BharatNXT: The bridge to effective payments solutions for SMEs

The promoters have made a successful pivot from being a supply chain financier to a profitable business payments platform for SMEs. It now has bigger plans

Rarely do startups manage to pivot to a new business model successfully, with the former promoters and investors well entrenched in the new setup. In most cases, the founders either decide to take separate ways or the investors find exit routes.

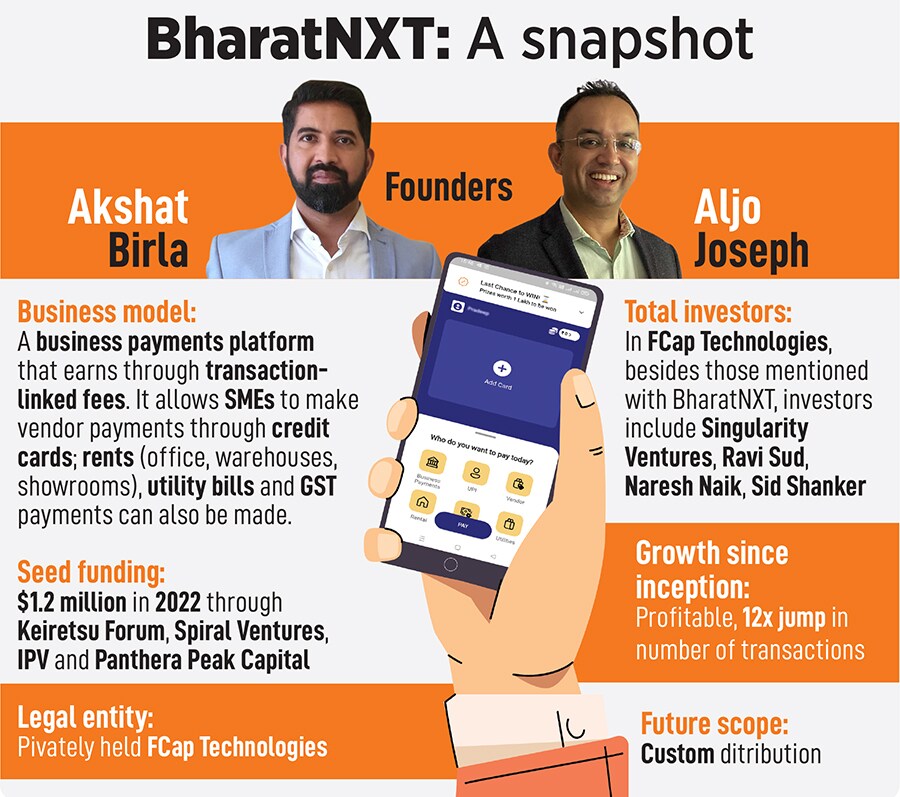

But none of this happened in the case of fintech company Finovate Capital, which, after successfully building a supply chain financing platform for small and medium enterprises (SMEs) in India, decided to halt that business and pivot to a business payments platform for the SME universe, which founders Akshat Birla and Aljo Joseph understood very well.

The rationale for a supply chain financing platform was a no-brainer. Despite their wide reach, micro, small and medium enterprises (MSMEs) had always struggled to get access to finance from large lenders. Prior to the introduction of the Goods and Services Tax (GST), voluminous paperwork and the need for physical verification of services to be provided meant that smaller suppliers were serviced by micro-finance companies and moneylenders, and rarely by large banks.

“Supply chain finance is a great concept and a secure way to ensure SMEs get liquidity, but we realised that while we created operational efficiency, and at zero percent NPAs, it was reliant on lenders to relax their credit policy. There was no differential strategy, which was creating value for everyone," Joseph, founder and chief business officer of BharatNXT, tells Forbes India.

Finovate Capital was well entrenched in the SME ecosystem: It had financed more than 4,300 borrowers, 18 anchors and had processed 24,000 invoices between March 2020 and December 2021.

Birla and Joseph have known each other since 2018 and they understood that a ‘me too’ venture, or one that would not be funded by venture capital, had to be ruled out. In end-2021, they came back to the drawing board to give contours to the new venture, at a time when a large number of buy-now-pay-later (BNPL) fintechs were growing rapidly and recording multiple funding rounds. BNPL would have been the natural transition from a supply chain financing platform, as they had the technology built already.

They initially had a BNPL plan, but deviated from it as they stared at the “What after that?" question. Since 2021, several BNPL business models have fallen through and investors have realised these businesses had no defensibility or moats. BNPL ventures have, since then, lost flavour with the Reserve Bank of India (RBI) too, which, in 2022, banned the loading of prepaid payment instruments with credit lines.

