After FTX's collapse, there is a need to re-evaluate crypto exchanges

The bankruptcy of centralised exchange FTX has jolted the crypto world, but there is optimism within India's crypto exchanges, which are betting on the upcoming G20 presidency

The dramatic collapse of American entrepreneur and once high-flier Samuel Bankman-Fried’s (SBF) $32-billion crypto empire in November could soon become part of economic studies as one of the biggest financial debacles of centralised exchanges. There could maybe, even, be mini-television series and movies that follow.

The Bahamas-headquartered FTX was one of the world’s largest crypto exchanges, having raised $1.5 billion through private funding in 2021. Its 30-year-old founder, with his distinctive casual clothes and unkempt hair, had seen his fortune crash from $16 billion to near zero within days, Bloomberg notes.

The bankruptcy has sparked fears of a contagion: Bankman-Fried’s trading firm and FTX affiliate firm Alameda Research has gone bust on November 28, cryptocurrency lender BlockFi filed for Chapter 11 bankruptcy citing exposure to FTX, while two other crypto lenders, Voyager Digital and Celcius Network, had also gone bankrupt earlier in the year. Today, Bitfront, a US crypto exchange said it suspended new sit-ups and will cease operations within a few months, Reuters reported. Bitfront"s problems are not connected to FTX, though.

Crypto prices had slumped by 15 to 17 percent during the days when Binance, an early investor in FTX, backed out of a deal to bail it out, citing concerns over FTX’s business practices. Oddly, since then, global prices of Bitcoin and Ethereum appear to be holding on, down just over 2.1 percent and 4.7 percent, respectively, since FTX announced its bankruptcy on November 11.

The problems for Bankman-Fried came fast, after a CoinDesk news report in early November said that Alameda Research’s balance sheet comprised largely FTT, a cryptocurrency token that FTX Exchange had invented, and there were no “independent asset like a fiat currency or another crypto". In the following days, there was a run on FTX, after customers withdrew millions of dollars from the exchange on news that Binance was going to liquidate all its FTT, after reflecting on Alameda’s financial health. Bankman-Fried tried to convince Binance to bail out the exchange but Binance declined to save FTX, after corporate due diligence and reports of “mishandled customer funds and alleged US agency investigations", a Binance statement said.

Alameda actively traded almost every cryptocurrency on every exchange and later became a market maker, which means it provided cryptocurrency to exchanges for their users to trade with. Alameda was a major cryptocurrency market maker and the largest recipient of all USDT printed by Tether. FTX was the preferred destination for institutional traders, day traders, and ordinary retailers.

Alameda actively traded almost every cryptocurrency on every exchange and later became a market maker, which means it provided cryptocurrency to exchanges for their users to trade with. Alameda was a major cryptocurrency market maker and the largest recipient of all USDT printed by Tether. FTX was the preferred destination for institutional traders, day traders, and ordinary retailers.

The bigger issue here is, how a centralised exchange like FTX and its affiliate Alameda Research had no appropriate accounting records of their cryptocurrency assets, as observed by FTX’s new CEO John Ray, who took charge when Bankman-Fried had no option but to step down. It raises concerns on the viability of centralised crypto exchanges.

“The biggest area to be affected in the global crypto trade will most likely be the use of centralised exchanges. We are finding out that they too closely resemble the very banking system that crypto was supposed to free us from. I’m quite sure that they will be heavily regulated going forward," Steven Svetlick, an independent US-based crypto and blockchain educator told Forbes India.

