Banking: What's next for loans?

Sluggish credit growth continues to hurt bank finances and will delay economic recovery. Retail lending will improve by March 2022, after the impact of a potential third Covid-19 wave

Lending activity from the banks—a key indicator of economic activity—in the form of credit to corporates, small businesses or individuals is still sluggish

Illustration: Chaitanya Dinesh Surpur

For several months in the current financial year, India’s economic data—statistically speaking—is likely to lie or will not reveal the complete truth. The country, on August 31, reported a jump of 20.1 percent GDP growth for the three months to June—its best ever fiscal quarter numbers—against the 24 percent economic contraction in the same period last year due to the shutting down of manufacturing activity and corporate business between March and May 2020.

With Nomura India’s Business Resumption Index rising above 100 (101.2) in the week ending August 15, for the first time since the pandemic began, experts are starting to debate about how quickly the economy will normalise to pre-pandemic levels. This index level supports the general positive outlook that the economy is picking up pace sharply from the impact of the crippling second wave of the pandemic, as mobility and workplace, retail and recreation activity improves.

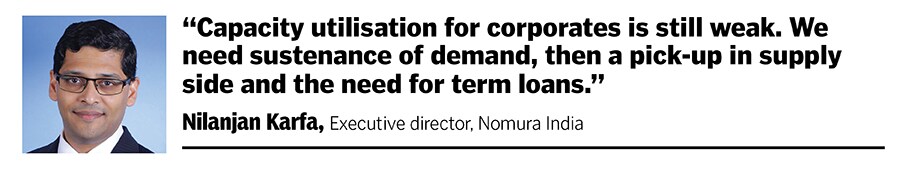

But lending activity from the banks—a key indicator of economic activity—in the form of credit to corporates, small businesses or individuals is still sluggish. It touched a 59-year low of 5.56 percent in the fiscal year ended March 2021 (see chart). Most private sector, public sector and small finance banks have shown weak credit growth in the June-ended quarter compared to the successive previous quarters of this year. Currently, most of the demand for loans is in the form of working capital but there is little in the form of term loans for expansion or longer-term credit for larger projects.

Low demand and the wariness of banks to lend due to continuing concerns of asset quality have kept banks risk averse. “The risk appetite among corporates has reduced. Expansion from large corporate groups also has been calibrated. The capital requirement to fund greenfield projects or brownfield expansion is very limited, either in the form of equity or debt," says Anil Gupta, ICRA’s financial sector ratings head. And all this while interest rates are at a seven-year low.

Barring the current cycle where steel and cement prices have escalated—and corporates have started to deleverage their balance sheets—business activity has still been weak. Refineries, fertilisers, mining and textiles have all reduced their debt in the financial year ended March.

Thus corporates have not been willing to borrow in a scenario where business has wound up and promoters and lenders stand to recover precious little through the bankruptcy route. Infrastructure giants GVK and GMR have deferred their capex plans for specific projects while Lanco, Reliance ADAG Group, Gammon India and Patel Engineering have all seen a slowdown over the past two years.

Joiel Akilan, chief India representative for BBVA, Spain’s second-largest bank, said the contraction in corporate banking lending is mainly due to “lack of investments in capex". “The demand for external commercial borrowings from foreign banks and institutions is declining due to the absence of major expansion plans or mergers and acquisitions abroad," he says.

Increased liquidity in the capital markets and the ability to raise fresh capital swiftly through bonds or public offerings have also kept large corporates away from adopting the traditional route of bank credit. Whatever capital raising is being seen is through a flood of IPOs by asset light companies, which will not lead to a credit cycle growth. Cement company Nuvoco Vistas, part of the Nirma Group, whose IPO in August was largely an offer for sale, was subscribed only 1.71 times. PVC resins maker Chemplast Sanmar also came to the markets to raise capital, but only a small portion was to fund capital expenditure.

“A corporate investing in a new capacity will want to see demand strength before planning investments. Capacity utilisation for corporates is still weak. We need sustenance of demand, then a pick-up in supply side and the need for term loans. Right now, lending has largely been towards working capital requirements," says Nilanjan Karfa, executive director, Nomura India.

Aggregate capacity utilisation data covering 584 manufacturing companies based on the Reserve Bank of India’s order books, inventories and capacity utilisation survey (Obicus) for the January to March 2021 quarter was at 69.4 percent, higher than 66.6 percent recorded in the previous quarter. But it is still well off the peak of 75.9 percent seen in the October-December 2018 period.

ICICI Bank’s executive director Vishakha Mulye, who heads wholesale banking, said the requirement for working capital has gone up as commodity cycles are at their peak and capacity utilisations have improved. But she said that while private capital expenditure for large projects has not been seen, growth is being seen in the public sector capex plans from corporates and public sector undertakings.

