What Koreans can teach Americans and Europeans on cracking India's auto market

Ford and Hyundai entered India at the same time, and as the first shuts shop in the country, the second has become hugely successful

SS Kim MD & CEO, Hyundai Motor India Limited, says that Hyundai India"s product planning and development processes are based on India. Image: Madhu Kapparath

SS Kim MD & CEO, Hyundai Motor India Limited, says that Hyundai India"s product planning and development processes are based on India. Image: Madhu Kapparath

It’s a tale of contrasting fortunes. And in many ways, it’s akin to David’s conquest over Goliath. Twenty-five-years ago, American automobile giant Ford, having revolutionised global automobile manufacturing, came to India’s shores with serious ambitions of striking gold. Ford was a pioneer in the assembly line manufacturing process, and remained an inspiration to many Indians who had long been deprived of global automobiles as India remained a protectionist regime.

Around the same time, Hyundai, a relatively unknown South Korean car manufacturer, having forayed into the US market barely a decade earlier, also came knocking to capitalise on India’s fledgling economy, which looked set for rapid growth. Both Hyundai and Ford set up their factories in Chennai.

Now, 25 years later, one has gone on to become India’s second-largest carmaker, while the other has shut shop.

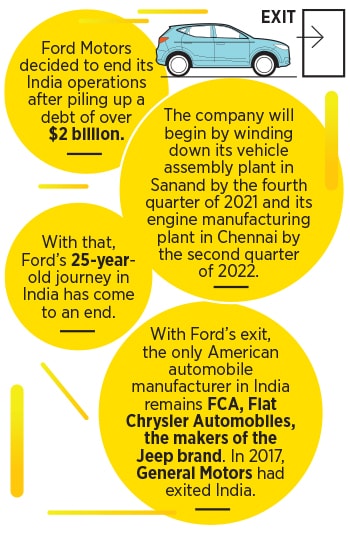

In early September, Ford Motors decided to end its India operations after piling up a debt of over $2 billion, making the Detroit-headquartered automaker’s India operations unsustainable. The decision to pull out of the world’s fourth-largest automobile market has also put a near end to an American dream in India. With Ford’s exit, the only American automobile manufacturer in India remains Fiat Chrysler Automobiles (FCA), makers of the Jeep brand. In 2017, General Motors had exited India.

“Despite investing significantly in India, Ford has accumulated more than $2 billion of operating losses over the past 10 years, and demand for new vehicles has been much weaker than forecast," said Jim Farley, Ford Motor Company’s president and CEO, in a statement. The company will begin by winding down its vehicle assembly plant in Sanand, Gujarat, by the fourth quarter of 2021 and its engine manufacturing plant in Chennai by the second quarter of 2022.

Former US Secretary of State John Kerry looks over the machines at a Ford India automotive factory with plant manager Kal Kearns (behind Kerry) in Sanand January 12, 2015. Image: Rick Wilking / Reuters

Former US Secretary of State John Kerry looks over the machines at a Ford India automotive factory with plant manager Kal Kearns (behind Kerry) in Sanand January 12, 2015. Image: Rick Wilking / Reuters

Ford had already written down some $800 million of non-operating assets in 2019, and will now turn its focus on selling iconic vehicles such as the Mustang, apart from manufacturing engines for export. Over the past few months, the company had tried partnering with other manufacturers to share platforms, and even attempted contract manufacturing in an attempt to sell its manufacturing plants.

“Despite these efforts, we have not been able to find a sustainable path forward to long-term profitability that includes in-country vehicle manufacturing," said Anurag Mehrotra, president, and managing director of Ford India, in a statement. “The decision was reinforced by years of accumulated losses, persistent industry overcapacity, and lack of expected growth in India’s car market."

With that, Ford’s 25-year-old journey in India has come to an end. It was one of the earliest foreign automakers to come to India after the Indian government allowed them to enter the domestic industry. Ford started out with a joint venture (JV) with the Mahindra Group for its India operations, called Mahindra Ford India Ltd. In 1998, Ford increased its stake in the JV to 72 percent, and renamed it Ford India.

“At the end of the day, it comes down to three key reasons," explains Puneet Gupta, director for automotive forecasting at market research firm IHS Markit says. “Ford could not get its cost structure under control especially with overheads there was a gap in sales strategy, which meant losing momentum and in comparison to the Asians like Hyundai, decision-making was slower."

In contrast, the combined entity of Hyundai and Kia, in which Hyundai holds a 33 percent stake, sells almost one in four vehicles in India.

The exit of Ford and its American counterparts from India, along with the dwindling fortunes of European carmakers in the country, is in stark contrast to Hyundai’s fortunes. A little-known player when it came to India, much of its success story was scripted by its first car, the Santro.