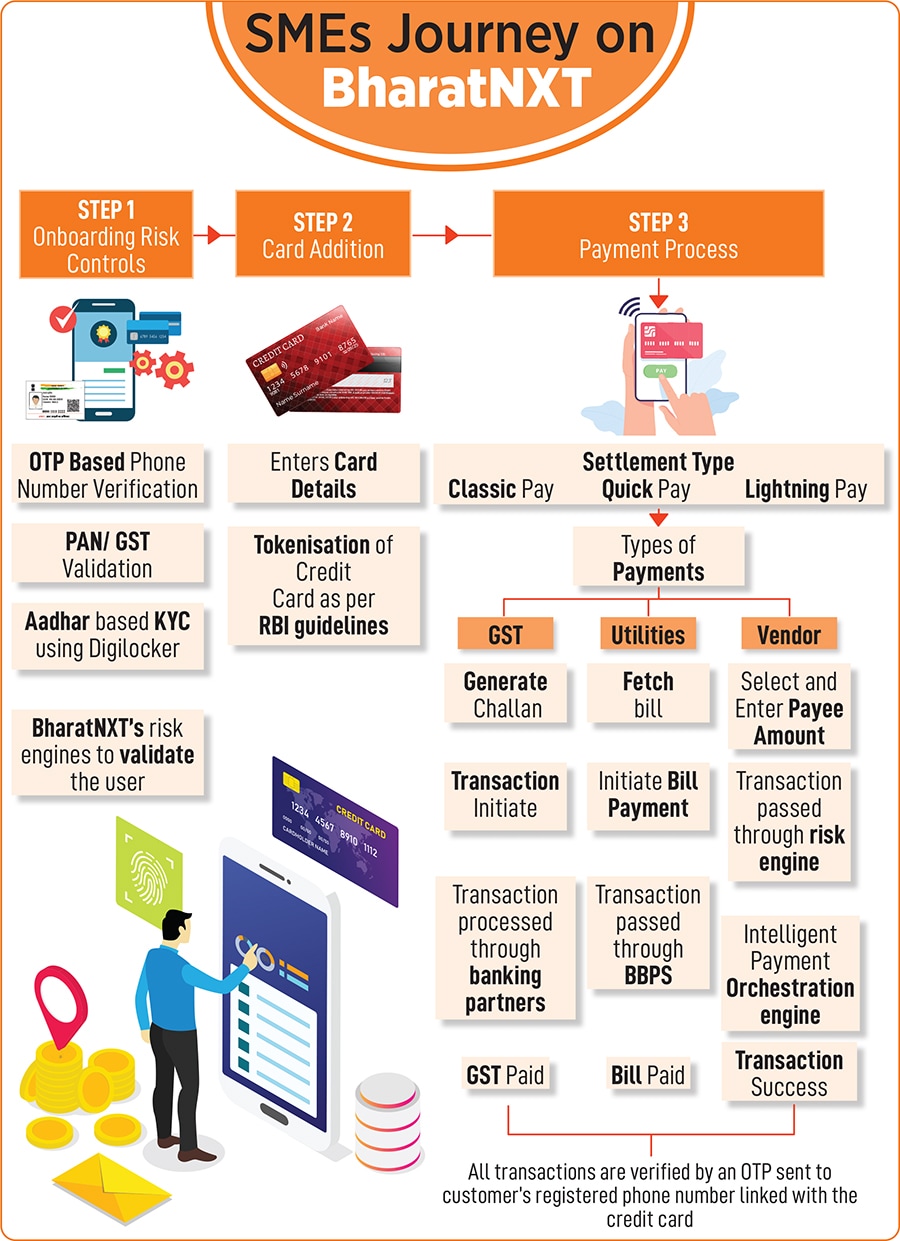

Birla and Joseph had been constantly speaking to their investors and a set of bankers. They wanted to stay close to the space they understood well, which was SMEs. They also wanted a model that was built for the future, allowing more payments for SMEs and tailored towards inclusion. These formed the genesis for the creation of BharatNXT, which is a business payments platform allowing SMEs to make vendor payments through credit cards, besides also towards expenses such as rent (office, warehouses, showrooms), utility bills and GST dues.

But between 2021 and now, what has not changed is the fact that SMEs are still starved of credit. “The micro and small businesses that don’t have access to a lot of formal unsecure business credit become the ideal target as they get ‘on tap’ access to credit for their business payments. We want them to focus on business growth while we take care of the cumbersome business payments," says Birla, CEO of BharatNXT.

The Indian business payments ecosystem has players such as Cred, RedGiraffe and Paymatrix, which offer a stack of payment solutions for retail customers. While PayMate offers solutions largely for enterprises. BharatNXT is the one-of-its-type in India servicing SMEs, claims Joseph. BharatNXT has an early mover advantage at this stage, where over 5 lakh people have downloaded the app and are using it around 70 percent of them would be SMEs.