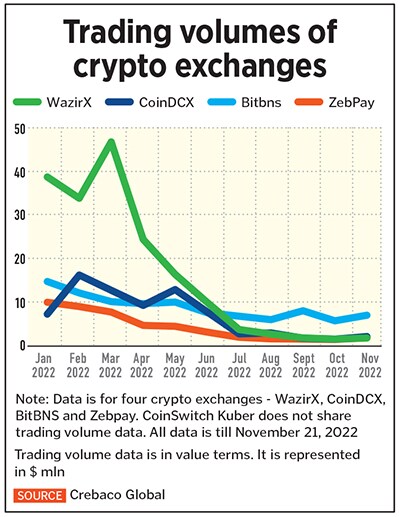

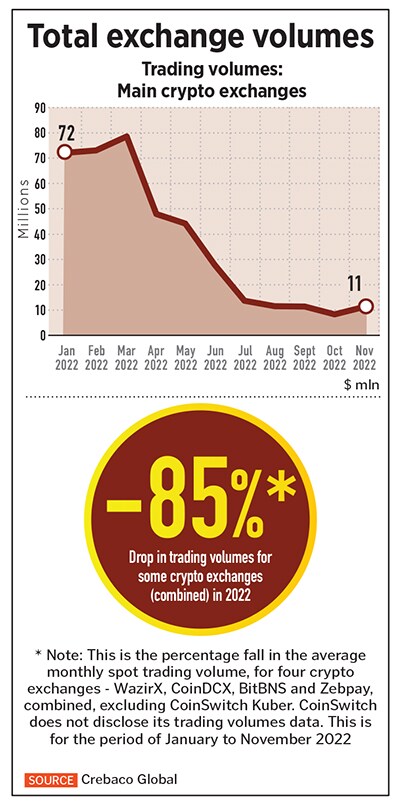

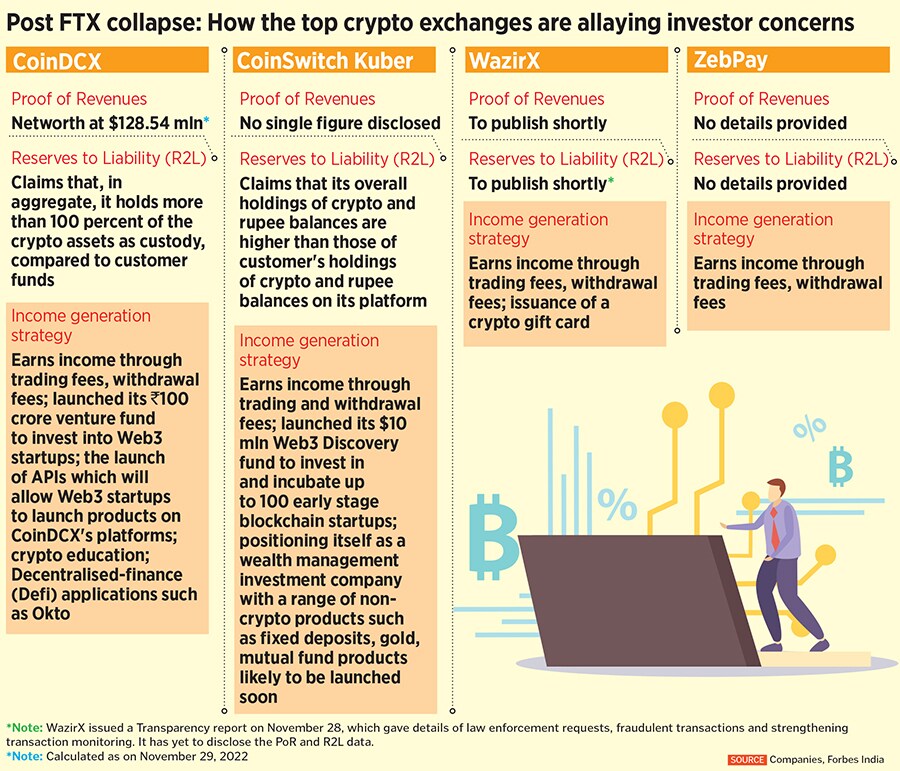

In unregulated crypto markets such as India—it is already reeling under the impact of rigorous taxes, sceptical policy makers and consistently shrinking trading volumes this year—the FTX collapse does not only mean a loss of confidence for users of cryptocurrency platforms. It means entrepreneurs leading these institutions have gone back to the drawing board to discuss and strengthen self-regulatory compliance norms, and try to build trust and transparency for the investing community (see table). Despite all the headwinds, most of the cryptocurrency exchanges in India saw robust year-on-year growth in profit in FY21 and a marginal dip in crypto adoption in FY22, due to a weakening global appetite to invest in riskier assets.

Every crypto exchange founder we spoke to use the word “shock" to describe the downfall of FTX and Bankman-Fried. “When I first heard of the FTX situation developing, I was shocked. Bankman-Fried was considered to be the best of everything crypto here in the US. Once we learned how FTX was being run and that he basically had unmitigated power, it became clear that he was more than likely using FTX for his own benefit," says Svetlick.

WazirX’s vice president Rajagopal Menon says, “In sporting terms, Bankman-Fried was the poster boy of crypto traders, the Virat Kohli of that space. The first reaction was one of shock. FTX was the world’s second-largest exchange, run by this genius wonder kid a crypto legend who had made his fortune by purchasing cheap Bitcoin in the US and selling it in Japan, where Bitcoin prices were much higher."

CoinSwitch’s Ashish Singhal calls FTX “a giant propped on stilts". “The earth shakes when giants fall. The detail here is that the giant was propped on stilts what we saw was not what it actually was. FTX and its sister entity Alameda Research mismanaged and misused customer funds, and took advantage of the lax regulatory oversight of their businesses by virtue of being an offshore exchange," Singhal tells Forbes India.

CoinDCX and CoinSwitch were quick to issue disclaimers of having no exposure to FTX or Alameda, while ZebPay and CoinDCX were quick to delist the FTT token after the FTX collapse. “As an immediate response to the event, the FTT token was delisted from ZebPay and the remaining FTT member balances were auto-converted to fiat to prevent further impact from the fallout," Avinash Shekhar, ZebPay’s CEO, told Forbes India.

In November, phrases such as ‘Proof of Reserves’ (PoR) and ‘R2L’ (Reserve to liability) became common data points which crypto exchange heads started to disclose to investors. Some of the leading international exchanges, such as Binance, Huobi, Bybit and Bitget, issued their PoR earlier in November.

