Herein lies the role of independent directors who are entrusted with the responsibility of being the eyes and ears of investors as they are expected to balance the interests of the management and its shareholders in letter and in spirit. In recent years, unfortunately, there have been several glaring instances where the board of directors has evidently failed to do so.

Few weeks ago, the co-founder and CEO of Sequoia Capital-backed fashion technology start-up Zilingo, Ankiti Bose, was suspended—until May 5—for allegedly inflating revenue to boost valuation, among other wrongdoings. Bose, reportedly, is contesting the charges of financial fraud and claims the ‘witch-hunt’ was triggered after she raised harassment complaints against an investor.

People in the know express disbelief that the board, particularly investor nominees, mysteriously failed to notice the mismanagement of millions of dollars, misgovernance, and accounting discrepancies over the years, and was spurred into action only after the whistle-blower complaint in March.

The matter is currently under investigation. Temasek’s Xu Wei Yang, Burda Principal Investment’s Albert Shyy, and Sequoia Capital’s Shailendra Singh, have stepped down from Zilingo’s board amid the probe. A detailed questionnaire sent to Zilingo remains unanswered.

![]()

Incidentally, another Sequoia-backed unicorn, BharatPe, was recently embroiled in similar allegations of financial irregularities which exposed serious loopholes in checks and balances at the fintech platform and led to a hostile management change over a wide-ranging acrimonious dispute between the company and its co-founder, Ashneer Grover.

Weeks after Alvarez and Marsal put forth recommendations for better governance standards in its audit report, controversy-hit BharatPe tells Forbes India it has made several changes in internal processes and systems, and is taking steps to strengthen the board. “While appointing an independent director is not mandatory for a company like ours, the board and management have still decided to appoint independent directors, and the process of identifying individuals is currently on," the company adds.

BharatPe plans to form an audit committee comprising majority independent directors and Chairman Rajnish Kumar. The payments company says it expects its independent directors to act as a guide, enhance corporate credibility, governance standards, and play a vital role in risk management for the company to be ready for an initial public offering (IPO) in the next 18-24 months.

The fintech company says it has appointed Mazars India as its internal auditor for auditing and implementation of internal financial and process controls.

In response to the ‘disturbing’ state of affairs at some of its portfolio companies in India and the southeast, Sequoia Capital said in its blog, “We will take a set of proactive steps as a responsible participant of this ecosystem and do more than our fair share to drive increased compliance across our portfolio companies including, but not limited to, governance trainings for founders and senior management, implementation of whistle-blower policies, more independent board representation, asking for more disclosures and more rigorous adoption of internal audits and controls."

![]()

The rising incidents of poor governance should be a wake-up call for stakeholders. It further reinforces the need for independent directors to pay close attention to all aspects of corporate governance.

In the course of this article, Forbes India interacted—on and off-the-record—with board members, company managements, institutional investors, corporate governance and proxy advisors to get an insider’s view of boardroom deliberations to understand how and why independent directors sometimes fall short in discharging their duties.

Key reasons include promoter tactics and expectations, work culture of subservience, hesitance to question, and the attitude of no accountability.

![]() Independent directors are often blindsided by the management and not provided complete informationIllustration: Chaitanya Dinesh Surpur

Independent directors are often blindsided by the management and not provided complete informationIllustration: Chaitanya Dinesh Surpur

“Being a corporate board director has been seen as a prestigious assignment. It has nothing to do with capability or accountability, it is some sort of Padma Bhushan or Padma Shri," JN Gupta, former executive director at the Securities and Exchange Board of India (SEBI), and, founder and managing director at Stakeholders Empowerment Services, says tongue-in-cheek.

Gupta likens the role of independent directors to a cameo role in a Hindi movie since they behave as if they have nothing material to do with the company’s story. “Nobody has ever thought that being an independent director is a role where one has to exert oneself and put in time and effort," he sarcastically remarks.

![]()

Clearly, Gupta is not pleased with their conduct. He says, “There are sins of omission and sins of commission committed by independent directors." He explains instances of inequitable and biased distribution of remuneration at some companies that show independent directors in poor light.

In one case, the remuneration committee of a listed company comprising mainly independent directors, signed off a recommendation to distribute 98 percent commission to the promoter-director and two percent to 7-8 directors. “If the promoter-director is 49x times more capable than the entire board put together then what is the need for the board at all," Gupta wonders.

