CSK and Dhoni: Beyond the crown

Chennai Super Kings' unlisted stock and valuations continue to climb, with a unicorn status not too far away. The expansion of the IPL—with two new teams in 2022—and skipper Mahendra Singh Dhoni build

For millions of CSK, and Indian cricket, fans, Dhoni and CSK are symbiotic and almost synonymous brands

For millions of CSK, and Indian cricket, fans, Dhoni and CSK are symbiotic and almost synonymous brands

Image: Michael Steele-ICC/ICC via Getty Images

On the night of October 16, when Chennai Super Kings (CSK) defeated Kolkata Knight Riders (KKR) to lift the Indian Premier League (IPL) trophy for the fourth time, the attention on the field quickly shifted from the match-winning exploits of CSK opener and former South African captain Faf du Plessis and West Indian white-ball veteran Dwayne Bravo to that of ‘Thala’—the franchise’s record-breaking captain Mahendra Singh Dhoni. Was the iconic player going to announce his retirement from the IPL, a year after he had quit international cricket?

A month after that win, Dhoni has broken his silence, saying his “last T20" will be in Chennai, CSK’s headquarters. “Whether it’s next year or in five years’ time, I don’t know," he said at a felicitation ceremony in the Southern city, which was attended by Tamil Nadu Chief Minister MK Stalin.

For millions of CSK, and Indian cricket, fans, Dhoni and CSK are symbiotic and almost synonymous brands. The World Cup-winning captain has led CSK to nine finals since IPL’s inception 13 years ago and has won four titles. He is CSK’s most-capped player with 172 games, and has the most runs and fifties. It is no surprise that the CSK management has indicated that Dhoni, 41, will be the first player it will retain for IPL 2022, scheduled to be played in India in April-May. “The ship needs its captain and rest assured he will be back next year," a CSK official was quoted as saying in October.

The CSK team, and Dhoni himself, have been to hell and back in the past four or five years. The franchise had been suspended for two years till 2017 due to the betting activity of its key official Gurunath Meiyappan in 2013. CSK came back from the suspension and won the T20 championship in 2018 and were runners-up in 2019. In 2020, they did not qualify for the playoffs for the first time in IPL history. Last year, the IPL was held in the UAE due to the Covid-19 pandemic, and with low sponsorship and without crowds, revenues of all IPL teams fell.

Dhoni’s future as a player had come under greater scrutiny after he quit all international cricket in 2020. Duff & Phelps India’s external advisor Santosh N wrote: “CSK’s worst ever on-field performance and the concerns of an ageing roster have negatively impacted the brand credibility, and a correction was inevitable," he said in their 2020 IPL valuation report.

CSK was dubbed “Dad’s Army" due to the surplus of over-30 players, including Dhoni, Bravo, Shane Watson, Suresh Raina, Ambati Rayadu and Kedar Jadhav, whose chances of representing their country were limited.

CSK was dubbed “Dad’s Army" due to the surplus of over-30 players, including Dhoni, Bravo, Shane Watson, Suresh Raina, Ambati Rayadu and Kedar Jadhav, whose chances of representing their country were limited.

But the bounce back of Dhoni and CSK is extraordinary, refuelling interest in the unlisted CSK stock, brand Dhoni and brand CSK. The introduction of two new teams into the IPL franchise—Ahmedabad (led by CVC Capital) and Lucknow (led by Sanjiv Goenka’s RG-SG Group)—is likely to boost valuations for the top performing teams in the coming years, including CSK, Mumbai Indians, KKR and Rajasthan Royals.

“The CSK and Dhoni brand go hand-in-hand, having gone through rough patches after which they bounced back. There can be no CSK without Dhoni… his leadership and consistency have been the key," says Bhairav Shanth, managing director and co-founder of ITW Consulting, which specialises in sports, media and entertainment consulting and management. CSK has the highest winning percentage (59.69 percent) among all IPL teams, ahead of Mumbai Indians (58.82 percent) and KKR (51.67 percent).

