Finovate Capital: A bridge to finance post-lockdown

Supply chain financier Finovate Capital is looking to tap into the demand for funds by small businesses when work swings back

Co-founders of Finovate Capital Aljo Joseph (left) and Akshat Birla are set for a busy business cycle in the coming months

Co-founders of Finovate Capital Aljo Joseph (left) and Akshat Birla are set for a busy business cycle in the coming months

Image - Aljo Joseph: Sharon Joseph Akshat Birla:Sheetal BirlaIn early May and after four months of deliberations, fintech company Finovate Capital finalised a multi-million dollar deal with the Indian arm of European tyre maker Continental. The Covid-19 lockdown influenced the way the deal was sealed by Finovate’s co-founder and chief business officer Aljo Joseph and its chief product officer Pavan Matai, a former banker at RBL Bank: Through video calls on Zoom, and a series of phone calls with Continental’s financial controller and various lenders, as well as an exchange of detailed notes and presentations.

Providing finance to a tyre company during a period of economic standstill—and when no cars were sold in India during April—can be a bit tricky. For Finovate, it involved a bit of thinking ahead of the curve. While the demand for new passenger cars, and consequentially tyres, is likely to be sluggish for several months, the demand from commercial vehicles and trucks owned by large fleet operators is expected to pick up in May and June. Continental has been allowed to open its Modipuram plant in Meerut, Uttar Pradesh, and production is expected to start soon, if the infection spread isn’t severe in the area.

Finovate, a supply chain financing (SCF) firm, has multiple lenders such as large private banks, non-banking financial companies (NBFCs) and a small financial bank to service Continental and cover its entire dealer spectrum. Besides Continental, Joseph says Finovate has already finalised another 17 deals and has closed a pipeline with existing clients to the tune of ₹15,000 crore so far.

Starved for capital

Prior to the revised government definitions of what constitutes a micro, small and medium enterprise (MSME), as announced in mid-May, there were at least 633.88 lakh such units in India employing over 11 crore people. According to the ministry of MSMEs, the enterprises contribute 30 percent to India’s GDP.

Despite the wide reach, MSMEs have always struggled to get access to finance from large lenders. Prior to the introduction of the Goods and Services Tax (GST), voluminous paperwork and the need for physical verification of services to be provided meant that smaller suppliers were serviced by micro-finance companies and moneylenders, and rarely by large banks.

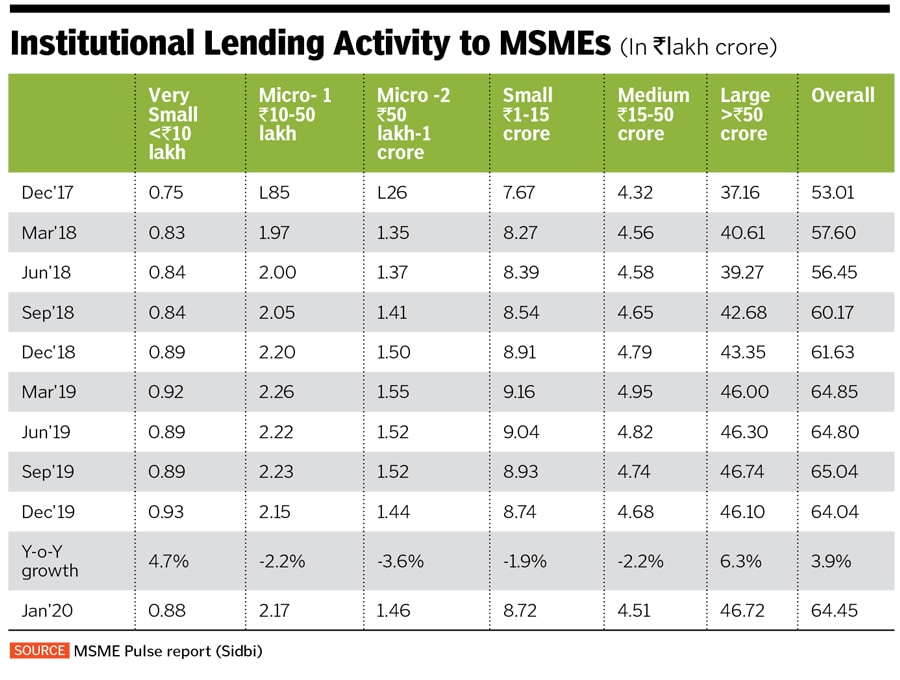

In India, small businesses were already starved for capital after NBFCs struggled to survive in the fallout of the bankruptcy of IL&FS in 2018. The lack of access to working capital for these businesses has become all the more critical since revenue from their clients stopped in mid-March. The SME credit gap—the difference between the total addressable demand for external credit compared to the total supply of credit from formal sources—is estimated to be ₹28 lakh crore ($380 billion), according to the World Bank.

By the most conservative estimates, the market potential for supply chain financing (SCF) is around ₹9 lakh crore, going with the assumption that 20 percent of credit availed will be towards working capital. Yet, SCF remains a hugely underpenetrated business in India, at 0.5 percent of GDP, while it is at 4 percent in China and about 9 to 12 percent in Spain, Italy and France (all pre-Covid19).

