There is also the parallel universe of decentralised financial (Defi) or alternative financial services building on blockchain applications where customers can transfer, trade or borrow cryptocurrencies. It is an ecosystem based on public distributed ledgers that allow financial transactions to take place without the involvement of a central authority. Platforms that offer decentralised financing also continue to operate unregulated in India.

The buzz is that India may introduce a cryptocurrency bill in the month-long winter session of Parliament that starts on November 29. While the timeframe seems uncertain, a tax structure for individuals to pay for gains/losses from crypto is expected to be disclosed sooner.

On November 13, Prime Minister Narendra Modi chaired a high-level committee meeting with industry stakeholders to decide the path ahead. The message from the meeting was that the government wants to ensure that advertising to invest in cryptocurrencies, which has been aggressive in the last six months, should not over-promise and be transparent.

Stakeholders present at the meeting declined to comment on the outcome of the meeting. But the reading between the lines is that crypto exchanges will be told to slow down advertising in the interim, until the government/agencies come out with a policy paper or tax regulation relating to cryptos.

![]()

In September, blockchain data platform Chainalysis ranked Vietnam and India as the first and second respectively in their global crypto adoption 2021 index. In recent months, CoinDCX, CoinSwitch Kuber and rival exchange WazirX have all advertised heavily through social media influencers and celebrities with the message that investing in cryptocurrencies is now mainstream, and retail investors, who were only eyeing IPOs and equities, should not miss out on investing in cryptos.

Institutional investor interest

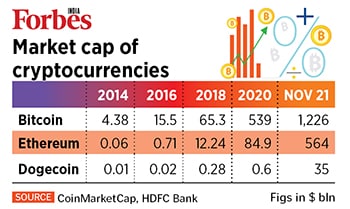

A combination of factors appears to have led to the rise in crypto-asset adoption in India. The listing of the first Bitcoin ETF by ProShares (an investment management firm) at the New York Stock Exchange in October has brought a certain amount of legitimacy to the industry. “It heightened mainstreaming excitement," says Ashish Singhal, founder and CEO, CoinSwitch Kuber. “JP Morgan"s forecast in November suggesting a doubling of Bitcoin prices may be another reason behind the rise in Bitcoin prices."

The JP Morgan market strategist Nikolaos Panigirtzoglou had forecast Bitcoin prices to rise to $146,000 [from the current $63,780], being viewed as a hedge for rising inflation. But new-age investors appear to have missed the point Panigirtzoglou made: For Bitcoin to achieve its target price, its current volatility—seen to be 4-5x that of gold—needs to reduce significantly.

The institutional interest in cryptocurrencies continues to grow. Vincent Lau, managing director of international operations at Huobi Global, says that several family offices have started to demonstrate interest in investing in cryptocurrencies. “SoftBank’s Vision Fund 2 investment into gaming platform The Sandbox caught investor interest," Lau tells Forbes India from Hong Kong. The Sandbox is a metaverse game where players can play, build, own and monetise their virtual experiences using non-fungible tokens (NFTs) on the Ethereum blockchain.

![]() Facebook’s name change to Meta is seen to be part of the company’s decision to expand beyond social media and connect people through virtual reality. The fact that Facebook, in a letter to investors, said that the Metaverse will require “not just novel technical work—like supporting crypto and NFT projects in the community—but also new forms of governance". Lau says a lot [of investor acceptance] will depend on the trend NFTs and gaming cryptocurrencies take in coming months. Indian celebrities and actors are conscious of this, thus launching their own NFTs.

Facebook’s name change to Meta is seen to be part of the company’s decision to expand beyond social media and connect people through virtual reality. The fact that Facebook, in a letter to investors, said that the Metaverse will require “not just novel technical work—like supporting crypto and NFT projects in the community—but also new forms of governance". Lau says a lot [of investor acceptance] will depend on the trend NFTs and gaming cryptocurrencies take in coming months. Indian celebrities and actors are conscious of this, thus launching their own NFTs.

Lau is working on strengthening their presence in the Indian market by continuing to enhance user experience. “The development of free education, the rationale behind crypto and tokens is all going to play a role. This is the beginning of the story," he says.

Within the Indian market, Huobi has seen robust growth in user numbers since the start of this year. On a quarter-to-quarter basis, new users on the platform have more than tripled in the September-ended quarter (up 248 percent). “India is consistently among our top three markets by total trading volume, as well as by total active users. It is by far the fastest-growing market which we have seen," Lau says.

CoinDCX Co-founder and CEO Sumit Gupta calls the current scenario as “the perfect storm" for crypto to succeed, coupled with the many real-world applications from transactions to payments.

