The Bengaluru-born Kannan had just finished his master’s degree in high-performance computing from the Singapore-MIT Alliance, a global partnership in graduate education between MIT, the National University of Singapore (NUS), and Nanyang Technological University (NTU), and joined Singapore Airlines in August. It took almost two years before air travel returned to normalcy since attack.

In 2019, almost two decades after he spent his life rising through the ranks at Singapore Airlines, Kannan shifted to India, only to be welcomed by another global mayhem. Kannan joined Vistara, the joint venture between Singapore Airlines and the Tata Group, as the chief strategy officer in June, six months before the first case of Covid-19 was detected in China. By January 2020, as air travel began to be curtailed, Kannan was elevated as the chief commercial officer and was in the thick of things when air travel came to a standstill in March.

“I took on the commercial role in January 2020 and then everything came crashing down, for the lack of a better word," the 42-year-old told Forbes India over a virtual interaction. “For two months we couldn’t fly, which was a big shock."

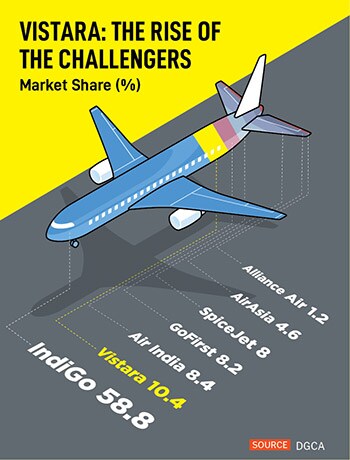

Fast forward two years, Kannan and Vistara seemed to have walked out of the crisis, relatively unscathed and, in the process, mightier than ever before. While many Indian carriers are bleeding, and in some cases even struggling to pay monthly salaries, Vistara became India’s second-largest airline by market share, crossing the significant 10 percent milestone in July. In January 2022, seven years after the Gurugram-headquartered airline first took to the skies, Kannan was appointed the company’s CEO.

Of course, market leader IndiGo is several knots away with a market share of nearly 60 percent, and closing in seems to be a Herculean task. But, beating well-established rivals, including SpiceJet and Go First, both of whom started a decade before Vistara began operations, certainly isn’t an easy task by any measure.

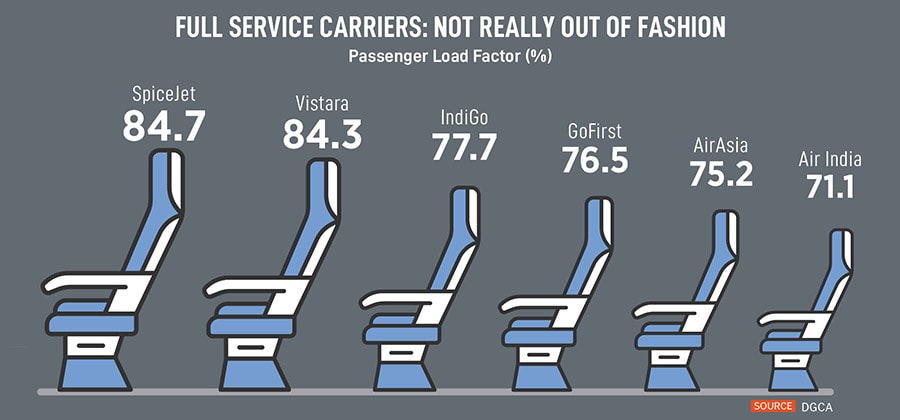

![]() “Vistara’s mandate is to be the best premium airline in the country and hopefully the world someday," Kannan says. “If you look at where we are today, more than 80 percent of the market is low-cost carriers. That’s not easy to change because all these guys have also ordered aircraft. They"re all growing because we expect demand to grow. So, at a high level. I would expect the same kind of share split to take place."

“Vistara’s mandate is to be the best premium airline in the country and hopefully the world someday," Kannan says. “If you look at where we are today, more than 80 percent of the market is low-cost carriers. That’s not easy to change because all these guys have also ordered aircraft. They"re all growing because we expect demand to grow. So, at a high level. I would expect the same kind of share split to take place."

That has meant that in the next few months, Kannan isn’t chasing after markets that low-cost carriers are targeting and is instead looking to build up a healthy mix of domestic and international operations, which could see 60 percent of its capacity being deployed in the domestic market with 40 percent in international. Currently, that ratio stands at 80:20, and Vistara will be adding nearly 17 aircraft by the end of 2023.

“Without doubt, as it stands, they are the best full-service airline in India today and it might be a while until these changes especially given the challenges the Tata Group face in turning around Air India," says Vinamra Longani, head of operations at Sarin & Co, a law firm specialising in aircraft leasing and finance. “Crossing the 10 percent market share number is very significant and that means, despite the competition, people are choosing Vistara over other airlines."