In another instance of gross violation of good governance, independent directors at a company actively colluded with the promoters of a company to further promoter interests. After one of the promoters, who was an executive director at the company, passed away, he was readily replaced by his wife at the same remuneration. The hiccup is that while the promoter was a technocrat with decades of industry experience, his wife does not have the domain expertise or relevant experience.

![]()

“The promoter’s brothers are also on the board and they draw the same remuneration since it is some sort of a family arrangement, and independent directors have permitted this arrangement to continue," Gupta says.

That the problem is deep-rooted in corporate culture is an understatement, given the slew of multi-billion-dollar scams at leading organisations that have come to light in the last few years. The common thread in these cases of massive irregularities is that independent directors were caught napping.

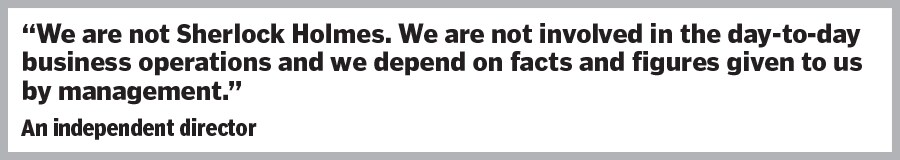

However, a financial services veteran who is on several company boards says, on condition of anonymity, that independent directors are often blindsided by the management. We are not provided complete information and we don’t have all the details, he says.

“We are not Sherlock Holmes. We are not involved in the day-to-day business operations and we depend on facts and figures given to us by management. If a promoter or CEO commits fraud, he obviously covers his tracks, making it extremely difficult to find out," he rues. He also talks about how many times the management selectively provides data to suit its agenda.

![]()

How about asking for information?

The board member elaborates an incident of a leading BFSI firm sending several huge bags containing 7,000 pages of documents for information. “Is it humanly possible for someone to go through it?" he asks.

Following this episode, he tells Forbes India, he joins boards with an agreement that the company will supply the ‘appropriate’ amount of information. The onus of giving relevant information is on the company, he adds. Besides, there are various indemnity policies that potentially shield directors from liability if fraudulent activities are unearthed at a company during their watch.

He explains he is wary of joining boards of family-run businesses because promoter interference is generally high and, as a result, independent directors cannot function freely or effectively.

He also points out, based on observations, that very often board members do not know the ins and outs of the industry and due to the lack of domain knowledge, they often gloss over board proceedings without active participation or a critical understanding of the discussions underway.

![]()

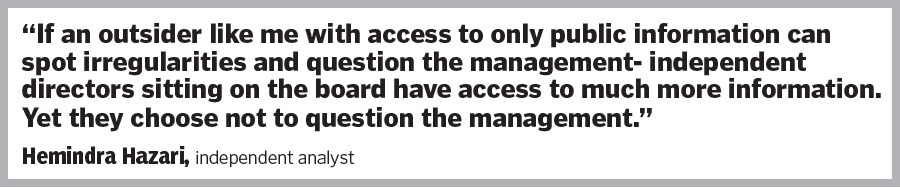

Accounting anomalies, fund diversion, related-party transactions, and questionable loan disbursements oftentimes continue for years under the nose of directors: How can they be so clueless about it, asks independent analyst and corporate vigilante Hemindra Hazari.

“If an outsider like me with access to only public information can spot irregularities and question the management, independent directors sitting on the board have access to much more information. Yet they choose not to question the management," asserts Hazari.

He frowns upon the inclination of independent directors to remain mute spectators even as errant promoters unabashedly flout norms and guidelines.

“The unwritten rule is that you [independent directors] cannot ask too many uncomfortable questions. If one persists in asking difficult questions to either the executive or promoter then invariably the director will not get another term and will be blacklisted as a director in the corporate world," he says.

He continues, “This is why independent directors toe the management line and in case an issue blows up and there is a regulatory investigation, the independent directors’ defence is that ‘we did not know’. But as an independent director you are supposed to ask questions."

Another boardroom insider says important questions are often not asked so that the matter is not recorded in the minutes of the meeting, thereby, allowing the board to feign ignorance if the issue explodes or comes under the scanner of regulatory and investigative agencies at a later date. This is increasingly evident as the National Stock Exchange (NSE) scam unfolds.

“There needs to be a lot more involvement and hard work, which independent directors are not willing to do. There are people who do not come prepared for the board meeting, they do not go through the agenda. If they would go through the agenda, they would be asking the right questions," complains another financial services expert who was appointed on a company board after a regulatory haul-up. He asked not to be identified.

