How NoBroker turned house-hunting on its head

The proptech company recently became India's first unicorn in the space by directly connecting property owners with property seekers. But can real estate brokers, ubiquitous in India, really be elimin

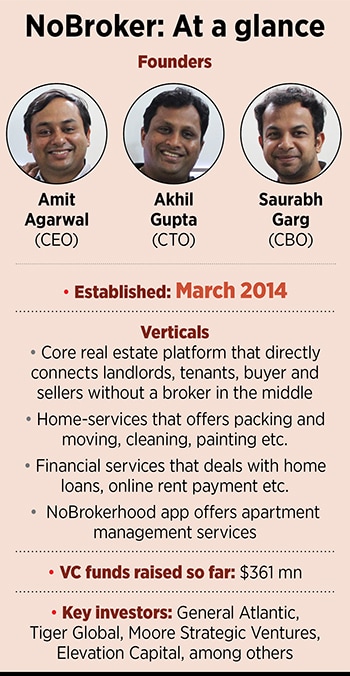

(L-R) Saurabh Garg, co-founder and Chief Business officer and Amit Agarwal, co-founder and Chief executive officer NoBroker.com

(L-R) Saurabh Garg, co-founder and Chief Business officer and Amit Agarwal, co-founder and Chief executive officer NoBroker.com

Image: Hemant Mishra for Forbes India

Sometime in mid-2015, when Amit Agarwal was chatting with his co-founder Akhil Gupta at NoBroker’s Bengaluru office, he noticed through the windows a mob of angry men heading towards them. He brushed it off as a regular “morcha" or protest and carried on his conversation. Minutes later, he was interrupted when that mob started banging on their office doors and breaking the glass windows. Around 50 of them—all real estate brokers—barged into the then one-year-old startup’s office, pulled the plugs on the computers and physically attacked the team. “It was a scary experience," says Gupta, 40. “But it also marked a turning point for us because it was then that we realised that we are truly disrupting the industry."

Set in early 2014, NoBroker, as the name implies, connects landlords, tenants, buyer and sellers directly with each other without a broker in between. It was a radical concept in India –and worldwide—at the time where brokers are seen as indispensable. Startups such as 99acres, Softbank-backed Housing.com and MagicBricks—the so-called property tech, or proptech players—were beginning to make their mark in India’s burgeoning real estate industry but none dispensed with brokers. They enlisted the latter on their portals and gave them access to customers. Similarly, in the US and China, no such broker-free proptech player existed.

“No brokerage as a term didn’t exist before we started out. If you look at Google trends, you’ll see that the phrase started picking up only after 2014," says Saurabh Garg, 42, also a co-founder who seeded the idea after a poor and expensive broker-led property-hunting experience in Mumbai. He then roped in Agarwal, his IIM-Ahmedabad batchmate, and Gupta, his junior from IIT-Bombay, to take the “no broker" idea to fruition.