According to data published by India’s aviation watchdog DGCA, Vistara cornered 10.4 percent of the domestic market in July this year. SpiceJet—which had been forced to cut down its capacity by 50 percent—held 8 percent of the market while GoFirst, the ultra-low-cost airline from the Nusli Wadia group stood at 8.2 percent. Vistara’s lone rival in the full-service carrier segment, Air India, held 8.4 percent of the market.

“As long as SIA is a shareholder, the strategy remains focussed on premium service," says Shukor Yusof, founder, and analyst of Malaysia-based aviation consultancy firm Endau Analytics. “Vistara isn"t after market share, it"s going after the market that can afford its fares—the middle class, and professionals.

Tata provides comfort to SIA to continue with its operations and directions, including establishing new routes or acquiring new planes.

![]() Vinod Kannan, CEO, Vistara

Vinod Kannan, CEO, Vistara

Rising star

Kannan, who grew up in Bangalore before moving to Singapore for his college education, joined Vistara after several stints at Singapore Airlines including stints in Italy, Indonesia, and as a chief commercial officer at Scoot, the low-cost arm of Singapore Airlines. Before he went on to become the CEO of Vistara, Vistara was headed by Phee Teik Yeoh and Leslie Thng in its seven-year history.

Under Thng and Kannan, while the company did turn to operating cargo during the lockdown, it did not entirely diversify itself into a cargo operator unlike some of its peers. Instead, the company spent its time ensuring the safety of the airlines and preparing for route rationalisations and network planning. “We did partake in cargo, not to the extent perhaps of some of my competition did," Kannan says. During the early days of the pandemic, domestic airlines such as IndiGo and SpiceJet built up a stellar business in cargo movement. In fact, SpiceJet is now planning to hive off its cargo business, which the company reckons will lead to a one-time gain of nearly Rs 2,600 crore.

“On the commercial side, we had to redraw our networks because some of the traditional sectors like Delhi-Mumbai or Delhi-Bangalore had dried up because corporates were not travelling," Kannan says. “People were not traveling for work anymore and were traveling to meet their loved ones. So, we had to re-tune our network."

The company also ensured there were no layoffs and while the senior management took pay cuts, those below a certain salary level were left off the hook. “We needed to make sure that aircraft were taken care of, even when they don"t fly," Kannan says. “So, we had made sure there are enough resources. We were also very clear we did not want to fire people. That would be the real last resort."

In the meantime, Vistara also quickly went about expanding its fleet, having added 13 new aircraft since March 2020. “At the start of the pandemic, the fleet size was 40. Today I sit at 53," Kannan says. “That has kind of helped us reach the number two spot in domestic market share because we were able to deploy capacity wisely and because of the trust that the passengers had." Vistara is owned by two of the world’s best-known brands, the Tata Group and Singapore Airlines.

![]()

Now, the company operates 25 percent more departures compared to two years ago and has ramped up its international offerings with the addition of two new Boeing Dreamliner aircraft. That has meant the company operates flights to London, Frankfurt, and Paris. It will also take delivery of one more Boeing 787 which is expected to join in October, in addition to four more expected in the next 12 to 18 months.

“In the next one and a half years, I will have another 16 to 17 aircraft, so that is a significant increase and a lot of it will be international because domestically we operate to 31 points already," Kannan says. “Those constitute most of the key points for our business model. Of course, when you look at the SpiceJet or the Indigos of the world, they do operate to second and third-tier cities. But our model is slightly different. We"ve covered most of the key places that we want to go to." IndiGo, the country’s largest airline currently has a fleet size of 279 aircraft and a destination count of 97 with 74 domestic and 25 international.

While Vistara will continue to add domestic routes—it had recently added Coimbatore—it will focus on ramping up frequency on existing routes. “International and Tier1 and Tier2 are strong points but by no means easy markets," says Satyendra Pandey, managing partner at aviation consultancy firm, Aairavat Transport & Technology Ventures. “The risk profile for these markets varies and will require comprehensive planning. Interestingly, other airlines are also after similar markets, thus intense competition is all but certain."

Flying high

Out of the 17 new aircraft that Vistara will take delivery of by end of 2023, 13 are narrow-bodied. “Out of the 13, 5 will be A-321, the longer version of the A320," Kannan says. “Some of them will be long range, so they can fly slightly longer. This product has been one of the standouts for us because you have lie-flat business class, which is something not many airlines do on a narrow-body aircraft." All that means apart from Europe, the company will also ramp up its presence in south Asia and the Middle East, among others.

“As full-service carriers, we"ve always said the value we bring to the table is magnified for an international flight or a longer flight because people understand and require the full-service offering," Kannan says.

