Has the NFT bubble already burst?

Non-fungible tokens shot to popularity earlier this year with headline-grabbing, multi-million-dollar sales of digital-only artworks. Globally, sales and token values have since fallen, while in India, NFT usage is slowly catching up. How much of it is hype and how much is here to stay?

Artist Anantha Krishna Nadamel and his digital art available as NFT. Clockwise: Spaceman Meme, Dogs Out, and Space Bistro.

Artist Anantha Krishna Nadamel and his digital art available as NFT. Clockwise: Spaceman Meme, Dogs Out, and Space Bistro.

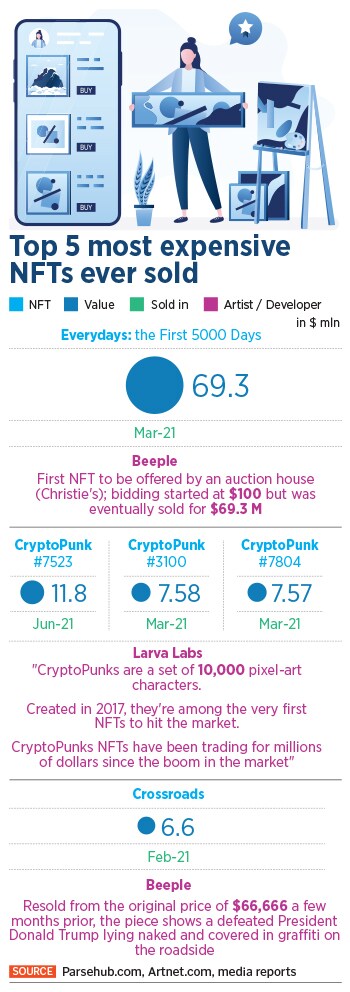

A day before the record-breaking $69 million sale of his digital-only artwork by Christie’s auction house in March 2021, Beeple—the artist whose real name is Mike Winkelmann—reportedly said: "I actually do think there will be a bubble, to be quite honest. And I think we could be in that bubble right now.”

Multiple headline-grabbing sales of unique digital tokens, known as non-fungible tokens or NFTs, soon followed: A blue-hued pixelated face of an alien sporting a headband—one of 10,000 unique 'CryptoPunks' released by creator Larva Labs in 2017—sold for $7.6 million; an NBA video highlight featuring LeBron James dunking a basketball in the late Kobe Bryant’s signature reverse windmill style sold for a $400,000; and even Twitter founder Jack Dorsey’s first-ever tweet, dated 2006 and promoted as an NFT, sold for a cool $2.9 million.

And so it goes that just about anything can be packaged and sold as an NFT: A jpeg image, an MP3 file, a meme, a tweet or a video clip. But buyers don’t own anything physical or tangible as they would if they were buying a painting or sculpture in the traditional sense. Instead, they own a string of code on the blockchain that represents ownership and authenticity of the work, but not the work itself. In the Beeple case, for example, the artwork, titled Everydays: The First 5000 Days, a mosaic of all the images the artist has been posting online each day since 2007 was collaged into a jpeg file and 'minted' into an NFT to create digital certificate of ownership that can be bought and sold. So Vignesh Sundaresan, a Singapore-based blockchain entrepreneur and the winning bidder doesn’t possess the original jpeg of the collage. That remains with the artist and can continue to be seen and shared online. Sundaresan merely owns a digital “token” that proves he owns the original artwork. Ownership is recorded on the blockchain, a shared ledger maintained by thousands of computers around the world.