When the Seoul-headquartered company decided to launch in India in 1997, Indians were only beginning to acquiesce to Korean brands. Apart from consumer products companies such as Samsung and LG, foreign carmakers like Ford, General Motors, and Mercedes-Benz were thronging India to capitalise on an economy that was liberalised in 1991.

Hyundai did not waste any time in developing a made-for-India car, which offered many firsts to the consumer. For example, a multi-port fuel injection engine with three valves in the entry-level segment instead of carburetors, along with power steering and rear seat belts. At its Chennai plant, the carmaker brought many of its South Korean makers and vendors, who localised the manufacturing processes, while maintaining international standards and controlling costs of body parts, headlights and engine parts, among others.

Hyundai did not waste any time in developing a made-for-India car, which offered many firsts to the consumer. For example, a multi-port fuel injection engine with three valves in the entry-level segment instead of carburetors, along with power steering and rear seat belts. At its Chennai plant, the carmaker brought many of its South Korean makers and vendors, who localised the manufacturing processes, while maintaining international standards and controlling costs of body parts, headlights and engine parts, among others.

Hyundai then brought in Bollywood superstar Shah Rukh Khan as its ambassador to establish the brand in the country the partnership continues to this day. “To a large extent, Shah Rukh Indianised Hyundai," says Harish Bijoor, founder-CEO, Harish Bijoor Consults. “He was a door opener for the brand, who had the image of a boy-next-door for a car-next-door product. Very few stars have had that contributory effect on a brand that they proposed, as Shah Rukh Khan did."

The South Korean carmaker also brought on board a crop of new entrepreneurs to become its dealers when many automakers were partnering with well-established names across multiple dealerships. “We wanted young, enterprising individuals who did not have a background in automobiles to become our dealers," Puneet Anand, group head for corporate affairs at Hyundai Motors India had told Forbes India in November 2019. “We wanted credible and focussed people and not the ones who were already dealers for other automobile companies. We had received interest from many well-established businessmen, but we chose to go with those who had a passion for automobiles."

Along the way, the company was also instrumental in creating newer categories of vehicles in the Indian market. “In 1998, when it came in with the Santro, it created a new segment in the automobile industry," says Gupta of IHS Markit. “It did the same with the i20, the Grand i10, and even with the Creta. It has understood the pulse of the market, which was ably helped by its understanding of the global automobile industry. Hyundai did not go about copying Maruti Suzuki, and created a niche for itself." In the process, Gupta reckons, Hyundai positioned itself as a premium to Maruti.

“When I speak to other manufacturers in India and ask them about their perspective on the country, their answer is that their brand is based in Japan or Europe, while the focus is on Japan or the US or Europe," SS Kim, the MD and CEO of Hyundai India had told Forbes India in November 2019. “We are 100 percent Indian, and our product planning and development processes are based on India."

In 2019, Hyundai also made India one of its regional headquarters, alongside Hyundai Motor North America and Hyundai Motor Europe. The three entities function autonomously in their respective regions.

Hyundai isn’t the only Korean company to strike gold in India.

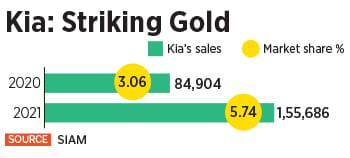

Kia Motors, which began selling its vehicles here in 2019, has already become the country’s fifth-largest car manufacturer, with 5.7 percent of the market. Hyundai, meanwhile, has a market share of 18 percent.

“While entering the Indian market, we conducted a thorough research for two years to understand customer needs, sentiments and industry gaps," says Tae-Jin Park, managing director and CEO, Kia India. “Upon finding these needs, we focussed on four major areas, including design, connected technology, and segment-leading features."

Today, Kia sells three models in India: Two SUVs and an MUV. “We made a conscious decision to launch segment-leading products in popular segments, which have garnered tremendous response from customers," adds Park. “Today, Kia has not only disrupted the mid-SUV and compact-SUV segments with Seltos and Sonet, but has also created a whole new segment of luxury MPV with the Carnival, which is a testament to our understanding of the market, the needs of Indian customers and our commitment towards the country."

The phenomenal success of Kia and Hyundai is also an eye opener for struggling European brands in India, including the likes of Volkswagen and Renault, who have just not been able to replicate their global success in India. “It is no secret that we have struggled so far," Gurpratap Boparai, managing director of Skoda Auto Volkswagen India had told Forbes India in January 2020. Despite entering India as early as 2001, Skoda never found a strong footing in the country. Volkswagen made a separate entry in 2007. The lack of localised productions in the initial phases, and inadequate launches, had significantly affected sales, which had prompted the company to redraw its India plan.