“Premium is measured by share of wallet," adds Pandey. “The label only matters to the consumer if the product and service are at a level where the consumer consistently pays more as compared to other options. For that to happen, several items have to align. While Vistara’s product has been good, volumes and yields in premium cabins are not to a point where they are in solidly profitable territory."

Then, there is the possibility that Vistara could see a merger with Air India. In October 2020, the Tata Group, which holds 51 percent in Vistara, managed to successfully purchase Air India when the Indian government put it on sale. As part of its bid, the Tata group’s wholly-owned subsidiary Talace Pvt Ltd put an enterprise value (EV) bid at Rs 18,000 crore with debt to be retained at Rs 15,300 crore and a cash component of Rs 2,700 crore. Tata’s bid was higher than the Ajay Singh-led consortia"s enterprise value (EV) bid at Rs 15,100 crore. Tatas took 100 percent control of Air India, the low-cost carrier AI Express, and Air India’s 50 percent stake in ground handling firm AI-SATS.

“In the long run, or at the very high level, perhaps there are synergies, but we also need to be mindful because, we are still competitors," Kannan says. “We don"t want to engage in any anti-competitive behaviour, so we do not talk about route rationalisation, networks, or pricing. Maybe down the road, there is an opportunity for procurement where we are pretty much price takers in the market. So those could be opportunities."

The Tata Group has so far remained silent on any merger talks, although it has promised to make Air India the airline of choice in terms of passenger comfort and service. In addition, the group is also reportedly considering merging AirAsia India, a company in which it owns 83 percent stake, with Air India Express, a low cost international arm of Air India that it acquired recently. In all, the Tata group owns and operates four airlines—Air India, Air India Express, AirAsia India, and Vistara. Air India and Vistara currently operate on both domestic and international routes. AirAsia India does not fly abroad, while Air India Express operates solely on international routes.

“Should Vistara continue to be the preferred full-service airline in the long run (as far as domestic market share goes), the Tata Group will find themselves staring at an interesting conundrum," adds Longani. “If the group is to consolidate its presence in the full-service airline space, which of the two brands do they retain? Given Vistara"s evident popularity, unless Air India is spruced up before such a merger, Vistara"s frequent fliers may feel disappointed and may even switch to an alternative which may be available once Jet Airways takes to the skies."

With Covid-19 forcing a rethink among passengers on their journey, customers are also expected to opt for direct flights, something Vistara reckons could be an opportunity for them, and even Air India. “People don’t want to transit and stop," Kannan says. “They want to take direct flights as much as possible. And they want to gravitate again towards brands they have confidence in. I think India does have a dearth of quality international long-haul operators. With the Tata group coming on board Air India, that will change."

Can Vistara fly higher?

Over the past few months, India’s airlines have seen numerous safety-related incidents forcing the country’s aviation watchdog to step in.

![]() Between May and July, for instance, SpiceJet saw nine incidents ranging from smoke in the cabin to the cracking of a windshield and an emergency landing in Karachi, prompting the aviation regulator to ask the airline to fly at 50 percent of its approved flights for two months. Go First, too, has reportedly grounded a fifth of its aircraft due to delays in engines.

Between May and July, for instance, SpiceJet saw nine incidents ranging from smoke in the cabin to the cracking of a windshield and an emergency landing in Karachi, prompting the aviation regulator to ask the airline to fly at 50 percent of its approved flights for two months. Go First, too, has reportedly grounded a fifth of its aircraft due to delays in engines.

“I wouldn’t attribute just to that," Kannan says in response to whether scaled-back deployments at other airlines led to a rise in market share. “We"ve expanded and addressed customer requirements. Is it because of these incidents that people are migrating? Probably. Potentially yes. That could be happening, but again, we need to be careful that we don"t shout out to say that this (safety) is the reason why people should travel with us. I would rather use the other aspects of why people need to travel with us."

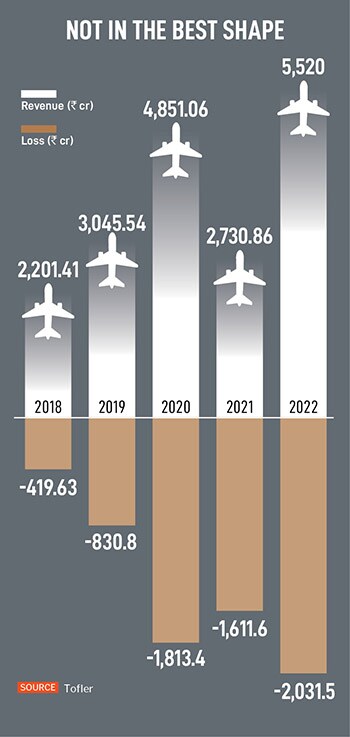

For now, Vistara is well funded, backed of course by two of the world’s biggest conglomerates, although the airline has been struggling with profitability. In the fiscal year 2022, the company’s annual revenue stood at Rs 5,520 crore, up by a staggering 100 percent from Rs 2,730 crore in 2021, while losses swelled to Rs 2,032 crore. It has also helped that the promoters have been pumping money into the airline and keeping it away from any financial turbulence that has affected some of the ailing domestic carriers.