The Reserve Bank of India’s crackdown on bad loans opened a can of worms exposing the shoddy credit culture of lenders. The Insolvency and Bankruptcy Code, 2016, paved the way to remove errant promoters who had gamed the system for years. Some examples include Essar Steel, Bhushan Power and Steel, Jaypee Infratech, and Amtek Auto.

Many promoters have been forced to exit, yet no tough questions were asked of the independent directors on the boards of such companies when misgovernance thrived and led to its eventual fall. Hazari says, “It is very important that independent directors are held accountable. They cannot get away by saying that we did not know."

Yes Bank, ICICI Bank, IL&FS, Punjab National Bank are few examples of financial institutions that were under the scanner for major lapses in sanction and disbursement of risky loans. Intriguingly, the chinks were not once exposed by the board, but only by whistle-blowers and scrutiny of regulators.

The ICICI Bank saga cannot be forgotten in a hurry. The board meekly continued to support former chief executive Chanda Kochhar despite whistle-blower complaints of quid-pro-quo transactions. In fact, the board gave a clean-chit to its CEO on the basis of an opaque ‘internal inquiry’. But a thorough investigation by the Srikrishna Committee found Kochhar guilty of fraud.

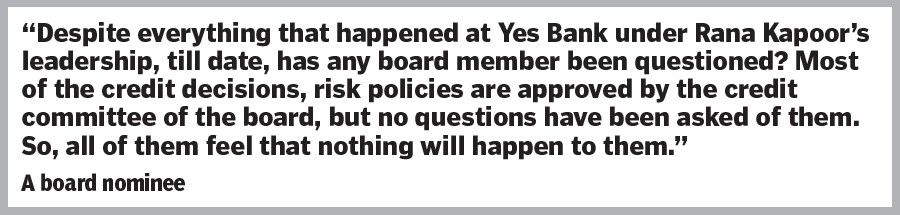

“Despite everything that happened at Yes Bank under Rana Kapoor’s leadership, till date, has any board member been questioned? Most of the credit decisions, risk policies are approved by the credit committee of the board, but no questions have been asked of them. So, they all feel that nothing will happen to them," says the second board member mentioned earlier.

Gupta says independent directors do not want to have skin in the game. “The problem is they are like pampered children. They want all the lollipops, ice-cream, chocolate, toys, but don’t ask them to do the homework," Gupta adds.

While the problem is clear the solution to the problem isn’t.

“There is no silver bullet for getting it right," says Shriram Subramanian, founder and managing director of proxy advisory firm InGovern.

Hazari suggests legal proceedings against independent directors who do not red flag governance issues. “Punishment has to be severe. If one or two prominent independent directors are sent into custody, others will fall in line," he says.

Many experts believe institutional investors must exert pressure and put their voting privilege to good use to ensure independent directors work towards safeguarding minority shareholders’ rights.

But in August last year, majority institutional investors and public shareholders voted against former SEBI chairman UK Sinha’s reappointment as an independent director on the Vedanta board. Yet, due to the backing of promoter group entities, Sinha got another term on the board. Ironically, the very group of shareholders Sinha is expected to represent and protect, have lost confidence in his credibility.

![]()

In such cases, how ‘independent’ is the independent director, since they are seemingly on the board mainly at the behest of promoters.

“An extreme solution could be to not allow promoters to vote for appointment of independent directors. But that will be unfair because some investor with just five percent stake can gain control over the board. So, this solution is as bad as the problem. Investor pressure is the only solution, but unfortunately this could also be compromised if their personal relationship outweighs their sense of duty," Gupta says.

Amit Tandon, founder and managing director, Institutional Investor Advisory Services, notices a clear shift in the conduct of independent directors after the hue and cry around some notorious governance lapses in systemically important organisations.

“Shareholder expectations have started to change, and there are instances of independent directors getting voted out of the board. This has meant many people who may have looked the other way, now want to be a lot more thoughtful about the discussions taking place," he adds.

Of course, all independent directors, promoters, and managements cannot be painted with the same brush. There are notable exceptions where company boards blew the lid off financial jugglery done by promoters. Take the case of CG Power: In August 2019, the board ousted the company’s chairman Gautam Thapar for alleged fraudulent practices. Moreover, experts point out, independent directors contribute in shaping the strategic growth trajectory of a company with their experience and expertise in specific fields.

“Are things perfect? No. Is there a scope for improvement? Certainly. But are they a lot better than five or ten years ago? I would answer yes. There is no end point that you have reached the goal," Tandon sums up.