On the face of it, brokerages have cut their price targets for most of these stocks but they are far from writing off these companies. In fact, several have initiated coverage of these companies, and a few have shifted their position to a buy call, and are recommending investors to add scrips of select new-age companies on ‘expectations of a pick-up’ given the ‘long-term growth potential’.

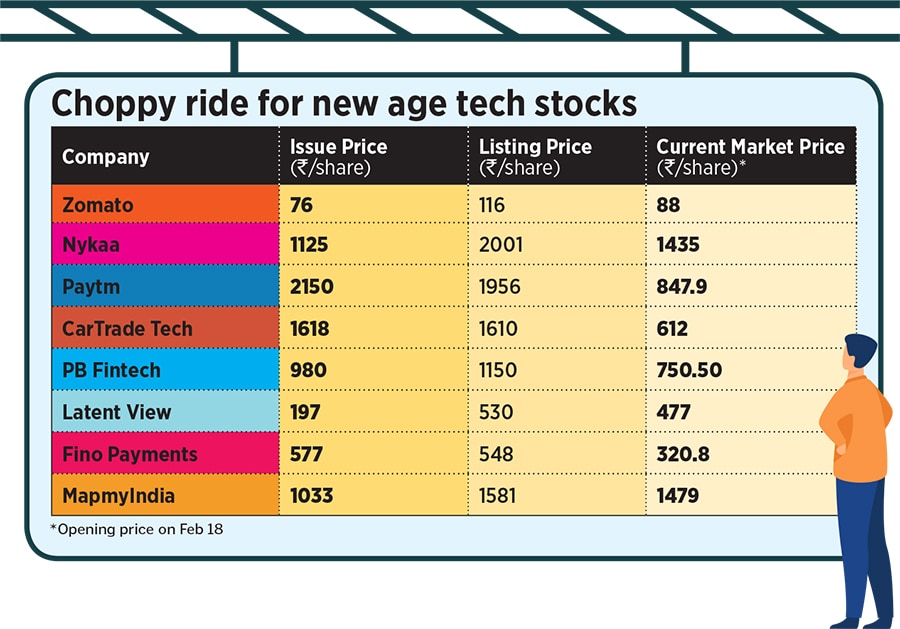

Importantly, all these companies are trading below their listing price and hit all-time lows, raising red flags on the projected growth trajectory, and denting investor confidence.

Market participants are divided on whether these newly listed tech companies are attractive at current valuations after the steep correction from the listing price. Many see a further decline in the coming months.

“A stock hitting a 52-week low or an all-time-low doesn’t make the company attractive. In fact, the price action may be justified as it signals that the company is struggling and its performance is weak", says Ramesh Mantri, chief investment officer, WhiteOak Capital Asset Management.

Besides, even at current levels, experts see froth in the valuation of stocks in this pocket, and are sceptical of adding these new-age companies to investment portfolios of retail investors.

“We especially cater to retail investors, and with valuations being rich, the stakes are very high. Their confidence evaporates if the company does not make money as their ability to withhold losses is limited. So, it is a tough call to take on whether to buy it, and then how long to hold it for the story to pan out," says Pankaj Pandey, head of research, ICICI Securities.

Focus on topline growth

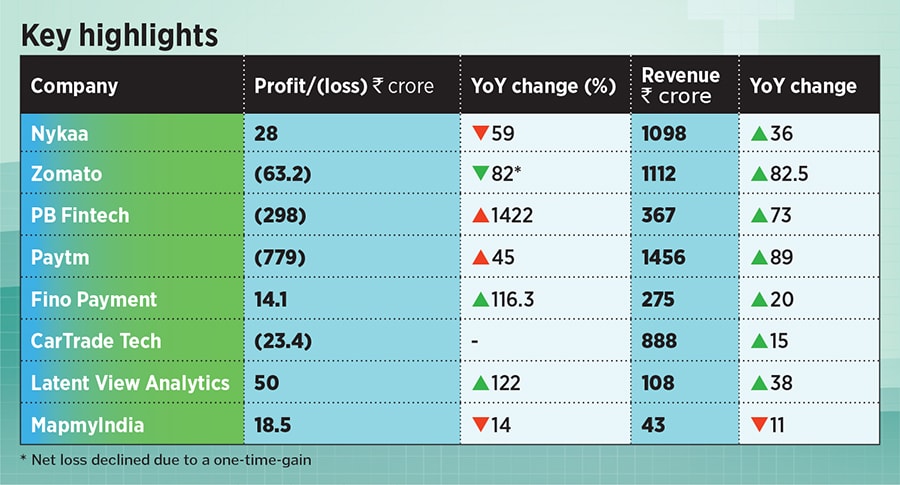

In the December quarter revenue grew at the cost of margin and profitability: A disturbing sign of the quality and sustainability of the growth momentum. Interestingly, while the pandemic catalysed rapid growth of the digital economy, the gradual return to normalcy slowed the pace of it, marginally, in Q3.