For the Tata group, apart from Vistara’s mounting losses, the company is also reportedly planning to write off loans worth Rs 2,600 that AirAsia India had accumulated, while Air India’s annual loss stands at over Rs 9,500 crore.

“Just because you"re backed by Singapore Airlines and the Tata group doesn"t mean that we can"t get let off," Kannan says. “Every investment has to have some sound business plan and I"m grateful that the shareholders agree with what we set out to do." This year, however, Kannan reckons the company was on track to perhaps turning around its fortunes before crude oil prices began rising while the rupee depreciated.

“We’ve seen very good revenue upside because of the market share but also because of the average fares, which we are able to command," Kannan says. “Because of oil price and USD exchange, which has depreciated almost 6-7 percent from January to now, a lot of that upside is gone. I had to pay a lot more to the fuel companies."

According to a recent report by rating agency ICRA, if the fuel cost increases by 30 percent compared to last year’s levels, and the industry can pass on only 10 percent of the increase by a rise in fares, the industry’s operating profit margin will moderate by 10 percent. Similarly, with the US dollar appreciating by more than 5 percent in recent times, earnings are also likely to be severely affected.

“Since 35–50 percent of the airlines’ operating expenses–including operating lease payments, fuel expenses, and a significant portion of aircraft and engine maintenance expenses—are denominated in USD, it has further pressured the earnings for the industry," Suprio Banerjee, vice president and sector head, ICRA, said in a statement. “This aside, some airlines also have foreign currency debt. Despite the significant improvement in passenger traffic, the revenue per available seat kilometre–cost per available seat kilometre (RASK-CASK)—spread for the Indian carriers in H1 FY2023 is expected to be unfavourable, owing to the significant surge in costs and the limited ability of the airlines to pass on the same to the customers."

Then, there is of course the entry of the new ultra-low-cost airline Akasa, along with the impending entry of Jet Airways, which could intensify competition in the Indian skies. Already, India offers one of the lowest fares in the world.

The Indian aviation market needs over 1,900 aircraft in the next 20 years to keep up with the growing demand for air travel. Aircraft manufacturer Airbus projects the 20-year traffic growth of India’s civil aviation sector at 7.7 percent, almost twice the world average of 4.3 percent. Domestic traffic growth is expected at 8.2 percent, one of the world’s highest.

“India continues to be an intensely competitive market," adds Pandey of AT-TV. “With Akasa and possibly Jet, the market will have seven to eight airlines all competing for similar demand. Yields will be diluted further while input costs continue to rise. In such a scenario, a clear and deliberate strategy built around market realities will be the key to success."

So, what happens now for Vistara? “Fuel price and the USD can singlehandedly kill me, and I can"t make any projections based on that," Kannan says. “But from a revenue perspective, I"m very confident that we"ve kind of seen a watershed moment."

Kannan knows a thing or two about emerging out of turbulence. And, when he says it’s now a watershed moment, it means only one thing for Vistara: It’s time to climb to cruising altitude.

“Vistara’s mandate is to be the best premium airline in the country and hopefully the world someday," Kannan says. “If you look at where we are today, more than 80 percent of the market is low-cost carriers. That’s not easy to change because all these guys have also ordered aircraft. They"re all growing because we expect demand to grow. So, at a high level. I would expect the same kind of share split to take place."

“Vistara’s mandate is to be the best premium airline in the country and hopefully the world someday," Kannan says. “If you look at where we are today, more than 80 percent of the market is low-cost carriers. That’s not easy to change because all these guys have also ordered aircraft. They"re all growing because we expect demand to grow. So, at a high level. I would expect the same kind of share split to take place."

Between May and July, for instance, SpiceJet saw nine incidents ranging from smoke in the cabin to the cracking of a windshield and an emergency landing in Karachi, prompting the aviation regulator to ask the airline to fly at 50 percent of its approved flights for two months. Go First, too, has reportedly grounded a fifth of its aircraft due to delays in engines.

Between May and July, for instance, SpiceJet saw nine incidents ranging from smoke in the cabin to the cracking of a windshield and an emergency landing in Karachi, prompting the aviation regulator to ask the airline to fly at 50 percent of its approved flights for two months. Go First, too, has reportedly grounded a fifth of its aircraft due to delays in engines.