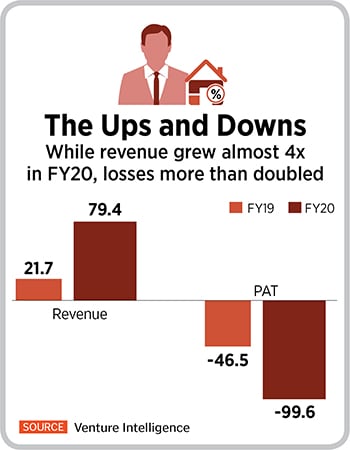

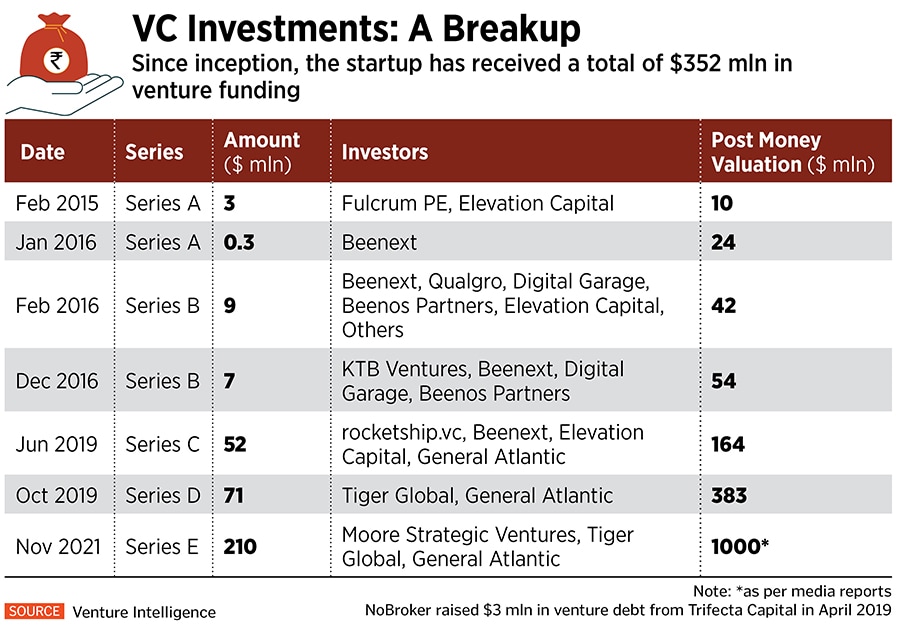

From being dismissed by multiple venture capitalists early on, NoBroker recently achieved the ultimate validation of its business model: A $210 million Series E fund raise by General Atlantic, Tiger Global and Moore Strategic Ventures in November 2021, doubled NoBroker’s valuation to a cool $1.01 billion, making it India’s first unicorn in the proptech space. NoBroker has over five lakh listings live on its portal and closes five lakh rental and sale transactions every year. Revenues stood at Rs 79.4 crore in FY20, up almost 4x over the previous year, accordng to data provider Venture Intelligence.

************

“You will not find a single broker on our platform," says Agarwal, 44, CEO, of the 16-million customers company that serves across six cities—Bengaluru, Mumbai, Pune, Chennai, Hyderabad and Delhi-NCR. The startup has evolved its technology to such an extent that a broker’s digital footprint is recognised by an algorithm, and he is immediately weeded out of the portal. Agarwal doesn’t let in on more details: “It’s our secret sauce," he smiles. But adds that besides the technology, customers take pride in being part of a brokerage-free community and report any incidents of brokers masquerading as buyers or sellers on the platform.

At the heart of NoBroker’s broker-free promise lies a C2C or consumer-to-consumer marketplace. Unlike a B2C or business-to-consumer marketplace that is easier to implement as the business side, comprising brokers in this case, brings in the supply while the startup focuses on demand generation, in a C2C model, the startup must bring in the supply as well as the demand. And, in an area like real estate, the commodity is “perishable" so one has to “micro match" property owners and seekers quickly, says Garg, chief business officer. A landlord, for example, will post a property on the portal, only to pull it down after 2-3 days once he finds a tenant.

At the heart of NoBroker’s broker-free promise lies a C2C or consumer-to-consumer marketplace. Unlike a B2C or business-to-consumer marketplace that is easier to implement as the business side, comprising brokers in this case, brings in the supply while the startup focuses on demand generation, in a C2C model, the startup must bring in the supply as well as the demand. And, in an area like real estate, the commodity is “perishable" so one has to “micro match" property owners and seekers quickly, says Garg, chief business officer. A landlord, for example, will post a property on the portal, only to pull it down after 2-3 days once he finds a tenant.

To enable this C2C model, NoBroker replicated “the broker brain" using machine learning algorithms, says Gupta, the chief technology officer. Just as a broker helps his clients with search and discovery, hyperlocal advice, matchmaking, and price guidance, NoBroker’s technology assists customers with all of that with the click of a few buttons. “Choosing a house depends on multiple factors such as proximity to one’s workplace, kids’ schools, pricing considerations etc. Our technology factors in all these aspects that a broker would otherwise help you with and throws up property recommendations," says Garg.

NoBroker provides this service for free. In case somebody wants premium services like a phone relationship manager, they must pay Rs 2000 per month upfront. One of the reasons venture capitalists didn’t buy into NoBroker’s model initially was because the startup was turning the traditional brokering model on its head by asking customers to pay upfront.

And even then, there was no guarantee that they would find a property of their liking. “Typically, if you see across the globe, money is paid after the deal is done. It’s an atrociously high intermediation fee—18 percent for rental and 4-5 percent for buy and sell, but it happens after the transaction. Here we were changing customer behaviour, but we were saying we will charge you 1/10th or 1/20th of what a broker charges," says Gupta.

In February 2015, almost a year after starting out and multiple rejections from top venture capitalists, NoBroker raised its seed round: $3 million from Elevation Capital (then Saif Partners). At the time, the startup had a mere 2,500 listings on its portal compared to the other online platforms like Housing.com which had raised $90 million from Softbank just months prior in December 2014 and boasted of over 350,000 listings. They worked with brokers which led to more listings but also more customer dissatisfaction.

“When we invested in NoBroker, most online platforms were working with brokers leading to a low level of customer satisfaction with constant gripes of most listings being fake, put up by brokers primarily to get customers contact details," says Mayank Khanduja, partner, Elevation Capital. He “intuitively" felt a broker-free platform would work because of the pain points it solved: “Indian real estate has always been a large market, but consumers were always forced to deal with brokers who made money only due to information asymmetry. Geographies like the US also have agents, but the market is far more organised, whereas in India almost anyone can become a real estate broker with no experience or qualification."

From those 2,500 listings in Bengaluru and Mumbai, NoBroker has today grown to over five lakh listings in six cities across India. When other property portals plastered ads across billboards and taxis, NoBroker stuck to word-of-mouth advertising. “We had a fraction of the marketing budgets of the other guys so we stuck to a very conservative approach," says Agarwal.