The phenomenal success of Kia and Hyundai is also an eye opener for struggling European brands in India, including the likes of Volkswagen and Renault, who have just not been able to replicate their global success in India. “It is no secret that we have struggled so far," Gurpratap Boparai, managing director of Skoda Auto Volkswagen India had told Forbes India in January 2020. Despite entering India as early as 2001, Skoda never found a strong footing in the country. Volkswagen made a separate entry in 2007. The lack of localised productions in the initial phases, and inadequate launches, had significantly affected sales, which had prompted the company to redraw its India plan.

The results have slowly begun to show results, with the company selling some 3,027 units in August compared to 1,312 cars during the same period last year, registering a growth of 131 per cent. The company’ recently launched Kushaq, meanwhile crossed 10,000 bookings in September. Yet, it is still a long way from cornering a significant part of the market.

Ford began operations in India with the Ford Escort, a sedan.

The company started out with a 1,600 cc petrol-powered engine, which went on sale in October 1996. “In many ways, the first car made all the difference," says Vinay Piparsania, a 20-year-old veteran at Ford India, and its former director. “The thinking at Ford then was to meet the global standards and there was a belief that the product in India shouldn’t be any different from what was in the US. We didn’t want to compromise on safety and luxury."

Unlike Ford, which had a partner, Hyundai came on its own to India and set up its subsidiary. It launched with the compact hatch, the Santro, a runaway hit.

“As an Asian player, it had a very Asian cost structure, compared to the Western world," says Piparsania. “Similarly, what is compact for India was very different from compact vehicles globally." The Ford Escort, while not a volume churner, boasted power windows, power steering, music systems, and air conditioning. Ford was also the first carmaker to let dealers use their names and even helped set up advances in body shop facilities at the dealers’ outlets.

With the Escort finding its feet, Ford soon turned to manufacture an India-specific sedan, at a lower price, which then went on to become a bestseller. The Ikon was a direct rival to Maruti’s compact sedan, the Esteem, and Hyundai’s Accent. “The Ikon used all the learnings from India and used more localised components and instantly became a hit," says Piparsania, who managed sales at Ford then.

But even as it began to find success in India, Ford’s global operations were in turmoil, with leadership changes, and concerns over safety. Between 2000 and 2001, it was in the midst of serious battle with tiremaker Bridgestone over its Firestone tyres, which were used on Ford’s popular SUV Explorer. By 2001, about 174 people were killed in accidents and crashes involving these tyres, and the carmaker and tyre-maker were blaming each other for them.

In India, Ford also had a problem with pricing. “We did not have a cost-plus pricing instead, it was market-based pricing," Piparsania adds. Much of that was because of the price-conscious Indian buyer, at a time when the Indian economy was only beginning to pick up pace. “Of course, the situation has changed now, and the Indian consumer has better purchasing power."

Meanwhile, after the success of Ikon, Ford’s successive launches, including the Fusion and Mondeo failed to woo buyers, before the company staged a comeback with Figo and EcoSport. The Mondeo was priced almost as much as a Mercedes, largely due to import duties. “With Ford, the problem was that every time they launched a new model, they would turn all the attention away from their existing models," adds Gupta of IHS Markit, who happens to own an EcoSport. “They never gave the required focus on the entire product portfolio. That meant being unable to take advantage of their products."

By 2015, Ford, which also had plans to launch a slew of vehicles, decided to set up a new state-of-the-art manufacturing plant at Sanand, on a 460-acre site, for $1 billion. The facility was to manufacture 2.7 lakh engines and 2.4 lakh vehicles a year. “In 2018, even when Hyundai’s plant in Chennai was running at full capacity, it never bothered to set up a new plant," says Gupta. “In contrast, Ford went and set up a new plant without those numbers, thus increasing overhead costs."

Now, as Ford folds up its India dreams, due to an unviable market and its own financial troubles, India’s automobile story is only looking brighter than ever before. According to government think-tank Niti Aayog, only 22 people out of a thousand own a car, as opposed to 980 and 850 per 1,000 in the US and the UK respectively, which means the market is still under-penetrated.

India’s automobile industry is expected to grow at 12.7 percent annually between 2019 and 2026, to reach $512 billion by 2026, according to consultancy firm Grant Thornton. “Rising middle-class and young populations, coupled with increasing disposable incomes and urbanisation is driving the growth of new vehicles sales in India," says a recent report by Grant Thornton. Alongside, there is also a push towards greener mobility, with even Tesla looking at bringing its vehicles to India soon.

“What we must also realise is that it"s not just in India that Hyundai has taken on the giants," Piparsania says. “Even in Europe and the US, Hyundai has become a force to reckon with. There is a lot that the company has to teach global automakers."

First Published: Oct 05, 2021, 13:40

Subscribe Now