“Some of these companies were large beneficiaries of the pandemic-induced changes in consumption. But as consumers normalise their life, these companies will face some growth headwinds in the short term. But a large number of these categories are under-penetrated and may not have a long-term implication," says Mantri.

Take, for example, Zomato. The food delivery company announced a flat revenue growth at Rs 1,112 crore on a quarter-on-quarter basis for the nine months ending December. The company attributed the weak growth in gross order value to the post-Covid reopening, shift from delivery to eating out, and a reduction in customer delivery charges.

![]()

Paytm reported a 45 percent year-on-year rise in net loss to Rs 778 crore in Q3. The 89 percent growth in revenue to Rs 1,456 crore during the same period was mainly led by loan disbursements, merchant payments via MDR, and new device subscriptions.

The management of Policybazaar clearly articulated its focus to scale up the business. PB Fintech, the parent company of Policybazaar, saw a 55 percent increase in its net loss to Rs 297 crore despite a 73 percent jump in revenue to Rs 367 crore in the December quarter on a year-on-year basis.

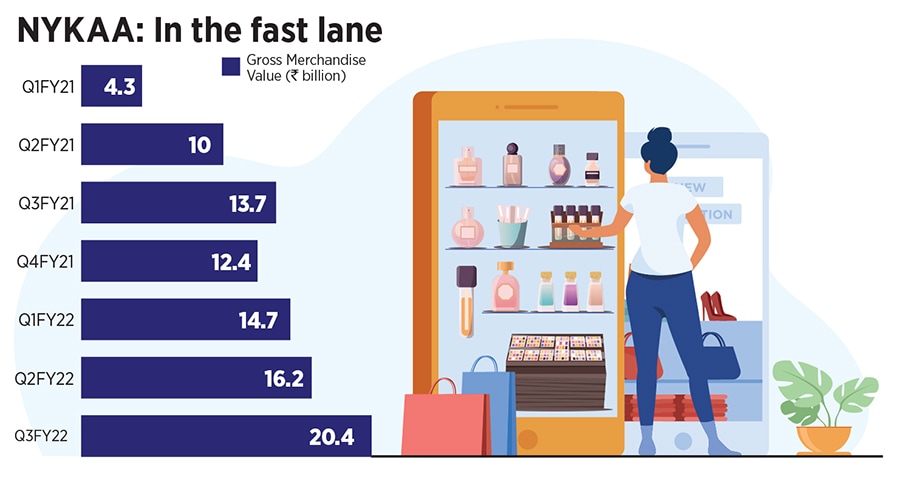

Beauty e-tailer Nykaa saw profit slump by 59 percent year-on-year to Rs 29 crore, largely due to higher expenses and tepid demand in the personal care and fashion categories. But, the return to normalcy helped improve sale of cosmetics in the December quarter, the company noted.

![]()

LatentView Analytics bucked the trend and registered a strong earnings report for the third quarter. Net profit increased by over 122 percent year-on-year to nearly Rs 50 crore, driven mainly by a 37 percent growth in sales to Rs 107.8 crore, during the same period.

If one silences the ‘long-term growth potential’ chatter, it is tough to directionally gauge where these companies are headed in terms of profitability. For one, many of these companies disclose the bare essential information mandated to check compliance boxes. The lack of substantial data greatly impairs sound investment decisions and does not augur well in the long-term, warn market veterans.

Lack of disclosures

In a note--on Zomato--to investors dated February 10, foreign brokerage outfit Jefferies’ analysts say, “Earnings release remains opaque, lacks substance, and describes only selective aspects of the business. Lack of management call leaves a lot to the imagination and our inexperience with the Internet sector does not help either."

This echoes the confusion faced by countless investors. Limited access to historical data, sketchy commentary on strategy, and lack of transparency, is disappointing, as the onus is on the company to communicate with its investors.

![]()

“There is definitely room for improvement in disclosure practices by these companies. They should reach out to investors and explain how the business is trending," Mantri says. Ultimately markets will force the management to improve disclosure practices, he asserts. “If investors don’t understand the underlying economics, it will start reflecting on the stock prices," Mantri adds.

Most new-age companies are hesitant about disclosing business metrics on the ground of losing competitive advantage. But industry insiders do not believe this to be the main reason. Mantri says, in some cases, the underlying numbers are not good, and so the management is not comfortable disclosing or discussing those aspects of the business.

