Focussing on flexibility: DBS Bank India

This well-capitalised, digitally-focussed, wholly-owned subsidiary of Singapore-based DBS is not just riding through a tough phase, it is doing it at the right pace, and knows where it is going

Most corporate amalgamations are tricky business. If the move is to merge a financially distressed and culturally different entity into another company, largely only through external due diligence, it makes things more difficult. And if it is being executed during the now-two-year-long pandemic—with people integration, hiring staff, and mental and physical wellness issues being real concerns—you would want to hope that macroeconomic conditions are on your side.

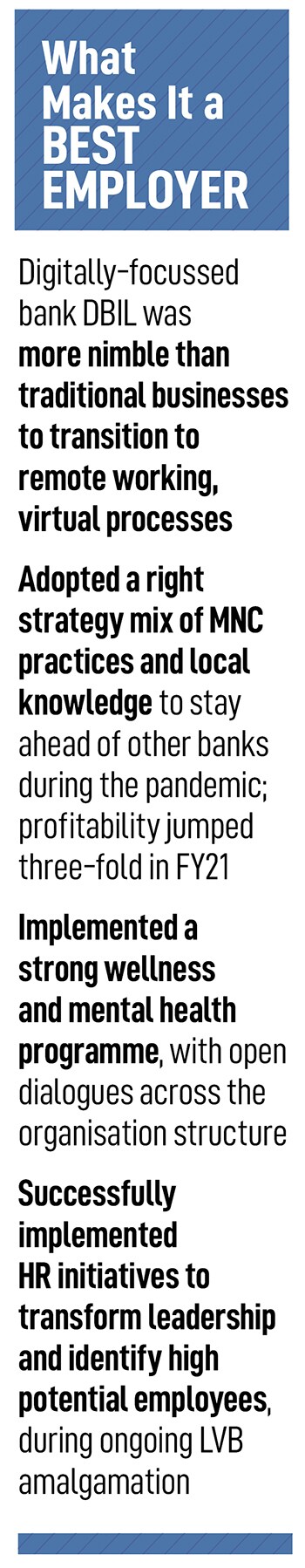

The fact that DBS Bank India Ltd (DBIL) has been voted into the Forbes India-Kincentric Best Employer 2021 list for the second successive year indicates that this well-capitalised, digitally-focussed, wholly-owned subsidiary of Singapore-based DBS is not just riding through a tough phase. It is doing it at the right pace, has prioritised HR, training and workforce planning, and knows where it is going.

In November 2020, the amalgamation of Tamil-Nadu-based Lakshmi Vilas Bank (LVB) with DBS Bank India was announced, following a Reserve Bank of India (RBI) direction for the same. The amalgamation was being carried out without access to LVB’s top management and where its capital had nearly been wiped out.

In a normal integration, a corporate would try to incorporate and impose its culture and discipline into the new structure. “But for an institution [like LVB] with a 95-year history and a customer-focussed legacy, we needed to imbibe this and create a unified culture, rather than impose our way of doing things," says Surojit Shome, managing director and CEO, DBS Bank India.

LVBs’ existing staff’s biggest concern was job security. DBIL conducted several townhalls to allay concerns two townhalls for all the staff were chaired by Shome, while four were focussed on group engagements. Over 250 training sessions towards integration have taken place to date. Shome hopes that by 2022-end much of the “heavy lifting" towards the amalgamation would be completed.

DBIL is the first among large foreign banks in India to start operating as a wholly-owned subsidiary (WOS) since April 2019, after operating as a branch since entering India in 1994. The bank, with the integration of LVB, has over 600 branches in more than 400 cities across 19 states, staffing over 6,000 people out of which around 3,800 came from LVB.

DBIL is the first among large foreign banks in India to start operating as a wholly-owned subsidiary (WOS) since April 2019, after operating as a branch since entering India in 1994. The bank, with the integration of LVB, has over 600 branches in more than 400 cities across 19 states, staffing over 6,000 people out of which around 3,800 came from LVB.

DBIL, which is well-capitalised with a 15.3 percent capital adequacy ratio, reported a three-fold jump in net profit at ₹312 crore for FY21, over the previous year, on revenue growth of 85 percent to ₹2,673 crore. The total customer base for DBIL is now 3.2 million.

The unified bank is young: The average age of LVB’s staff is 37 and DBS’s staff is 36. “So we have a lot of people who want to build careers with us, rather than exit the bank," Shome says.

The bank has, during the pandemic, undertaken a series of initiatives, both in the wellness and training space, to prioritise people management. DBS Bank India runs the RUOK campaign to address concerns around coping with grief and anxiety through group therapy sessions. “No one likes to be seen as vulnerable. We shared the message that it is okay to feel stressed or under pressure and find solutions from the same," says Kishore Poduri, managing director and country head (human resources) at DBIL. Open dialogues on mental health were organised through guidance from certified professionals, where no topics were taboo.

Like several corporates across countries, DBS Bank offered the Work from Home (WFH) option for its employees. Even as the Omicron variant wave appears to be waning, the bank has offered employees, depending on their role, the 60:40 option where up to 40 percent of the work time—approximately two days a week—could be from home or a distributed workplace.

“We are trying to create flexible workplaces and flexible work options," Shome says. But the bank, being an essential service and consumer-facing industry, will not widen the scope of WFH further, as it is not a gig organisation.

Job attrition for DBIL is now lower than pre-Covid-19 levels, at just less than 10 percent in 2021, compared to 7.5 percent in 2020 (when people did not seek jobs during the pandemic) and around 12-13 percent in 2019. DBIL hired 1,589 people in 2021, which included 725 people into the bank and 864 people at DAH2 in Hyderabad, the bank’s first technology development centre outside Singapore.

DBS continued with two successful programmes during the pandemic one to find great leaders and improve management effectiveness, and the other to identify high potential employees. In the task to find great leaders, DBS ran regular workshops in 2020-21 between sub-groups of leaders with employees: Through T-Hurdles to reflect on team behaviour that need to improve, and now T-Circles, where collaborative skills, deep listening, anytime feedback, psychological safety issues are discussed. The T-Circles programme will run for the next 18 months.

Another successful programme by DBS involves running intervention programmes for high performing employees each year, from a junior to senior level. Once the training escalates, the employee is encouraged to execute critical projects for the bank. Each year, around 9 to 15 percent of the total employees are identified as high potential, Shome says.

“Given that this period was difficult for most corporates, DBS’s ability—as a digitally-focussed bank—to transition to a new way of working was much smoother than those with traditional sales models. Its focus was firmly back on dealing with macro conditions," says Roopank Chaudhary, partner and chief commercial officer, Aon Consultancy.

First Published: Mar 02, 2022, 13:03

Subscribe Now