When Finovate pivoted to BharatNXT, the promoters had capital that could provide less than 10 months of runway. But since their launch in May 2022, BharatNXT has notched some impressive numbers. It has already “turned profitable", its promoters say, on revenues that could touch Rs 100-130 crore by March 2024. Transactions per month have risen 12x to 1,20,000 in May 2023, from 10,000 in September 2022.

Legally, Finovate Capital and BharatNXT are part of the privately held FCap Technologies, incorporated in November 2018. Venture capital firm Singularity Ventures, Ravi Sud (former CFO at Hero MotoCorp), Naresh Naik (IREP Capital), Sid Shanker (ex-Singapore general manager of Deliveroo), besides Keiretsu Forum, Spiral Ventures, IPV and Panthera Peak Capital are existing investors in FCap Technologies.

In 2022, BharatNXT raised seed funding of $1.2 million from four investors including Keiretsu Forum, Spiral Ventures, IPV and Panthera Peak Capital and smaller contributions came from the earlier investors to Finovate Capital.

Suresh Parashar, 39, operates three businesses: Embroidery arts business, leasing of heavy construction machines such as JCBs, and an ethnic fashion wear business. These are all small-businesses that he has been running out of Ahmedabad, Gujarat, over the past three years, using BharatNXT as his payments platform.

Business payment cycles for most small businesses are often irregular and Parashar (name changed) is no exception. “Clients to whom the JCBs are rented out to, do not pay on time. We need to pay the operators and manage servicing. But by using the BharatNXT app for my payments, I get a credit window of around 45 days… so there is no cash crunch for me." He says.

BharatNXT charges Parashar a service fee for using its platform, whereby a direct credit is made into the beneficiary/suppliers accounts. He says, “I am satisfied that the credit window is attractive and the transactions go through smoothly, so I can focus on my business," which brings in around Rs 70-80 lakh annually.

BharatNXT services another small business entrepreneur, assisting him with GST-linked payments. Raja Raghunath, 29, the CEO of Hyderabad-based startup WCX Laundry, runs three verticals that provide co-living and students’ housing companies with uniform upkeep. Raghunath uses the BharatNXT platform to make all his GST-related payments. WCX (Wash and Clean Experts) Laundry services around eight clients in Andhra Pradesh and Telangana, and is finalising expansion into Mumbai and Pune over the next few months. The laundromat generates revenues of Rs 12-20 lakh per month, servicing more than 15,000 customers daily. “I use my SME business credit card through the BharatNXT platform and get 45 to 60 days extra credit, which helps me manage my cash flows," Raghunath told Forbes India.

There are at least 633.88 lakh MSMEs in India employing over 11 crore people. According to the Ministry of Micro, Small and Medium Enterprises, these enterprises contribute 30 percent to India’s GDP. Thus, for BharatNXT, it continues to be not just a relevant, but also, growing universe, which needs credit and services that help them manage their cash flows and make payments on time.

But Birla and Joseph are already planning for the next growth phase for BharatNXT, besides continuing to service SMEs. They are keeping a watchful eye on the regulations and licences for payout partners, as and when RBI considers these. “We see ourselves moving towards building custom distribution plans or a combination of products for them," Joseph says. BharatNXT may also consider enabling SMEs to get more credit limits.

Sujit Kunte, principal and head of India for Spiral Ventures, one of the new investors in BharatNXT, believes the startup is in the right space. “India is too vast a market and there is thus a place for every payment method to operate. Credit cards, particularly in the SME world, is a powerful financial instrument but has low penetration in commercial usage, being limited to mainly travel and entertainment segments. SMEs could use credit cards as an effective means to solve working capital issues," Kunte tells Forbes India.

Spiral Ventures is particularly keen to look at companies such as BharatNXT, as it is solving grassroot-level issues for MSMEs. “As a VC, we find this a big value-add," he says. Spiral Ventures is a Japan-focussed VC fund making seed and early-stage investments in Indian startups. Spiral Ventures also identifies companies that could have the potential to expand into Southeast Asia and help boost investments to Japanese companies. It also supports companies in going public.

“In the short-term we see BharatNXT as a company that will sustainably build the user base. It has the potential to become a diversified fintech company. Licensing of its platform is also a possible business option," adds Kunte, who knows Birla from their INSEAD business school days. Is there a potential to connect the Japanese fintech ecosystem to BharatNXT, through Spiral Ventures? In the coming years this could be a possibility. Till then Birla and Joseph have their hands full servicing SMEs and creating custom distribution solutions for them. Endless opportunities beckon.

First Published: Jun 21, 2023, 10:29

Subscribe Now