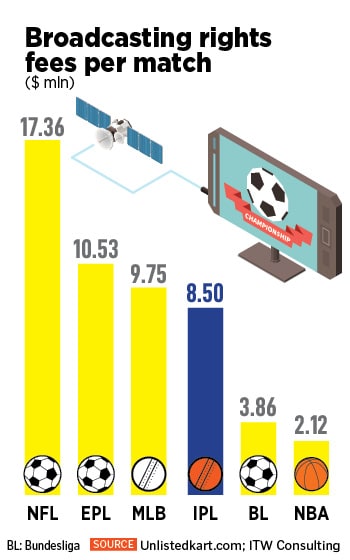

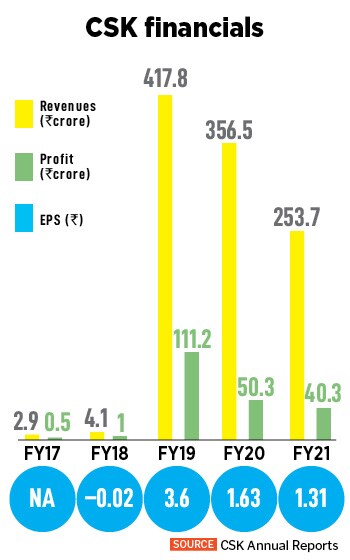

CSK is the only IPL cricket franchisee whose shares are on offer in the unlisted market. The stock has surged in the unlisted space by over 680 percent or 8x in stock value in two years to around Rs180 in November 2021 from Rs23 in 2019. CSK’s enterprise value (EV) is close to about Rs7,200 crore ($960 million), approximately 19x of its FY21 revenues (see table), according to ITW Core, the research and deep data arm of ITW Consulting. Prominent football clubs’ EVs, as listed in the Forbes Most Valuable Sports Teams of 2021, are in the range of 6-7 times their FY21 revenues (Manchester United"s EV, for example, is listed as $4.2 billion and its revenues are about $643 million annually the numbers are similar for teams such as Liverpool, Manchester City and Chelsea), says an ITW Core note.

The Enterprise Value of a sports team is driven by these elements:

* Basic financial modelling in the form of discounted cash flow analysis where estimation is made of the future revenues and costs of the franchise, and they are discounted by a rate of return to arrive at the net present value (NPV) of the enterprise. If the standard growth rates in IPL revenue streams are extrapolated to perpetuity, CSK"s EV would be lower than what it is trading at in the secondary market currently the premium can be explained by two other reasons:

1. Scarcity. The IPL, like the NBA or the NFL, is a closed ecosystem of teams with no promotion or relegation (unlike the EPL and other football leagues), thus guaranteeing teams a share of revenues each season. With the IPL stopping the expansion at 10 teams, there is appetite to participate in their business model and a bit of premium is added on to the share price (the possibility of an exit later on because CSK might be planning for an IPO at some stage also drives that higher price expectations, much like it happened during Manchester United"s IPO).

1. Scarcity. The IPL, like the NBA or the NFL, is a closed ecosystem of teams with no promotion or relegation (unlike the EPL and other football leagues), thus guaranteeing teams a share of revenues each season. With the IPL stopping the expansion at 10 teams, there is appetite to participate in their business model and a bit of premium is added on to the share price (the possibility of an exit later on because CSK might be planning for an IPO at some stage also drives that higher price expectations, much like it happened during Manchester United"s IPO).

2. Future growth prospects of the franchise, its ability to attract more sponsorships and the kind of fan loyalty the brand commands. Valuation and pricing are not necessarily the same for a sports franchise. Ashwath Damodaran, in a presentation at the MIT Sports Analytics conference in 2015, spoke of "mood and momentum"—behavioural factors from investors—as drivers of price or value of the franchise. Currently, both mood and momentum are very much with CSK. Damodaran also spoke about how one tells the story plays an outsize role as well. CSK has done that as a team. That is on the back of its efforts of building a community of dedicated “Yellow Army" fans—which is how most iconic teams internationally have built their legacy (and their value), ITW Core says.

Besides valuations, the expansion of the IPL calendar for 2022 has emerged as a positive for the stock. High-profile domestic investors continue to hold on to the CSK stock, including LIC and hypermarket chain DMart owner Radhakishan S Damani. Some foreign funds such as ELM Park Fund and Hirtle Callaghan Emerging Markets fund hold 4.99 percent and 2.87 percent respectively in CSK, as of FY20 (see chart).

The sustained presence of institutional investors has made retail investors confident about CSK, despite a certain amount of volatility in the stock. CSK’s scrip had risen to Rs190-200 levels in October-end. From there, the stock has edged down a bit due to profit booking.

Chennai-based chartered accountant Pranay Shah made his first investment—in the form of CSK stocks—after being mainly focussed on listed large cap stocks in previous years, being bullish in the areas of health care (labs), commodity-focussed infrastructure, building materials and packaging.

“I studied CSK’s balance sheet data and took the plunge," Shah, a former research analyst at Sparx Capital, tells Forbes India. Shah believes that CSK’s stock value (see chart) will continue to be driven by the brand it has built. “I see a lot of undiscovered value left," adds Shah, who plans to stay invested in CSK for at least five years. “CSK appears to have been fully vaccinated," he jokes. Shah will continue to invest in unlisted shares, which includes Anand Rathi Wealth, Mobikwik and PolicyBazaar. About a fourth of Shah’s portfolio is in unlisted stocks of which half is in listed equities and the rest balanced by fixed deposits and debt products.