That approach involved no physical agents and no physical offices—except one in Bengaluru. It also involved closely listening to the customer. For example, when customers asked them who would draw up the rental agreements in the absence of a broker, NoBroker was quick to add that to its service offering. When customers enquired about packing and moving services after closing a deal, NoBroker added that to the mix. Today, the startup has a home-services vertical that offers services such as painting, cleaning, home interiors, besides packing and moving, all disorganised, fragmented businesses crowded with small, unbranded players. Sixty lakh customers use these services every year, says Agarwal, and the business is growing 5x year-on-year.

That approach involved no physical agents and no physical offices—except one in Bengaluru. It also involved closely listening to the customer. For example, when customers asked them who would draw up the rental agreements in the absence of a broker, NoBroker was quick to add that to its service offering. When customers enquired about packing and moving services after closing a deal, NoBroker added that to the mix. Today, the startup has a home-services vertical that offers services such as painting, cleaning, home interiors, besides packing and moving, all disorganised, fragmented businesses crowded with small, unbranded players. Sixty lakh customers use these services every year, says Agarwal, and the business is growing 5x year-on-year.

NoBroker also forayed into financial services allowing customers to pay rent online through their portal and earn valuable credit card points as a result. They will be entering the home loan space as well. “We close around half a lakh buy-and-sell transactions per year, which means there is a huge demand for home loans," says Agarwal. Insurance will be another area of growth.

Revenues grew almost 4x to Rs 79.4 crore in FY20, up from Rs 21.7 crore in FY19. Roughly 50-55 percent of the revenues come from the core real estate platform, while the balance comes equally from home and financial services. “We believe that the one-stop shop offering makes the entire real estate journey seamless and provides consumers with a far superior experience in this unorganised market," says Shantanu Rastogi, managing director at General Atlantic who led the recent $210 million fund raise.

NoBroker also launched NoBrokerhood, an app to help housing societies better manage their affairs, two years ago. The app offers apartment management services such as parcel deliveries, visitor entries, domestic help and services and also has a financial module that allows residents to pay their maintenance bills online, among other services. At present 10,000 societies are using the app in 11 cities across India and NoBroker plans to scale that to 100,000 in the next two years. “We’re extremely aggressive about NoBrokerhood. Our core real estate service is something a customer will use once in 2-3 years, but NoBrokerhood app is something they would use 4-5 times a day," says Agarwal. The app is free for societies to use with it, the startup hopes to become a household name and divert traffic to its core real estate business.

“The market was stagnant for the last 6-7 years for multiple reasons—RERA, demonisation, GST etc. But we are now seeing an upward cycle in buying and selling real estate and we think it’s a multi-year cycle, for the next 5-6 years at least," says Garg. To that end, the NoBrokerhood app will help NoBroker, the platform, achieve top-of-mind status and expand across the 50 cities it intends to with the funds recently raised.

**************

While NoBroker aims to become the “one-stop-shop" for a customers’ real estate needs by offering a full stack of allied services, the other proptech players including Square Yards, Housing.com and Magicbricks, among others, are also going the full stack route. But Gupta says, “Our real competition is not these websites, but real brokers on the street."

But can the broker segment in India be wished away?

It’s a huge industry, worth $1.5 billion (Rs 11,200 crore), according to industry estimates. The market is unorganised and fragmented but it is believed that there are around 10 lakh brokers in the country, according to the National Association of Realtors India.

“Brokers cannot be written off," says Ramesh Nair, CEO of Colliers India, who previously headed JLL’s India business. “It’s like saying I read a legal book and don’t need a lawyer. Brokers bring in local expertise, technical know-how, add consultative value and help you negotiate a good deal," he says. Today 50-60 percent of all residential deals are carried out via brokers, while international property consultants advise on 90 percent of all commercial deals in India, he says.

But NoBroker’s 16 million customers are evidence that its broker-free model is working, at least in some segments. For instance, the startup is “very, very strong" in the resale segment, says Agarwal, because that is where customers are most at ease with doing away with the broker. “Lakhs and crores of customers end up paying a huge amount of brokerage for a poor experience," he says.

On the flipside, when it comes to new property deals—consider buying a new house in Mumbai—customers prefer to be expertly guided. “Buying a new house is the most important decision of your life. Today, even the smallest house in Bombay will cost Rs 1 crore. You’re not going to make that decision based on online leads," says Nair.

In the end, what will prevail is what the customer wants. The real estate market with an annual turnover of approximately $120 billion (Rs 90,000 crore) is large enough for both kinds of players—broker-led and broker-free—to co-exist. Says Agarwal, “We just have to keep our ears to the ground and listen to our customers. If we can keep doing that, the opportunity is huge."

First Published: Dec 06, 2021, 14:23

Subscribe Now