![]()

Despite the incongruous absence of full financial information and visibility on the road to profitability, many brokerages have forayed into the unknown territory armed with the confidence of exponential growth in some of these firms in the future. Financial purists, however, have scoffed at the idea, underlining healthy cashflows and profit as the main components of a good business model.

Fear of Missing Out?

The investment thesis for betting on these new-age startups is the long runway for growth in a growing economy that has witnessed robust digital adoption and evolving consumption patterns. In response to market volatility, muted December quarter earnings, and the massive fall in US and China tech stocks, most brokerages have cut their target price for several internet companies. However, these stocks are very much on their radar.

A weak December quarter has prompted brokerage firm Jefferies to cut its price target of Zomato to Rs 120 per share from Rs 175. However, it retains a ‘buy’ rating on the stock on expectation of a pick-up. But there are downside risks.

For example, an increase in competition from new entrants, Swiggy, and direct ordering will eat into Zomato’s market share and lead to slower-than-expected growth. Furthermore, uncertainty on how unit economics will pan out, regulations for platform businesses, and challenges in expanding beyond the core business, are some factors that could adversely affect the company, it says.

“With only 10-11 million monthly transacting users currently, Zomato has a long runway for customer acquisition and revenue growth, albeit this may come at the cost of near-term profitability. The platform also has an optionality of expanding into other adjacent categories such as grocery etc.," say Jefferies’ analysts.

![]() Similarly, Kotak Institutional Equities initiated coverage of Nykaa with an ‘add’ rating, although it has cut its 12-month price target to Rs 2,120 from Rs 2,480. Its analysts say, “Nykaa’s model focusing on content-based customer acquisition, curation and convenience is scalable with long-term growth potential." The brokerage expects Nykaa to deliver a robust CAGR of 41 percent in revenue over FY2021-26E, which is likely to be driven by growth in transacting users.

Similarly, Kotak Institutional Equities initiated coverage of Nykaa with an ‘add’ rating, although it has cut its 12-month price target to Rs 2,120 from Rs 2,480. Its analysts say, “Nykaa’s model focusing on content-based customer acquisition, curation and convenience is scalable with long-term growth potential." The brokerage expects Nykaa to deliver a robust CAGR of 41 percent in revenue over FY2021-26E, which is likely to be driven by growth in transacting users.

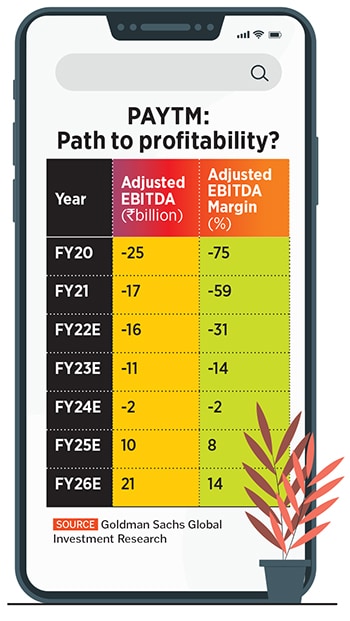

In a report dated February 6, analysts at Goldman Sachs upgraded their rating for Paytm to ‘buy’ from ‘neutral’ although they trimmed the target price to Rs 1,460 from Rs 1,600. At the current stock price level, the risk-reward is seen as skewed to the upside, the analysts say.

“Our analysis suggests the current share price is implying multiple headwinds including MDR caps, a decline in market share for Paytm, and significantly slower ramp-up of Paytm’s financial services, which we view as unlikely," note the analysts in the mentioned report. Based on its analysis, Goldman Sachs expects Paytm to break-even on the EBITDA front by FY25.

The valuations may seem perplexing given the traditional approach to financial modelling, and the recent cracks seen in highly valued US tech stocks may merit a cautious approach, but new-age businesses will continue to pull investors.

“What we are currently seeing is a very small subset of what we will have in the next few years, as a large number of unicorns will go public, but not all of them will succeed," says Mantri.

The challenge is to understand the missing pieces in the business to spot the long-term winners in this space. Investors must focus on the size of the market opportunity, valuation, unit economics, competitive advantage, execution, and the quality of the founders and the management team, Mantri adds.

Experts are sceptical of adding these new-age companies to investment portfolios of retail investors.

Experts are sceptical of adding these new-age companies to investment portfolios of retail investors.

Similarly, Kotak Institutional Equities initiated coverage of Nykaa with an ‘add’ rating, although it has cut its 12-month price target to Rs 2,120 from Rs 2,480. Its analysts say, “

Similarly, Kotak Institutional Equities initiated coverage of Nykaa with an ‘add’ rating, although it has cut its 12-month price target to Rs 2,120 from Rs 2,480. Its analysts say, “