“I studied CSK’s balance sheet data and took the plunge," Shah, a former research analyst at Sparx Capital, tells Forbes India. Shah believes that CSK’s stock value (see chart) will continue to be driven by the brand it has built. “I see a lot of undiscovered value left," adds Shah, who plans to stay invested in CSK for at least five years. “CSK appears to have been fully vaccinated," he jokes. Shah will continue to invest in unlisted shares, which includes Anand Rathi Wealth, Mobikwik and PolicyBazaar. About a fourth of Shah’s portfolio is in unlisted stocks of which half is in listed equities and the rest balanced by fixed deposits and debt products.

Krishna Raghavan, deputy CEO at Unlistedkart, a market-making and research platform for unlisted stocks, says “CSK has proven to be one of the favorite picks in the unlisted space based on the performance of the franchise in the league and also being backed by promising investors."

“IPL is the most-valued cricketing league across the world and CSK is the only franchise to have seen such high valuations," adds Raghavan. Dhoni’s semi-final cameo winning runs (18 not out off six balls) versus Delhi Capitals helped drive social media interest. Wavemaker India’s IPL 2021 report said the IPL’s social media chatter grew by 33 percent over last year and crossed over 80 million mentions this season. CSK was the most popular IPL team with 13.8 million mentions.

Raghavan says considering the factors “contributing to CSK"s performance and valuations, one player"s [Dhoni] retirement would not have great impact on the franchise’s valuations".

CSK came into existence in 2008, when N Srinivasan-owned India Cements, the country’s leading cement maker, bought the franchise rights for Rs346 crore. CSK was initially run as a strategic business unit of India Cements, but was later demerged to become a wholly-owned subsidiary, Chennai Super Kings Cricket Ltd (CSKCL) in 2015. In 2018, India Cements transferred its entire holding in CSK to a shareholders’ trust (see shareholding table) and it became a separate subsidiary.

CSK generates revenues from gate-ticket collection, in-stadium advertising, and merchandise (T-shirts, mugs, home décor) sales. Maximum revenues come from broadcasting rights which analysts say contribute about 60 percent of the total revenue, followed by around 20 percent from sponsorship and about 10-15 percent from ticket sales.

“CSK is estimated to continue generating strong revenues from merchandise sales, sponsorships, portions of prize money and digital viewership revenues for FY22. Going forward, with a strong management on and off field, coupled with recovery in the sports industry and CSK’s popularity, one can expect profit and revenue growth," says 5paisa.com research, in a note to clients.

Dhoni himself remains an equally strong brand. He not only drove India to the top of the International Cricket Council (ICC) rankings in December 2009 but is also the only cricket captain in the history of the game to have won all ICC trophies—the World Twenty20 (2007), the 2010 and 2016 Asia Cups, the 2011 World Cup (2011) and the Champions Trophy (2013).

Dhoni remains one of the highest-earning sports personalities he has been in the Top 10 of all Forbes India Celebrity 100 lists since 2012. In the last list, in 2019, he had 26 brand endorsements, which included Indigo Paints, Cars24, India Cements, Colgate, Gulf Oil and Panerai watches. He has also launched his own lifestyle brand SEVEN and his own production house, Dhoni Entertainment.

Dhoni remains one of the highest-earning sports personalities he has been in the Top 10 of all Forbes India Celebrity 100 lists since 2012. In the last list, in 2019, he had 26 brand endorsements, which included Indigo Paints, Cars24, India Cements, Colgate, Gulf Oil and Panerai watches. He has also launched his own lifestyle brand SEVEN and his own production house, Dhoni Entertainment.

ITW’s Bhairav is confident that both the brands—CSK and Dhoni—will continue to grow. “The IPL is a matured franchise over the past 14 years. Its journey will be like the football leagues, where the players command the value of the franchise. In all likelihood, Dhoni will start to play the role of a mentor or a playing coach, which will be larger than just a player or the captain of a team."

But what happens when Dhoni finally retires from the IPL? Santosh N of Duff & Phelps says: “CSK must find a new marquee player to attract sponsors post Dhoni’s retirement, to maintain its brand value otherwise, there might be further value correction." Bhairav believes otherwise. “CSK’s enterprise and brand values will continue to increase with or without Dhoni playing in the team. Good leadership is about finding a replacement and being replaceable. Dhoni is already creating this structure. He will not leave CSK without a clear succession plan and bench strength."

After CSK’s IPL victory this year, Dhoni said it was not about him being there in the top three or four [positions]. “It"s about making a strong core to ensure the franchise doesn"t suffer." The core group, he said, will have to have a hard look to see who can contribute for the next 10 years." As CSK plans bidding for players towards the 2022 season, Dhoni reportedly does not want to be the first player to be retained. He wants the CSK management to identify other players who can be the top-earners and emerge as top performers for the franchise. That is proof that he is already ensuring that there is a clear succession plan where the team goes beyond people who just fill up slots. Dhoni is also thinking about a franchise which grows into the next decade. This is exactly what will drive CSK and its valuation higher.

First Published: Nov 26, 2021, 10:04

Subscribe Now