It is quite likely then that the revival in corporate credit will happen only when investing in capex commences after the Covid-19 pandemic is brought under control.

The states of Kerala, Andhra Pradesh, West Bengal, Uttarakhand, Goa continued to be under total or partial lockdown while Maharashtra, Karnataka, Tamil Nadu, Haryana and Gujarat commenced unlocking and lifting of restrictions of business activity, and mobility in August. The total number of new Covid-19 cases averaged around 35,000 in India in mid-August, dropping off from its peak of around 4 lakh in early May.

With the Delta and Delta-plus variants spreading across some regions in India, the threat to life and the pressure on the healthcare system remain real, which could derail the recovery in some of the high frequency economic indicators.

While the Indian Council of Medical Research (ICMR) has warned about the possibility of a third wave in coming weeks, they assess that it could be “less severe" than the second wave.

The commentary from India’s bankers remains positive for a sustained economic revival but the data, for the calendar year, does not appear to back it up. Most lenders have seen a sharp jump in deposit growth, compared to credit. The credit to deposit ratio for all banks was at 71.5 percent in FY21, compared to 78.2 pre-pandemic in March 2019, according to RBI data. A lower figure indicates a weaker earning capacity for a bank, where higher income is generated through loan growth.

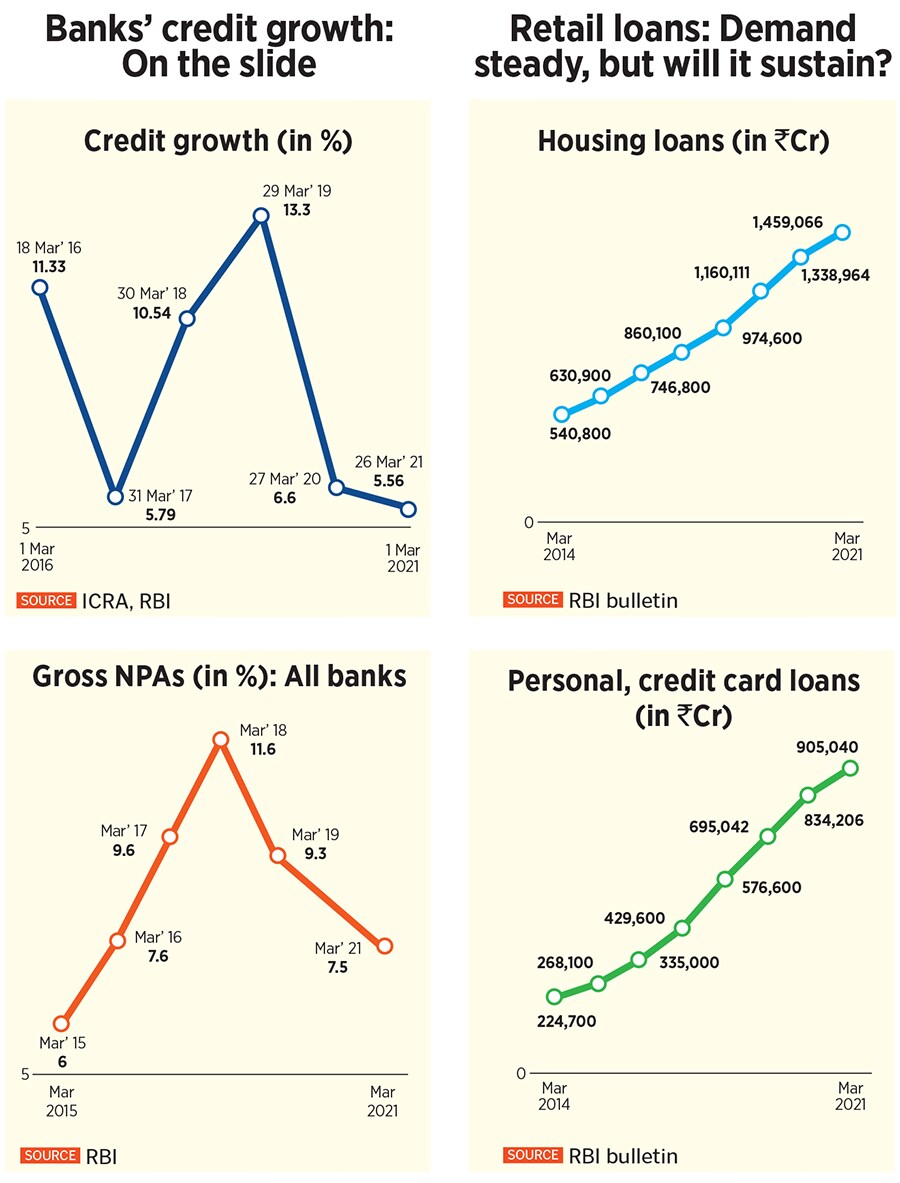

India’s largest private sector lender HDFC Bank has seen retail loan origination slowing. Domestic retail advances were down 0.77 percent to ₹523,489 crore for June 30, 2021, compared to ₹527,586 crore in March 2021. Total income was down 3.27 percent to ₹36,771.47 crore from ₹38,017.5 crore in March.

