets last year. Tata Sky remains one of the rare companies where Temasek remains invested since 2009.

Temasek is also building the blockchain and AI infrastructure portfolio in Singapore, having already invested in the Bahamas-based FTX crypto exchange.

Lambah said that India’s economic growth story remained intact despite a few tough quarters ahead. “The policy framework is predictable and the broad macro-economic potential remains intact," Lambah said. The one challenge is that private capex is still to pick up, with the government being the main spender. Once this happens fresh investments will start to flow in.

First Published: Jul 15, 2022, 09:36

Subscribe Now