The joint venture—majority owned by Glance, and operated jointly with the Collective Artists Network—is called Glance Collective.

‘A house of brands’

“Glance Collective is a very interesting play, linked to our focus on influencer and celebrity-led ecommerce, but more to be able to directly incubate and create a bunch of celebrity and creative brands," Piyush Shah, co-founder of InMobi, and president and COO of Glance tells Forbes India.

Through the joint venture, Glance expects to work with several creators and celebrities — a hundred for starters — “to actually create these brands which they can be calling their own," Shah says. “It’s going to be an overall effort for us to create a house of brands in a very different model altogether."

Glance has its platforms with a large audience to offer, whereas the Collective Artists Network will bring forth its access to the creator and celebrity side of things, he says.

“We believe that both live commerce and creative video commerce is on the cusp of disrupting the shopping ecosystem, not just in India, but Asia and globally," says Mansi Jain, vice president for content and revenue at Glance.

How Jain expects this to work is that the combination of Glance and Roposo offers a large audience to the creators by way of millions of daily, weekly and monthly active users. Glance alone has over 130 million daily active users. “We will be working with the creators end-to-end, from creation of the brands to launching and scaling them," Jain says.

The joint venture expects to work with “top Bollywood celebrities to leading digital influencers" in different categories such as entertainment and food, for example, she says. There will be some announcements of well-known names in the near future, she says.

These celebrities could be actors, comedians, and home chefs and so on, says Vijay Subramaniam, co-founder and group CEO of Collective Artists Network. Glance Collective wants to create a 100 new brands around the identities of an equal number of celebrities and influencers, he says.

The idea here is that the creator and the celebrity can go live themselves on Glance and Roposo to talk about their own brand. “They will bring their heart and soul to this because they want the (brand) experience to reflect who they are, and that’s where we think this will create magic for the consumers," Jain says.

A typical example is a young influencer posting short videos describing various beauty products on both Glance and Roposo. In the coming days, she will be able to integrate that with features like polls and questions that viewers can pose. Eventually, a shopping cart process will be built into the apps, where users can browse products that the influencer has been talking about, and buy them. This will be increasingly interactive, and in local languages too.

![]()

Shop101’s integration with Glance and Roposo will provide all the technology and infrastructure needed for online commerce — from manufacturing to distribution. It also offers an online marketplace for any direct-to-consumer brand out there that wants to tap the Glance and Roposo user base. That means creators can not only promote their own brands, but also “pick up any product and showcase them within their content", Jain says.

India’s ban on global short-video leader TikTok set the scene for domestic startups such as Glance, ShareChat and Dailyhunt to capitalise on the opportunity. A year down the line, Indian short-form video apps captured most of the user base left behind by TikTok and are growing the market as well.

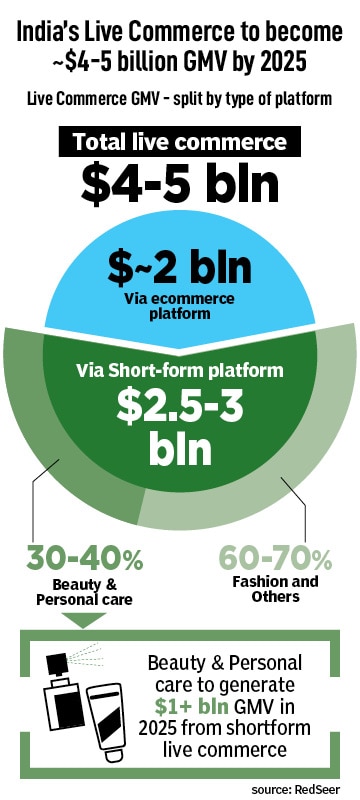

It was time for brands to tap into this, consultancy RedSeer noted in a report in June. The live commerce segment is expected to clock a gross merchandise value of $4-5 billion by 2025, led by strong growth in beauty and personal care and fashion, both in metros and small cities, RedSeer projects.

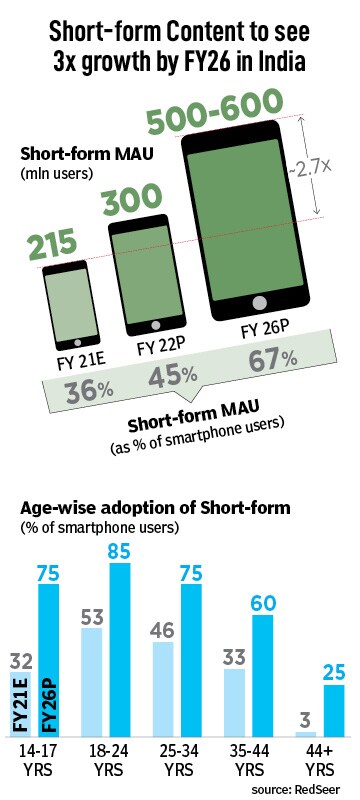

RedSeer expects short form content to catalyse live commerce volume of $2.5-3 billion by 2025 in India. Short form content is the fastest growing content category in India as well as globally, according to the consultancy. The market is expected to see a three-fold growth in users in the next five years in India. As short form sees more adoption, it will inevitably boost the live commerce segment as well.