![]()

Fluctuations to continue

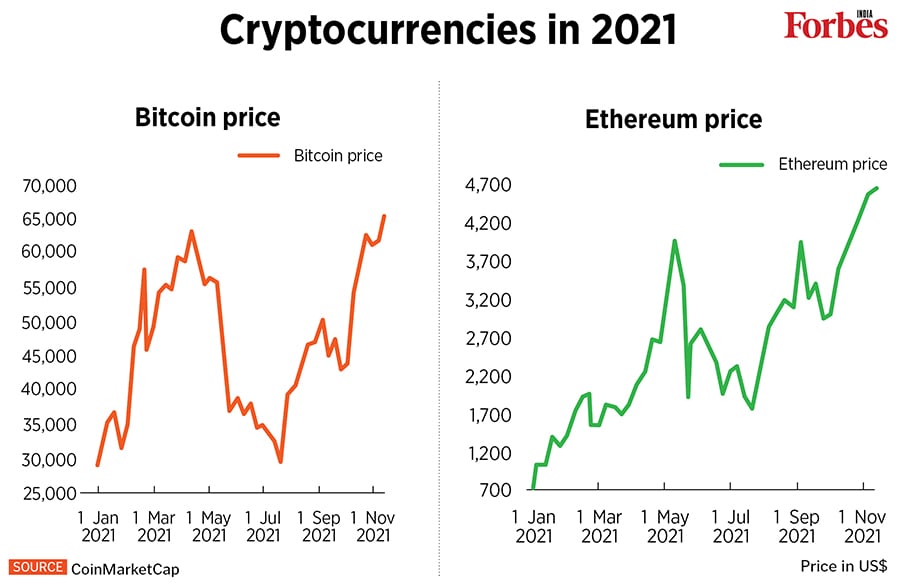

With prices of Bitcoin and Ethereum still elevated (see chart), experts say this volatility is likely to continue. CoinSwitch’s Singhal says there might be minor ups and downs, price corrections in coming days. “We will have to wait and see how long this frenzy continues." CoinDCX’s Gupta is optimistic on the “transformative potential" of crypto and the impact it can have on industries and communities at these levels. “While there are concerns that crypto is a fad, we believe that it is here to stay, particularly with all the adoption we are witnessing, from traditional banking giants to legacy businesses."

Multi-stage venture capital (VC) firm Lightspeed, which has made several investments in Defi companies and cryptocurrency exchanges, says India has become a hotbed for blockchain talent. There are over 10,000 blockchain developer jobs currently open in India on LinkedIn alone, compared to 30,000 in the United States. “Just a year or two ago, this number was probably in the 100s at best," the company said in a report in November.

The intermediaries in the crypto business now believe that India appears to have moved beyond considering a ban on crypto to possibly adopting a middle path by introducing curbs and checks. RBI Governor Shaktikanta Das, however, reiterated the central bank’s concerns on cryptocurrencies at a recent event, calling them a “serious concern to RBI from a macroeconomic and financial stability standpoint". Despite Das’s concerns, India is unlikely to go the way of China, which in September, banned all trading in cryptocurrencies.

Anirudh Rastogi, founder of Ikigai Law, who has represented crypto exchanges before the Supreme Court says, “The government may be wanting to rein in over-aggressive advertising relating to cryptos, which is sensible. Guidelines for the industry on advertising are always welcome. The only worry is if legislation does not carry the nuance, it could do more harm than good. Many countries have taken a light touch approach to legislation of cryptocurrencies, as it is a complex and rapidly evolving subject."

Praphul Chandra, founder and chief scientist of KoineArth, a blockchain-based supply chain startup, says the maturity with which policy circles are viewing the crypto space has increased. Chandra advocates that legislation toward crypto should be differentiated. “Technology platforms and solutions for supply chain, trade finance and healthcare may need cryptocurrency to deploy their solution on public blockchain," he says.

Singhal of CoinSwitch says any “minor curb will actually see an increase in trading volumes in India as regulation will legitimise the industry". There is no doubt that well-defined parameters for transacting crypto will lead to a deeper mainstream adoption, after a bit of price volatility. As the government is unlikely to go the China way (of imposing a ban), the policy stance is expected to be more accommodative in coming months.

There is also the parallel universe of decentralised financial (Defi) or alternative financial services building on blockchain applications where customers can transfer, trade or borrow cryptocurrencies

There is also the parallel universe of decentralised financial (Defi) or alternative financial services building on blockchain applications where customers can transfer, trade or borrow cryptocurrencies