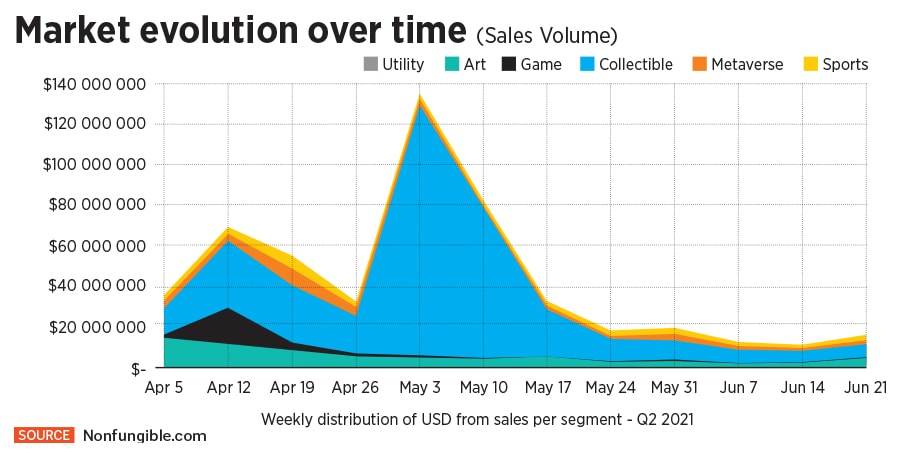

Google Trends, a rough but indicative metric, shows that global interest in the term NFT shot up in February, peaked in March and has since fallen dramatically. In India too, interest in the term started climbing in mid-February, peaked in May and declined precipitously in June. By July, interest had plateaued to February levels.

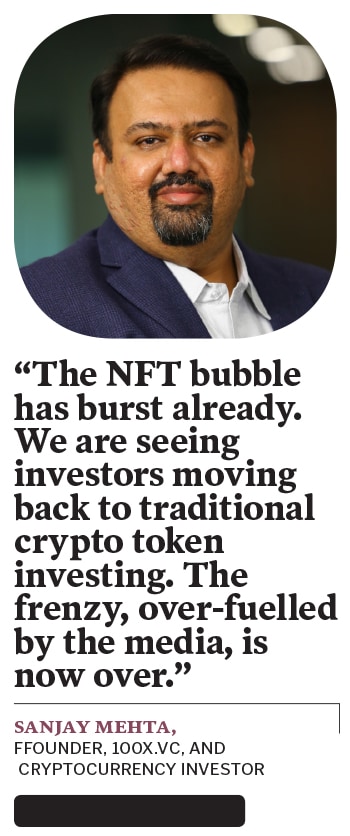

“The NFT bubble has burst already. We are seeing investors moving back to traditional crypto token investing. The frenzy, over-fuelled by the media, is now over,” says Sanjay Mehta, founder of venture capital firm 100X.VC and a long-time cryptocurrency investor. Data confirms this: Daily NFT sale volumes have fallen from $100-plus million in March to around $10 million today, according to data tracker Nonfungible.com.

This what the process involves: Registering with a

This what the process involves: Registering with a  Artist Amrit Pal Singh and his digital art series titled 'Toy Face'.

Artist Amrit Pal Singh and his digital art series titled 'Toy Face'. Among his spoils is an NFT of the domain name India.Crypto which he bought for around $8,500 in an auction on OpenSea, a three-year-old, US-based NFT marketplace that raised $100 million in funding led by Andreessen Horowitz in July 2021 at a valuation of $1.5 billion. “In the real world there’s a huge opportunity in buying and selling popular domain names. A similar opportunity will arise in the virtual world too. As India becomes more entrenched in cryptocurrencies over the next 3-4 years, India.Crypto will become a domain name that everyone will want. At that time, it might even fetch me $100,000, who knows?” says Malviya.

Among his spoils is an NFT of the domain name India.Crypto which he bought for around $8,500 in an auction on OpenSea, a three-year-old, US-based NFT marketplace that raised $100 million in funding led by Andreessen Horowitz in July 2021 at a valuation of $1.5 billion. “In the real world there’s a huge opportunity in buying and selling popular domain names. A similar opportunity will arise in the virtual world too. As India becomes more entrenched in cryptocurrencies over the next 3-4 years, India.Crypto will become a domain name that everyone will want. At that time, it might even fetch me $100,000, who knows?” says Malviya.