In November, phrases such as ‘Proof of Reserves’ (PoR) and ‘R2L’ (Reserve to liability) became common data points which crypto exchange heads started to disclose to investors. Some of the leading international exchanges, such as Binance, Huobi, Bybit and Bitget, issued their PoR earlier in November.

CoinSwitch, in data verified by taxation and assurance consulting firm INMACS, said that as of November 4, the total CoinSwitch holdings are greater than total users’ holdings. This simply means that the total rupee and crypto holdings held by CoinSwitch are greater than the crypto and rupee held by CoinSwitch on behalf of its users.

CoinDCX, on its blog, shared its PoR, by publishing on-chain and off-chain assets and a list of wallet addresses for exchanges such as Binance, OKX, KuCoin, Huobi and Bybit. The dashboard, created in collaboration with crypto portfolio tracking platform Nansen, provides the net worth (market value of all crypto assets that the exchange has on behalf of users and the exchange) on a particular date and the token and protocol allocation.

CoinDCX’s CEO Sumit Gupta, while disclosing the exchange related data, said PoR was “only half the picture". He went on to present the Reserves to Liability (R2L) ratio for CoinDCX (see table), which showed that CoinDCX has an at least 100 percent R2L ratio for its top 10 tokens it holds on behalf of users.

But Sidharth Sogani, founder and CEO of Crebaco Global, a crypto and blockchain market research and ratings firm, argues that PoR and R2L are not enough: “All the Indian crypto exchanges say that they are solvent. I dare any of the crypto exchanges to audit with us, we will do it for free." Sogani claims that Crebaco’s business development teams had reached out to them, but did not hear back. Over 95 percent of Crebaco’s revenues come from overseas, in the form of consultation for ultra-high-net worth individuals (UHNIs), sale of research and data to governments/regulators/SEZs.

While these are the matrices being adopted in India, the lack of regulation means each crypto exchange is trying to self-regulate and at least show customers that it has enough funds to cover all its users’ assets, which indicates that it is fully backed. Svetlick suggests there should be a strong push for transparency in the day-to-day operations of India’s exchanges.

Crebaco has suggested to policy makers in India a roadmap that could be followed towards improved governance and transparency of crypto exchanges. This includes: Auditing and compliance standards must be filed with regulators multi-signature wallets and HSMs (hardware security modules) should be mandatory there needs to be better guidelines for liquidity providers a fixed license fee and deposit shall be taken by the regulator on tier-based method as per the turnover or volume of the exchange crypto exchanges should not be holding user funds for more than 30 days, they must remit them to their non-custodial wallets registered at the time of sign up real-time proof of reserves are necessary.

Most crypto exchanges continue to see weak trading volumes, though buying at lower prices was seen after the FTX collapse. WazirX’s Menon says business is “as usual" for the exchange and its users, with deposits, withdrawals, and trading fully functioning. 0“As an exchange, we make money when users trade. Trading is a function of sentiment and right now the sentiment is pretty negative. Things will get worse before they get become better," he says.

CoinDCX and CoinSwitch continue to seek newer revenue streams, which include making investments in Web 3 startups through venture funds launched in 2022. Though neither exchange has disclosed the investments made to date, they are likely to be small, considering that the industry is still in a nascent stage.

The coming year could be the most critical for cryptos, in view of the G20 presidency, which India will assume for one year starting December 1. The country will chair about 200 meetings over the next 12 months, where the issue of regulation of crypto assets is expected to be discussed, besides the broader matters surrounding sustainable economic growth and technology-enabled development across sectors.

Minister of Finance Nirmala Sitharaman has, in the past, called for international cooperation to regulate cryptos. Digital technology is being embraced by the Reserve Bank of India, as it is expected to continue to push for the adoption of the central bank digital currency (CBDC), whose pilots are currently underway.

Minister of Finance Nirmala Sitharaman has, in the past, called for international cooperation to regulate cryptos. Digital technology is being embraced by the Reserve Bank of India, as it is expected to continue to push for the adoption of the central bank digital currency (CBDC), whose pilots are currently underway.

WazirX’s Menon says, “Governments will be pressured to act, ushering in regulations," post the FTX fiasco. “The G20 presidency gives India a unique opportunity to set the agenda on global crypto regulation because what is adopted by the G20 countries will set the tone for the rest of the world to follow." This could happen as early as 2023, he says.

Singhal is equally optimistic that “regulators across the world would feel an urgency to address the jurisdictional void that exists today." He says that while the FTX collapse certainly has had a negative impact on the crypto industry, “this is not a failure of crypto in itself. In fact, the FTX fiasco could well turn out to be crypto’s Enron moment: A disaster that ultimately leads to better standards and regulations for the industry."

Svetlick also voices a similar view. “Although the FTX event may lengthen the crypto winter, it is better that it happened sooner than later. This will allow crypto to take a pause, re-evaluate itself as a whole and come back with a better fit for society and its future."

First Published: Nov 29, 2022, 15:43

Subscribe Now