Some of the reasons for this growth are continuity in entertainment, fresh content every day, localised reach for creators, and reducing attention span among viewers.

What’s the competition?

Glance has competition. VerSe Innovation has raised $450 million in its Series-I funding round, said the Bengaluru-based local language technology platform company in a press release on August 12. Investors include Siguler Guff, Baillie Gifford, and affiliates of Carlyle Asia Partners Growth II. Existing investors Sofina Group, Qatar Investment Authority (QIA) and BCap also participated in this round.

VerSe Innovation says its proprietary technology platform serves one out of every two internet users in the country through its short video platform Josh and its local language content platform Dailyhunt.

Less than six months earlier in February, VerSe raised more than $200 million in an investment from Falcon Edge Capital via Alpha Wave Ventures, Glade Brook Capital Partners, Google, Microsoft and QIA, taking the total capital raised in the first half of 2021 alone to over $650 million.

The latest investment will be focused on strengthening the company’s position as the “largest, fastest growing local language AI driven content platform in the country", VerSe says in its press release.

![]()

“With a strategic focus on video content and building for Bharat, we have seen strong traction emerging from the next billion users coming out of regional India," Virendra Gupta, VerSe’s founder, says in the press release. “This investment comes at a time when we are on path to further expand into newer geographies and widen our family of apps to serve audiences at a global level."

VerSe plans on both deepening and broadening its artificial intelligence and machine learning capabilities to “drive further on monetisation including e-commerce and live streaming", the company says. VerSe has a local language creator base of over 50 million people, and its platform sees over 80 billion video plays per month, according to the company’s press release.

VerSe has more than 115 million monthly active users and over 56 million daily active users. Dailyhunt serves over 300 million users every month, offering content in 14 languages from more than 100,000 content partners and individual content creators, according to the press release.

“The company’s accelerated growth over the last 24 months has positioned them as category leaders in the digital local language content space in India with both Dailyhunt and Josh," Vikram Vaidyanathan, managing director, Matrix India, an early investor, says in the press release.

Mohalla Tech, which operates the local language social media platform ShareChat, and a short-video platform, Moj, said in July that it raised $145 million as an extension of its Series-F round of funding. The investment valued Mohalla Tech at $2.88 billion. Investors include Singapore’s Temasek, Moore Strategic Ventures and Mirae-Naver Asia Growth Fund, which is jointly set up by Mirae Asset and South Korean web portal Naver Corp.

In April, Mohalla Tech raised $502 million. The company will use the money to improve its AI feed, attract and incentivise content creators and buttress cybersecurity. In total, the six year-old startup has raised $911 million so far. The company has hired senior executives in the AI/ML spaces in recent months in the UK and the US, and continues to aggressively look for more senior recruits in this space, Mohalla Tech said in a press release in July.

Moj has a monthly active user base of 160 million, with nearly one in three of them making and adding content to it, Ankush Sachdeva, co-founder and CEO of Mohalla Tech, says in the press release. “To strengthen our leadership position, we will continue to invest in our AI capabilities, scaling our global AI organisation, building advanced editing tools and helping our creators monetise on the platform," Sachdeva says.

The company says that an average user spends 34 minutes a day on Moj, and the platform receives 4.5 billion views daily. ShareChat has an average user time spent of 31 minutes daily. Moj and ShareChat together reach 340 million users.

The Shop101 advantage

One thing that seems to give Glance an edge is its quick move to acquire a strong ecommerce capability through the purchase of Shop101. While the advantage may not last, it certainly gives Glance the early-mover edge.

Shop101, was founded by Abhinav Jain, Aditya Gupta and Kalpak Chhajed in 2015 as a social ecommerce platform. Today, it is a full stack e-commerce company, with a 300-strong team, a network of 10 million resellers and 10,000 supplier partners, serving customers in 2,000 towns. Among its investors were Vy Capital, Stellaris Venture Partners, Unilever Ventures and Kalaari Capital.

“When we invested in Shop101 in 2017, the thesis was that people are more likely to buy something from someone they trust. This was beginning to happen on social media and today it’s called social commerce. We expect it to become a large opportunity," Rahul Chowdhri, a founding partner at Stellaris Venture Partners tells Forbes India. “And Shop101 and Glance have synergies that will hopefully lead to much larger outcomes as a combine."

![]()

“It is very clear that Glance has a large base of users who come to their properties and spend a lot of time looking at influencer videos. Shop101 brings the commerce expertise and that’s the synergy that we think works very well with the two of them coming together," Chowdhri says.