HDFC Bank’s country head (retail assets) Arvind Kapil told analysts in July they saw a “very sharp bounce back" in the demand for auto loans, unsecured loans, loans against property and home loans. Though the growth was strong from levels a year ago, it was not too impressive sequentially.

But HDFC Bank is set to make a comeback to the credit cards business. The RBI, on August 17, lifted an eight-month ban on the bank from issuing new credit cards. This will mean that the bank will bounce back in the credit cards business that will boost retail advances.

ICICI Bank saw an equally weak growth in its retail loans portfolio, edging up just 0.73 percent to ₹455,192 crore in June end from its March level, but was up around 20 percent from levels a year ago.

For the Banking, Financial Services and Insurance (BFSI) sector as a whole, demand for auto loans has improved, with people seen preferring a personal vehicle than travelling by public transport in a pandemic world.

The need for a second home, possibly far away from the urban centres, has also increased, leading to a rise in demand for cheap home loans.

Some of the larger public sector banks, such as Bank of Baroda and Punjab National Bank, have both reported a decline in total income in the quarter ended June.

The top management of other banks such as Yes Bank and IDFC First Bank—both of which saw a rise in their net non-performing assets (NPAs) in the June-ended quarter—will need to keep an eye on debt-ridden Vodafone Idea (VI). Yes Bank and IDFC First Bank have an exposure of around two percent each to VI in their loan book. Though the account has been marked as a stressed asset, the banks will hope they do not need to make higher provisions to this account.

Vodafone Idea reported a consolidated net loss of ₹7,319.1 crore during the June-ended quarter and a loss of ₹7,022 crore in the previous March quarter, hurt by lower revenues, lower average revenue per user (ARPU) and a drop in subscribers after the second wave induced lockdowns in April and May.

Aditya Birla Group chairman Kumar Mangalam Birla, who in August resigned as non-executive chairman and director of VI, had offered to hand over his 27 percent stake to the government or any domestic financial institution to keep VI afloat.

The RBI expects NPAs for all banks to increase to 9.8 percent for FY22, higher than the FY21 figure (see chart). Based on the data available till now, ICRA data on NPAs shows the highest stress of 38 percent in the MSME space, 30 percent in retail, 17 percent in agriculture and the balance 15 percent in corporates.

Nomura’s Karfa, in a note to clients in July, had quoted the RBI as saying the full impact of the pandemic won’t be visible till the various liquidity and loan guarantee schemes play out fully. “We concur and agree that while these schemes have ensured the near- to medium-term asset quality remains suppressed, the horizon is a little hazy," the note says. The risk-reward remains favourable in the large-cap banking space, he added.

Restructuring of loans was under one percent for the banking system, with the highest proportion coming from the MSME segment where public sector banks have had a higher share of restructuring, the Nomura July report said.

The restructuring for non-banking financial companies (NBFCs) is expected to move up to 4.1 percent to 4.3 percent by March 2022 while the same for housing finance companies is estimated to go up to 2.0 to 2.2 percent.

Nitin Aggarwal of Motilal Oswal Securities says the one challenge going ahead would be if the quantum of restructuring of loans in the books of public sector banks rises beyond what has been accounted for. State Bank of India’s chairman Dinesh Kumar Khara in August said the bank has already kept a higher provision for any restructuring. [It has 2,056 restructuring applications pending for approval in the June-ended quarter.] Bank of Baroda has told analysts that in restructuring 2.0, the total restructured amount is ₹4,359 crore, including ₹3,800 crore in the retail segment.

Barring this factor, retail lending activity is likely to improve in the coming two quarters, experts said. “As mobility starts to pick up and business activity improves, lenders will be less risk-averse and the demand for personal loans and credit cards will improve," says Nitin Aggarwal, banking analyst at Motilal Oswal Securities. The stock market buoyancy has seen healthy retail participation. “The creation of more assets means more ability to borrow. [Across retail banking] we will see good pockets of recovery across segments."

For the broader recovery of capital expenditure, the near-term demand will have to come from the central and state governments. The pace of growth towards government-backed infrastructure projects has been satisfactory, so has resource mobilisation from the government side.

With the third wave of the pandemic a real possibility, a deeper and more real recovery in credit demand and consumer spending is likely to emerge only in the January to March 2022 quarter.

First Published: Sep 08, 2021, 10:17

Subscribe Now