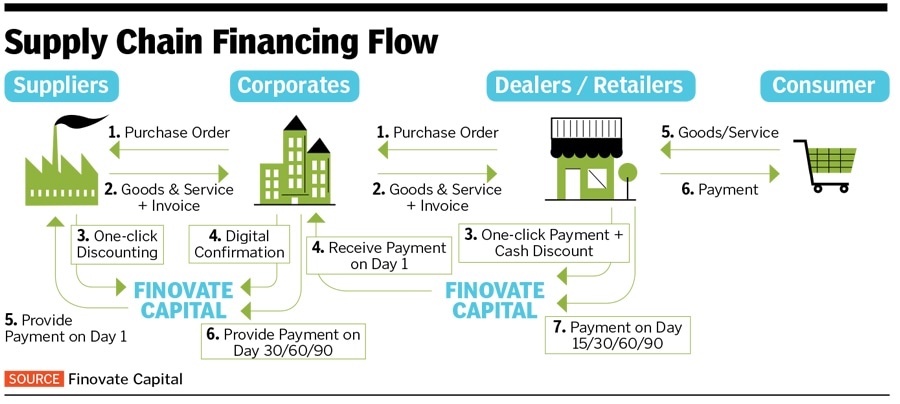

This is where companies such as Finovate come in. Through a technology platform it optimises cash flow by ensuring buyers can extend their payment terms to their suppliers and the SME (supplier) gets access to quick working capital from a range of lenders (see flowchart).Though the micro segment of the MSME space has been among the hardest hit, experts believe it will be able to ride out the lockdown crisis. Baskar Babu Ramachandran, managing director and co-founder of Suryoday Small Finance Bank, says, “Post Covid-19, I have reasonable confidence that post restoration of normalcy, the micro segment of MSMEs will bounce back and return to normalcy. This is because most borrowers in this segment are self-employed and have availed of loans for an economic activity.”

For Suryoday, it has been business as usual on the liability (deposits) side on the asset side, while lending broadly is currently at a standstill, it is expected to start gradually. With about 14 lakh customers, the bank has introduced a small working capital product besides the traditional ones. This is being offered as an overdraft limit for its microfinance customers during the current situation in two of its branches in Tamil Nadu and Odisha at lower interest rates to help revive economic activity. “We will scale up this product across 100 branches shortly,” says Babu.

In the right place

The constant demand that small businesses will have post-lockdown gives Akshat Birla, founder and CEO of Finovate Capital, the confidence that they are in a great place. “It will get tougher when the lockdown is lifted, but it will also get better in terms of more business. The first thing that MSMEs need is working capital. We will have to double down on the work we are doing now to ensure there are no leakages.” The correlated nature of their careers brought Joseph and Birla together. Birla had worked with Samsung at its Seoul headquarters from 2013 to 2018 and had led the fintech programme for the launch of Samsung Pay in SE Asia and India. “But Samsung was still thinking like a hardware company and it was very conservative in a rapidly-changing payments space,” Birla says. He came back to India and identified SCF as a space that was underpenetrated and could be disrupted.

The correlated nature of their careers brought Joseph and Birla together. Birla had worked with Samsung at its Seoul headquarters from 2013 to 2018 and had led the fintech programme for the launch of Samsung Pay in SE Asia and India. “But Samsung was still thinking like a hardware company and it was very conservative in a rapidly-changing payments space,” Birla says. He came back to India and identified SCF as a space that was underpenetrated and could be disrupted.

Joseph, who had previously worked at KPMG and EY, was already running his own neo-banking startup CredSaver, which offered loans to MSMEs. “We met at a coffee station at a shared workspace in early 2018 and discussed synergies we could draw on,” recounts Birla. But they never found a common client. When Joseph decided to move on from CredSaver, Birla urged him to join Finovate in 2019.

Being acutely aware of the problems finance companies face while building their own lending book in an uncertain environment, Birla was clear it was not the route forward. “We never wanted to become a bank or an NBFC, where the aim was to only acquire customers. We never saw the need to bring in own capital and build our own book when we could get partners to do that,” says Birla. Finovate makes money by charging a percentage of the processing fee (indirectly from the borrower) and a platform usage fee which they charge the lender.

As the Covid-19 storm has hit hard, some of Finovate’s lenders have stayed away. “We had 16 lenders working with us pre-Covid, we now have seven. The large lenders are all still active,” Joseph says.

Finovate is now exploring options to help a US-based pharmaceutical multinational to get finance for their diagnostic labs businesses. “This would be done by offering dealer finance solutions through a small finance bank which will pay the pharma company on Day 1 and take exposures on each of these diagnostic labs,” says Joseph. Diagnostic businesses are seen as safe havens in the post Covid-19 world and lenders are keen to work with them. Finovate has identified pharmaceuticals, FMCG, chemicals, road and bridge construction, irrigation, seafood and milk products as the sectors they need to focus on.

Business confidence will continue to be difficult to assess in the coming months even as the lockdown is eased in some parts of India. “India cannot do business on the basis of zones. Lenders need to have that confidence,” says Aseem Bhardwaj, CEO (corporate finance) at Manappuram Finance.

Bhavik Hathi, managing director of Alvarez & Marsal (India), says for most sectors, the April-June 2020 quarter could see zero growth (compared to the same quarter last year), while Q2, Q3 and Q4 could see a 75, 50 and 25 percent drop, respectively, in sales compared to the corresponding quarter of the previous fiscal.

For Finovate, the business cycle will just get busier in the coming months. The company raised an undisclosed amount in angel funding in 2019 through its existing investors: Venture capital firm Singularity Ventures, Ravi Sud (former CFO at Hero MotoCorp), Naresh Naik (IREP Capital) and Sid Shanker (ex-Deliveroo Singapore general manager). Birla and Joseph are in talks with their existing investors to raise a small second round as “they do not want to slow down at this stage”. A broader Series A funding should not be ruled out by early 2021.

Finovate also aims to be an SCF neo-bank of the future. For this it will need to raise additional capital, build integration with some banks and bring in sectoral experts. It’s a long journey ahead and the company is well positioned for the ride.

First Published: Jun 02, 2020, 14:14

Subscribe Now