The evolution of Glance

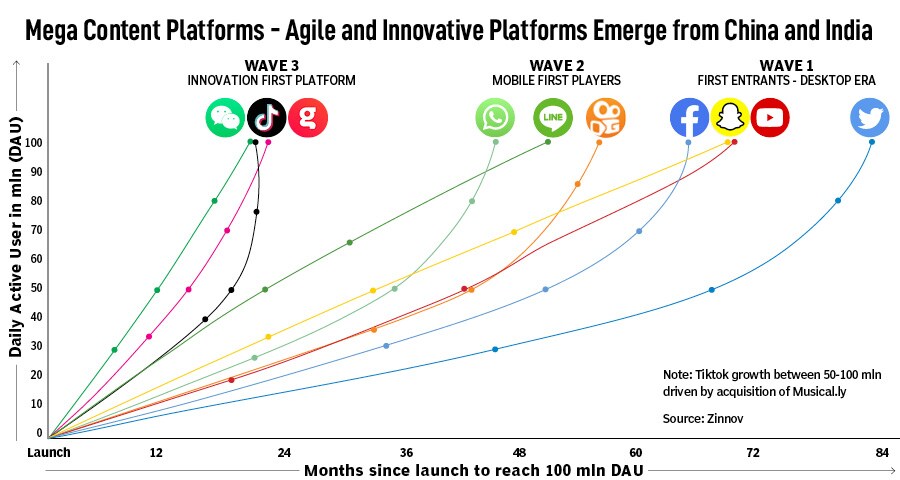

Glance is among the fastest-growing content platforms, and the largest platform of its scale to come out of India, according to Zinnov, a consultancy. It is part of the latest wave of mega content platforms, the third wave, which includes TikTok and WeChat from China, and Glance from India. Glance took less than 21 months to race to 100 million daily active users, Zinnov notes in a whitepaper on India’s digital economy in March.

Shah recalls building Glance “almost like a stealth project". The lock screen came across as pristine mobile real estate, yet untapped, so there was an opportunity to reimagine how content was discovered. With its 130 million daily active users across India and Southeast Asia, Glance is among the top 10 content platforms worldwide, he says.

The company works closely with five handset makers including Samsung, Xiaomi and Oppo, and has an installed base of over 300 million smartphones. The lock screen app surfaces news, games, and entertainment, and soon, there will be shopping.

Glance acquired Roposo in 2019 with the idea that the next generation of content for youth will be led by influencers. Acquiring Shop101 was about looking at the intersection of content, creators and commerce to reimagine mobile shopping altogether.

“Our thesis is that traditional ecommerce is functional and intent-led. More and more, I would say, consumers, especially youth, are looking for shopping experiences that are fun and entertaining, and yet the product has to be good as well," Shah says. “We’ve seen this happening in China in a big manner. When mobile shopping is live, and influencer led, it makes shopping more interesting and authentic. And we want to bring that change in India and globally, through creators, influencers and celebrities — that’s the overall plot."

Glance and Roposo are strong on the content and creator side, and Shop101 brings a strong ecommerce backbone, tech and infrastructure. “This is the first major strategic investment we have made after our funding in December, so you can imagine that this is pretty important to us," Shah says. “We were already monetising through ads as one pillar, but now commerce is going to be our second important pillar for monetising Glance and Roposo."

The deal was a mix of cash and equity, and the entire 300-person team at Shop101, including the founders, is being integrated with Glance. While the content experience will happen on Glance and Roposo, the technology backbone and supply chain infrastructure will come from Shop101. Glance will also tap into Shop101’s reseller network, Shah says.

This will enable all kinds of brands, be it a large consumer goods company or a new-age direct-to-consumer brand or even a small-town entrepreneur making garments. Sellers started with large ecommerce marketplaces when those were the only options, but the content and creator-led online sales model offers a more authentic and intimate alternative, Shah says.

This has prompted many direct-to-consumer brand startups to start making the effort to use digital content to connect with their brands. Sugar Cosmetics, which has been doing this for some years now, is an example, as is, more recently, Pankhuri, a women-oriented online community-based social commerce site.

The overall experience makes it “better than a television advertisement", Shah says. In the long term, “a loftier ambition is to help young creators monetise their talent on a more sustained basis and not just a one-off cheque", he explains. This is because there will be revenue-sharing models that will emerge in India too. The concept is not new — in the US, for example, a reviewer of an electronics gadget, who has a large following, will get a small cut for every purchase of the gadget made using a link provided on her Youtube channel.

A team of more than 40 data scientists is continuously working on the AI to make the Glance experience very relevant and personalised. Glance is also working on making the content visually appealing “like an Instagram on your lock screen", says Shah Finally, Glance aims to be live as up-to-the-minute as possible with what is happening around the user.

In the future, there are other areas that Glance could expand into. For example, if there is a greater sense of normalcy next year with more people being vaccinated against Covid-19, and perhaps even vaccines for children, it will not be difficult for Glance to offer coupons and discounts to stores in local malls. Financial services can be offered too — with the idea of embedded finance catching up in the digital world — and this is something Shah says they are keen on, but have not invested in enough yet, because currently the focus is entirely on growing the live commerce segment.

Over the next two years, Shah expects Glance to be much more international — “that’s a huge ambition for us". InMobi has a large part of its core business coming from the US and China. In the same way, Glance will go global over the next two years. The next step will be to take Roposo global as well.

“Who knows how we evolve as a platform. Just look at how WeChat has evolved in China, or ByteDance," Shah says. “We want to do this step-by-step."